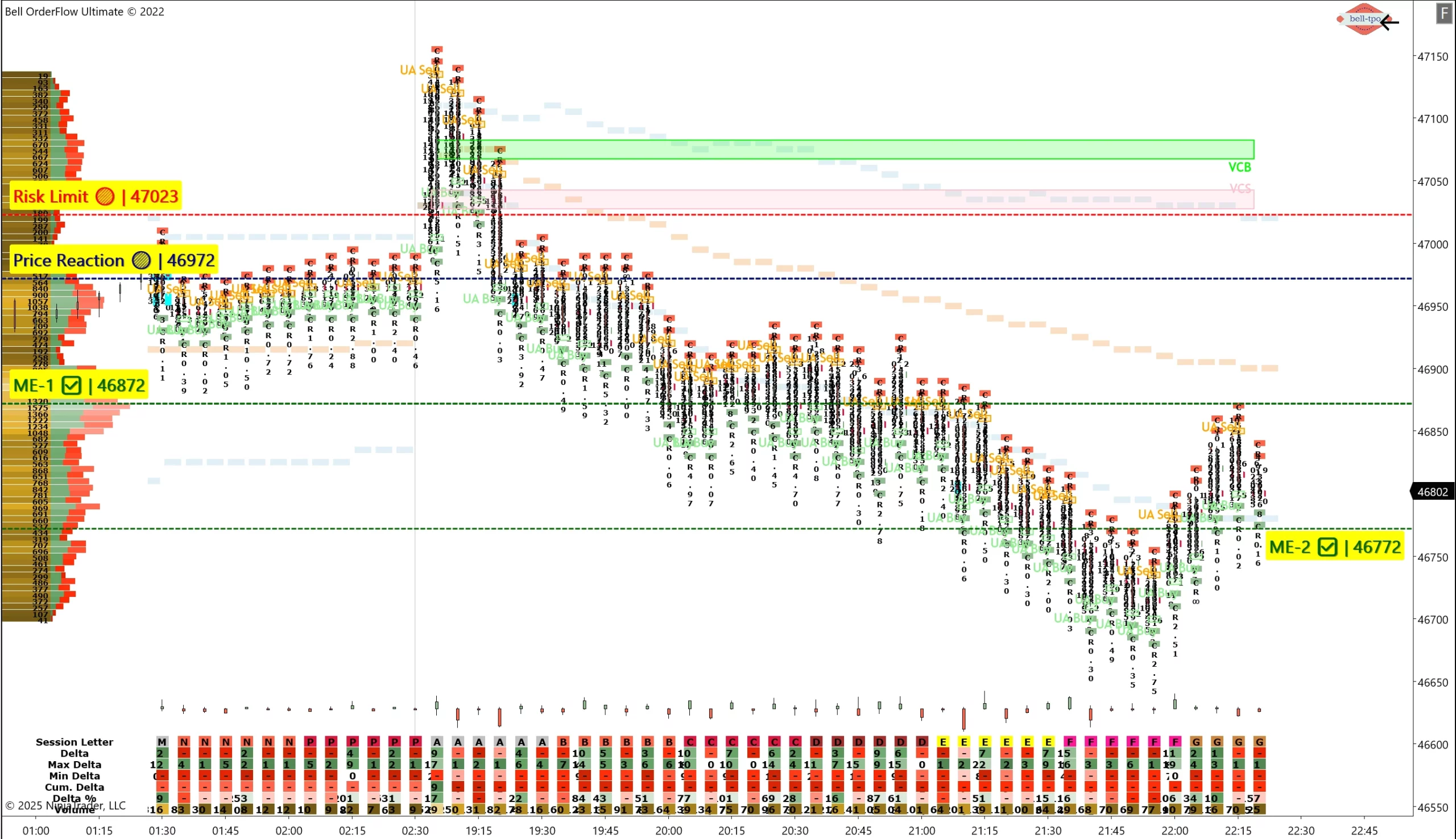

YM DEC25(Dow Jones): 200-Point Structured Downside Move with VC Zone in Bell Orderflow Ultimate

The YM DEC25 (Dow Jones Futures) session showcased the precision and clarity of Bell Orderflow Ultimate in navigating a structured downside move.

By leveraging VC Zone insights along with key structural references—Risk Limit, Price Reaction, and ME levels—traders captured a clean 200-point move with confidence and discipline.

Phase Overview: VC Zone as the Bias Setter

The session opened with VC Zone-driven signals that helped identify early selling pressure, setting the stage for a downside move.

Key Reference Points

- Risk Limit @ 47023 Acted as a protective upper boundary, defining the point beyond which the bearish setup would have been invalidated. Remaining below this level gave traders conviction to stay aligned with the downside.

- Price Reaction @ 46972 Served as the critical trigger point, marking the shift in auction pressure toward sellers. Holding below this reaction confirmed that the market bias was firmly on the downside.

Progressive Confirmation through ME Levels

The move developed step by step, guided by ME levels, which validated the auction flow’s strength and offered progressive checkpoints.- ME-1 @ 46872 Indicated the first equilibrium shift downward, reinforcing that sellers had sustained control after the initial breakdown. Provided the first checkpoint to guide continuation, keeping traders aligned with the move.

- ME-2 @ 46772 Represented a deeper equilibrium shift, confirming that seller dominance remained intact as the move extended further. Helped in tracking the auction flow’s progression and avoiding premature exits.

Net Outcome

The combination of VC Zone bias, Price Reaction trigger, and progressive ME levels guided traders through a 200-point downside move in YM DEC25. Each reference point played a distinct role in ensuring clarity, discipline, and confidence during the session.Key Takeaways

- VC Zone provided the foundation for directional conviction, highlighting where market control shifted to sellers.

- Risk Limit and Price Reaction acted as core reference points, balancing conviction with discipline.

- ME Levels mapped the move’s progression, offering structured checkpoints during the downside trend.

This session reaffirmed that Bell Orderflow Ultimate’s VC Zone and structural references transform complex market data into a clear, step-by-step roadmap for traders.

✅ Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com to discover how VC Zone and equilibrium-based tools simplify decision-making in volatile market conditions.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making any trading or investment decisions. Past performance is not indicative of future results.