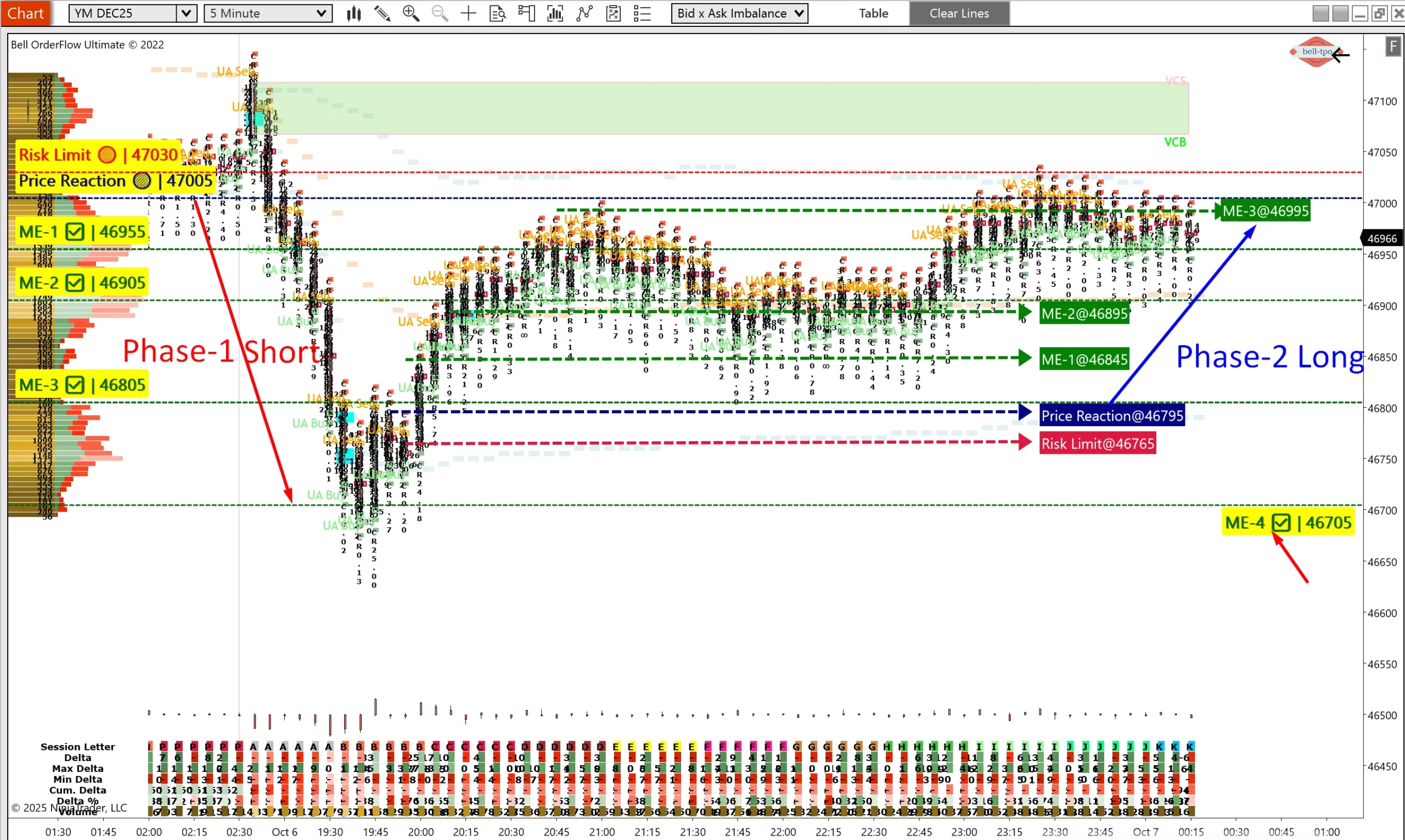

YM DEC25(Dow Jones): 500 Points Captured with Alerts and Structured References in Bell Orderflow Ultimate

The YM DEC25(Dow Jones) session once again highlighted the clarity and precision of Bell Orderflow Ultimate’s alert-based approach.

By combining VC Zone, TBTS, UA, and CR alerts with clear structural references, traders captured a net 500 points in two distinct phases.

Phase-1: Downside Move with VC Zone + TBTS Alert (300 Points Captured)

The session opened with bearish activity identified early through VC Zone and TBTS alerts, guiding traders to align with the downside bias.- Price Reaction @ 47005 → Marked the initial auction shift toward sellers, confirming downside control as the session began. Holding below this reference kept focus on short trades.

- Risk Limit @ 47030 → Served as a protective upper boundary for the bearish setup; staying below it reinforced confidence in the downside move.

- ME-1 @ 46955 → Acted as the first equilibrium checkpoint, confirming sustained selling pressure after the early break.

- ME-2 @ 46905 → Highlighted the continuation of auction flow in favor of sellers, providing guidance to stay aligned with the downmove.

- ME-3 @ 46805 → Reflected a deeper equilibrium shift, showcasing that sellers maintained control into lower price zones.

Phase-2: Upside Reversal with TBTS + UA + CR Alerts (200 Points Captured)

Following the downside move, the market reversed upward with strength, guided by TBTS, UA, and CR alerts, helping traders participate confidently in the recovery.- Price Reaction @ 46795 → Marked the decisive turnaround point, where buyers re-established control, signaling the start of the upmove.

- Risk Limit @ 46765 → Defined the protective lower boundary for the bullish setup; holding above it confirmed the reversal’s validity.

- ME-1 @ 46845 → Indicated the first equilibrium shift favoring buyers, showing that upward momentum had a solid foundation.

- ME-2 @ 46895 → Validated continued buying strength, reinforcing confidence to stay aligned with the uptrend.

- ME-3 @ 46995 → Represented the upper equilibrium checkpoint, where buyers maintained control to complete the structured rally.

Net Gain: 500 Points

- Phase-1: 300 points captured on the downside with VC Zone + TBTS alert.

- Phase-2: 200 points captured on the upside with TBTS + UA + CR alerts.

Key Takeaways

- VC Zone, TBTS, UA, and CR alerts provided real-time auction flow insights, guiding traders to align with market direction in both phases.

- Price Reactions and Risk Limits served as clear markers for directional conviction, minimizing uncertainty.

- ME Levels acted as progressive checkpoints, making it easier to navigate the auction flow with discipline.

This session demonstrated that alert-driven trading combined with structured market references delivers clarity and confidence, even in volatile conditions.

✅ Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com to see how our alert-focused framework simplifies trading decisions.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making any trading or investment decisions. Past performance is not indicative of future results.