Trading Opportunities in a Narrow-Range Market with Bell OrderFlow Ultimate

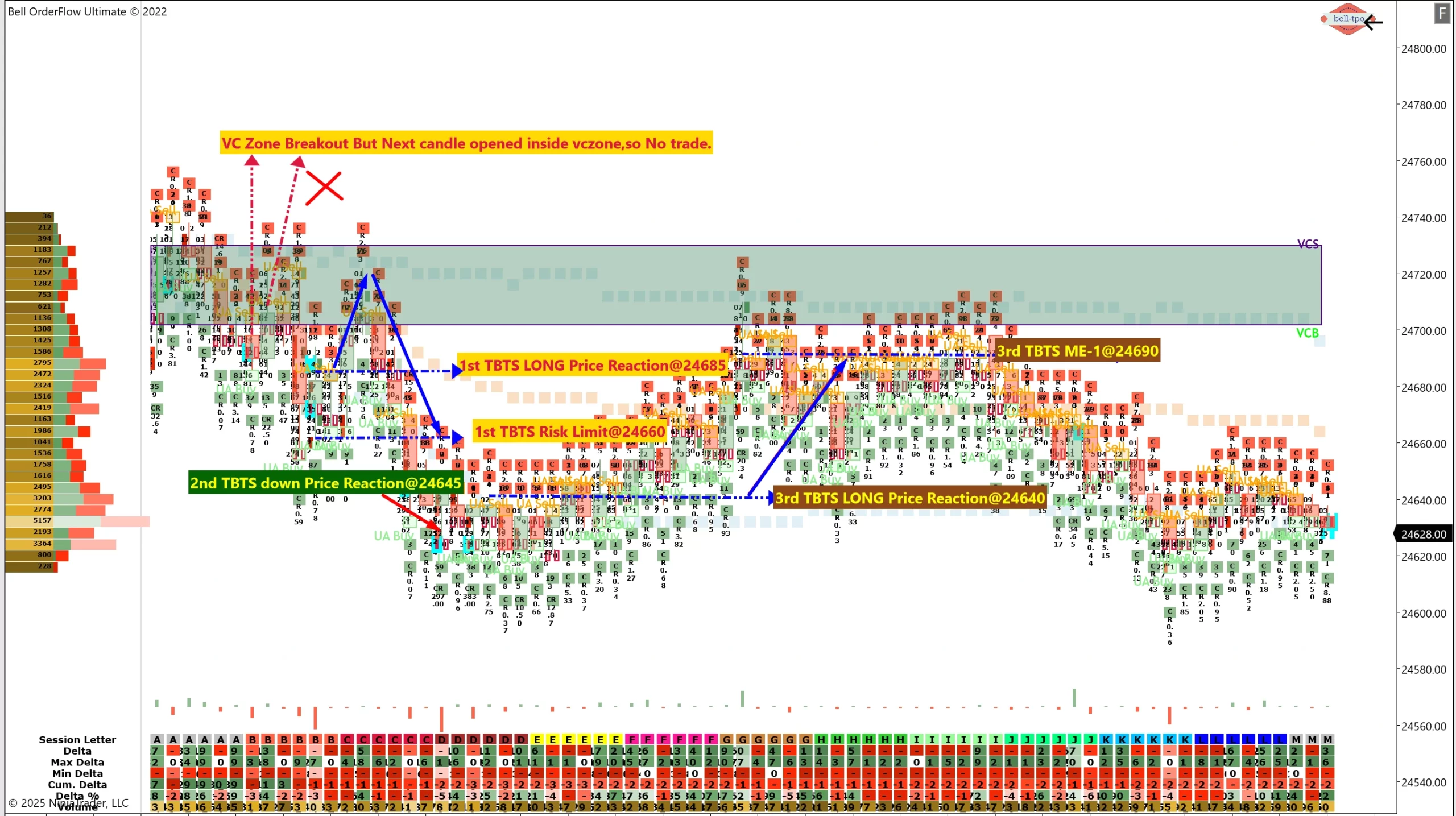

The first VC Zone breakout was observed, but the next consecutive candle opened back inside the VC Zone, indicating the breakout did not sustain.

Today’s market in NIFTY_I was a classic example of a low-volatility, narrow-range session. Even in such conditions, traders who understand market structure and alerts can identify potential opportunities without overtrading.

Phase 1:- The first TBTS Long Price Reaction was seen at 24685. However, the move quickly tested the TBTS Risk Limit at 24660, resulting in a small controlled loss of 25 points.

- This phase reinforced the importance of respecting predefined risk levels in narrow-range environments.

- A second TBTS alert on the downside triggered a Price Reaction at 24645. The move was short-lived and closed at 24640 as a new TBTS Long setup was confirmed.

- This helped in managing exposure and avoiding overstaying in weak moves.

- The third TBTS Long Price Reaction came in at 24640, moving towards ME-1 at 24690.

- This provided a structured opportunity to capture a 30-point net move for the day despite the low volatility.

Low-volatility sessions may seem dull, but with the right tools and concepts, structured trades can still be executed successfully. The key lies in understanding alerts, respecting risk limits, and staying patient for high-quality setups.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.