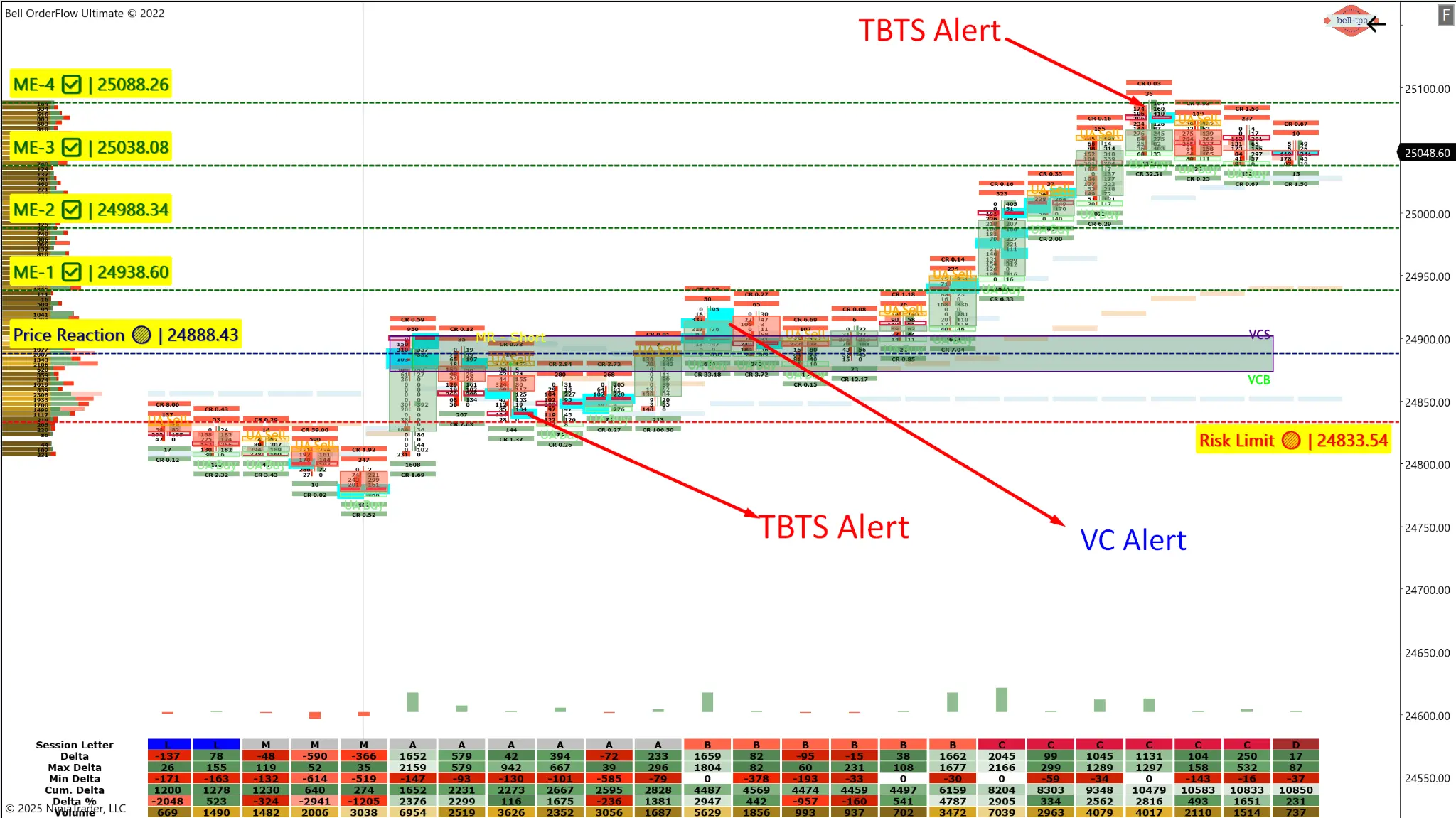

Structured Price Discovery with Bell Orderflow Ultimate: 200-Point Move Captured with VC Zone & TBTS Alert

Today’s market displayed a well-structured price development captured effectively through the combination of TBTS Alerts and VC Zone breakout. The move spanned a net 200 points, emphasizing the role of price behavior around key Market Equilibrium (ME) levels and orderflow alerts.

Key Observations:

🔹 Price Reaction Zone @ 24888.43This level marked the initial sign of responsive buyers stepping in. The subsequent demand absorption indicated strong interest at this zone.

🔹 Risk Limit @ 24833.54This acted as a boundary for informed risk assessment. Price stayed well above this threshold, validating continued upward intent.

🔹 ME-1 @ 24938.60The first major confirmation came as price cleared ME-1 decisively, supported by increased delta strength and trapped sellers unwinding.

🔹 ME-2 @ 24988.34Further directional confidence emerged when price sustained above ME-2, reflecting continuation strength post-TBTS alert.

🔹 ME-3 @ 25038.08With the breakout from the VC zone gaining momentum, this level was taken out cleanly, confirming an aggressive auction phase.

🔹 ME-4 @ 25088.26Final leg of the move culminated here, with signs of absorption and inventory balancing, marking a potential pause zone.

Educational Takeaway:

Today’s flow was a classic example of how Volume Cluster (VC) Zones, Trapped Buyer/Seller Alerts (TBTS), and ME-level-based structure can provide high-conviction market context. No predictive calls or trade recommendations are made—this serves purely for chart-based education and strategy refinement.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.