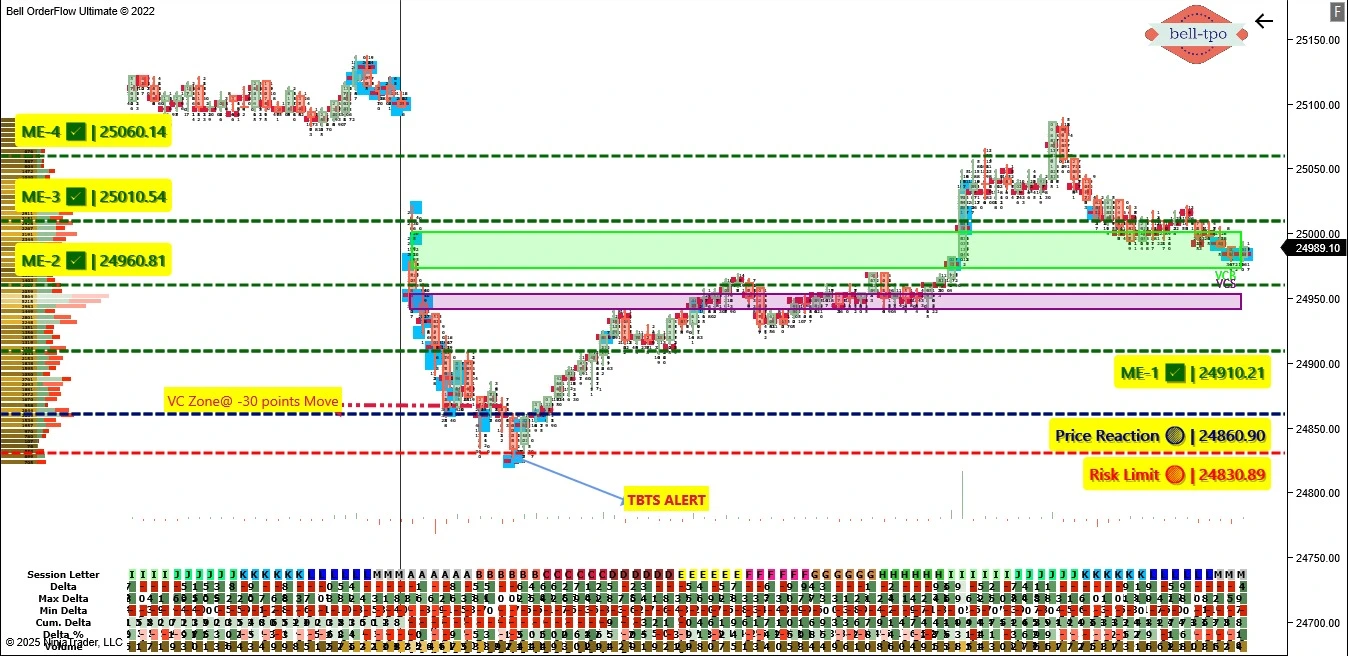

Structured Market Analysis Using Bell Orderflow Ultimate: 170-Point Move Captured with VC Zone & TBTS Alert

Today’s market action showcased the precision of Orderflow-based trading. While an initial move from the VC Zone didn’t go in our favor, the TBTS Alert identified a strong reversal, leading to a well-structured 200-point move. After netting off the earlier 30-point deviation, a total 170 points move was captured using disciplined observation of price behavior around Market Environment (ME) levels and risk zones.

🔍 Key Reference Levels and Observations

📌 Price Reaction @ 24860.90This level marked the early indication of responsive buyers stepping in after a failed VC Zone attempt. The TBTS alert aligned with this price response, setting the stage for a reversal.

📌 Risk Limit @ 24830.89Defined as the lower boundary of acceptable market structure failure. The price respected this zone, validating it as a safe invalidation point for short-term directional bias.

🧠 Market Environment Levels

✅ ME-1 @ 24910.21This level served as the first hurdle for upward continuation. Once breached, it confirmed the buyer’s strength and set the pace for continuation.

✅ ME-2 @ 24960.81Post-acceptance above ME-1, this level was tested and consolidated, establishing it as a key control zone during the mid-phase of the trend.

✅ ME-3 @ 25010.54Price sustained above this level briefly, showing rotational behavior. It reflected short-term profit booking by early buyers and fresh absorption by responsive sellers.

✅ ME-4 @ 25060.14The final intraday destination zone. Price approached and reacted, making it a natural exit reference for many intraday participants. This also indicates potential inventory adjustment happening near the top.

📘 Educational Note:Tools like TBTS Alert and VC Zones, when used with clear reference levels such as ME zones and price reactions, enable traders to respond to market behavior rather than predict it. The key lies in structured observation and disciplined execution.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.