Structured 194-Point Move Captured Using Bell Orderflow Ultimate

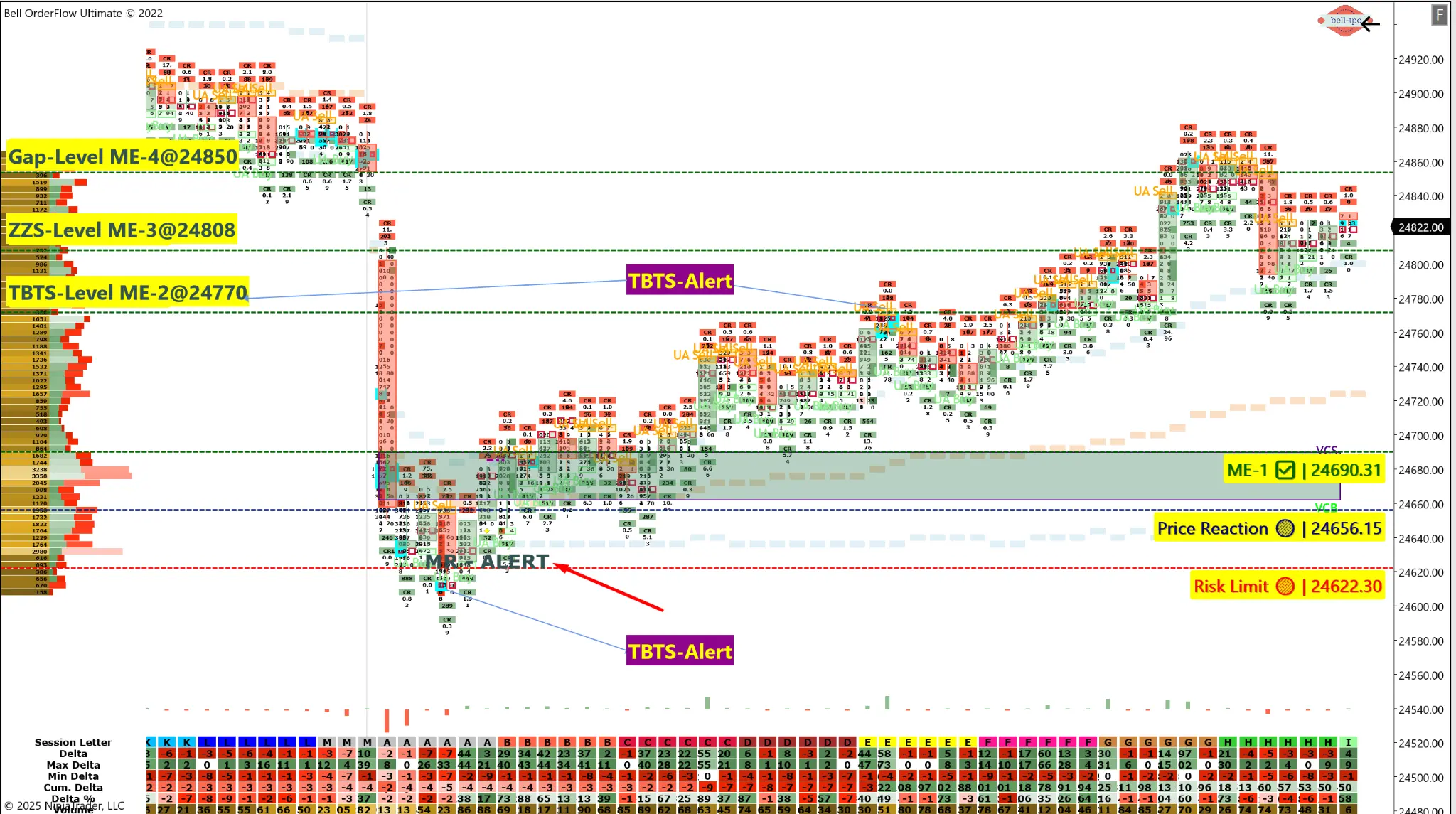

Today’s session unfolded a high-conviction opportunity using the structured logic of Bell Orderflow Ultimate. By aligning key volume-based levels with real-time alerts, we were able to track a 194-point move across multiple Market Equilibrium (ME) zones — from the initial Price Reaction to the Gap-Level high.

🔍 Key Observations & Levels:

- 📌 Price Reaction Zone @ 24656.15 The session began with a strong Price Reaction in this zone, setting the foundation for the directional shift. This early response indicated potential support formation aligned with cumulative delta exhaustion.

- 🛡️ Risk Limit @ 24622.30 The Risk Limit served as the invalidation point for the observed reaction zone. The price never breached this threshold, validating a well-protected setup and reinforcing disciplined risk management.

✅ Market Equilibrium Progression:

- ME-1 @ 24690.31 The price smoothly transitioned through this zone post-initial reaction. This confirmed structural acceptance and marked the beginning of strength in market sentiment.

- TBTS Level (ME-2) @ 24770.00 A TBTS Alert was triggered here, indicating a volume transition breakout. The flow above this level further strengthened the bullish structure, supported by aggressive buyers sustaining the control.

- ZZS Level (ME-3) @ 24808.00 This zone, identified using the ZZS (Zone-to-Zone Structure) logic, offered a minor pause. It reflects earlier absorption, and breaching this confirmed broader participant engagement.

- Gap-Level (ME-4) @ 24850.00 The final move extended into the Gap Zone. Such levels often attract liquidity, and today’s fill at this ME-4 range rounded off the complete 194-point journey.

🎯 Summary:

From the first Price Reaction @ 24656.15 to the final push into the Gap-Level ME-4 @ 24850.00, Bell Orderflow Ultimate’s logic-based tools — MR-Alert, TBTS confirmation, and ZZS zones — enabled a rule-based interpretation of market flow.

🔍 Key Takeaway:Understanding structural levels with clear validation logic can improve market clarity. This educational review emphasizes concept-based learning over predictive trades.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.