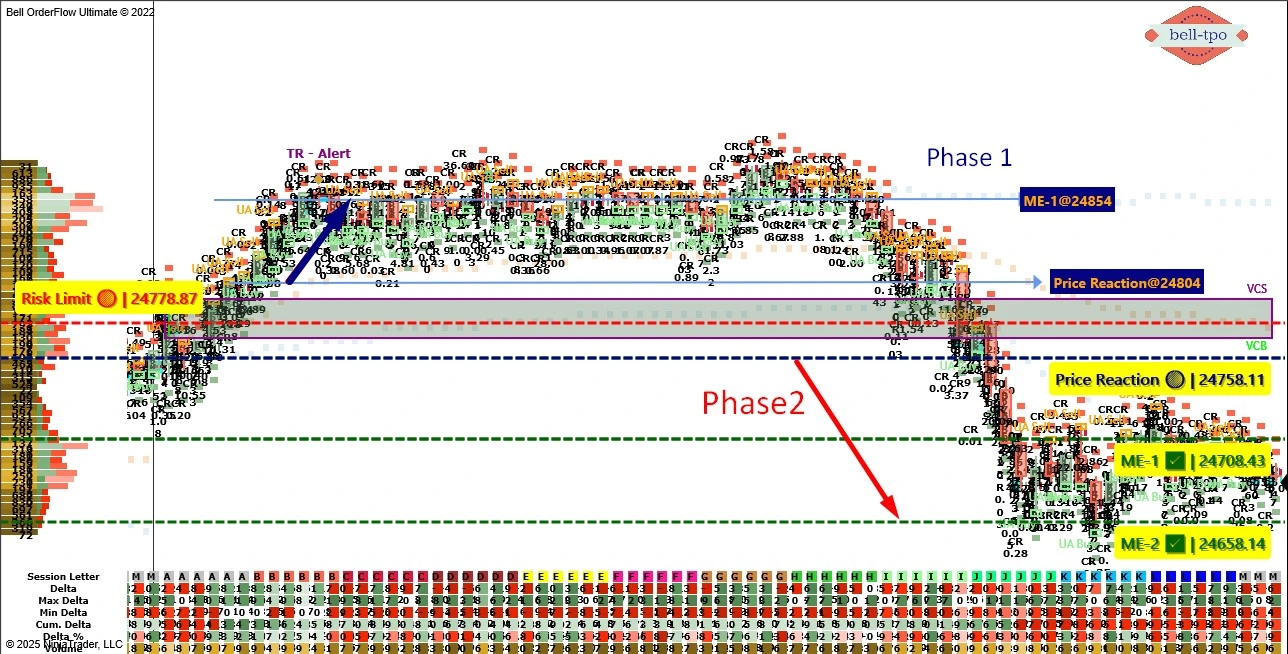

Structured 150 Points Move in NIFTY_I with VC Zone (2nd September)

This session highlights how VC Zone along with Bell Orderflow Ultimate reference levels helped in tracking a clean two-phase move. The observations here are strictly for learning and analysis — not a trading recommendation.

Phase 1 – Upside Exploration

- Price Reaction @ 24804: The reaction point acted as the pivot where buyers displayed strong initiative, setting the tone for the session.

- ME-1 @ 24854: Served as the first milestone of acceptance, confirming momentum continuation above the VC Zone.

Phase 2 – Downside Move

- Price Reaction @ 24758.11: Clearly marked the rejection point, signaling the shift in directional intent within the VC Zone.

- Risk Limit @ 24778.87: Functioned as the cap for downside risk, providing clarity for order flow analysis.

- ME-1 @ 24708.43: A decisive intermediate level that reinforced trend tracking and offered a checkpoint within the VC Zone framework.

- ME-2 @ 24658.14: Represented deeper structural completion, aligning with the broader flow observed through the VC Zone.

Key Highlight – VC Zone in Action

Throughout this session, the VC Zone remained the core reference point — from identifying buyer aggression in Phase 1 to confirming rejection and downside control in Phase 2. This demonstrates how the VC Zone, when paired with ME levels and Price Reactions, helps structure both upside and downside market phases.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.