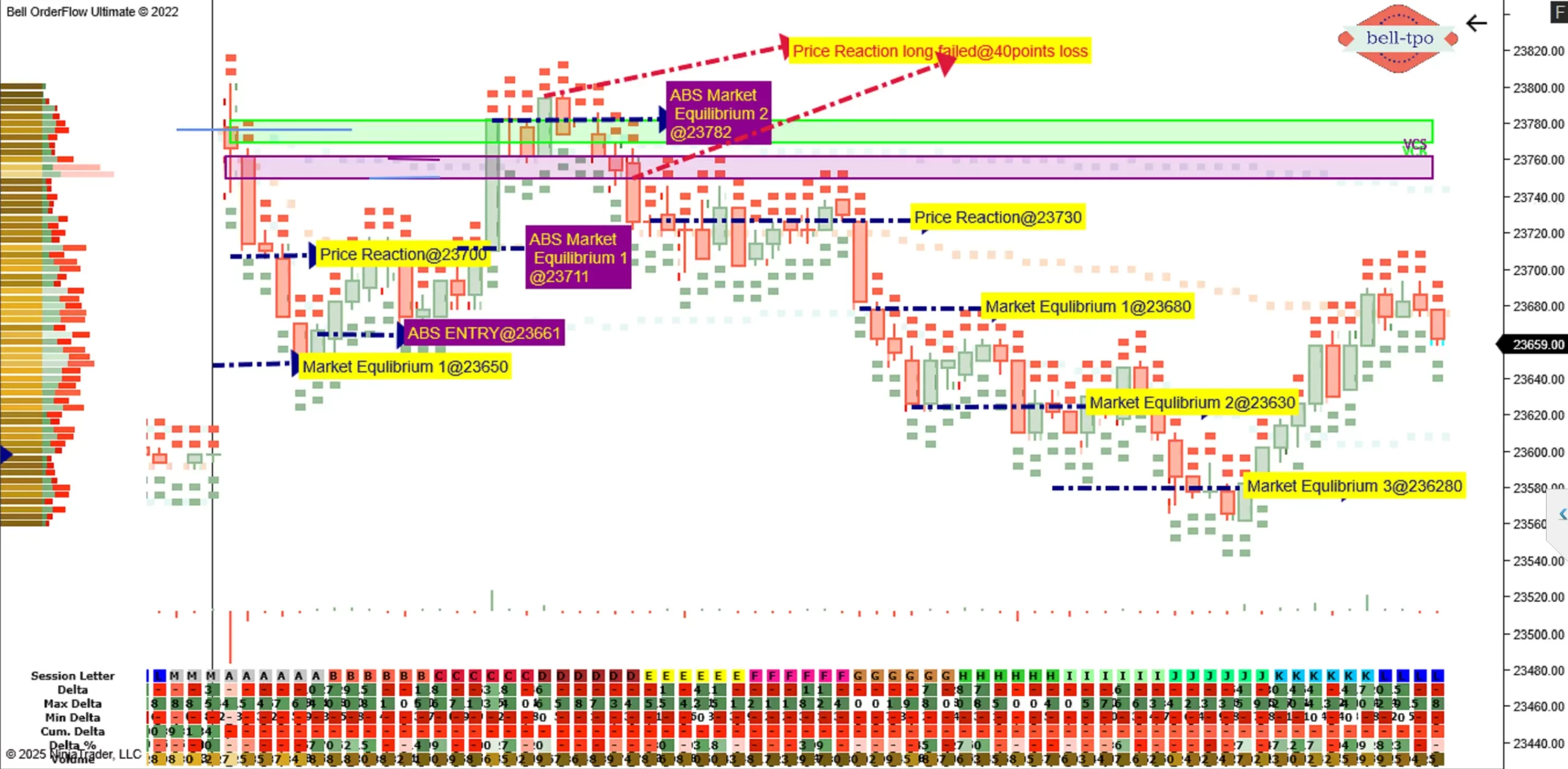

Precision Trading with VC Zone & ABS: Capturing Market Reversals with a 250-Point Move

Today’s session was a textbook example of how VC Zone and ABS (Absorption) concepts help traders identify structured trade opportunities. The price initially reacted to the VC Zone, leading to a strong short trade. As the market dynamics shifted, an ABS-based long trade confirmed strong selling absorption, giving a 100-point move. Later, a VC Zone long entry failed with a 40-point loss, but a second VC Zone short trade resulted in a 150-point move, making the session highly structured and tradable.

🔹 VC Zone & ABS Concepts in Action

📌 First Trade – VC Zone Short (Success) → 100 Points Move- The market reacted at the VC Zone, leading to an initial short trade.

- This move followed price absorption, confirming selling strength.

- The trade resulted in a 100-point move, validating the VC Zone setup.

- Price reversed as ABS Entry confirmed strong selling absorption.

- This led to a 100-point move to the upside, as buyers stepped in.

- A long trade setup at the VC Zone failed due to weak buying support.

- This resulted in a 40-point loss, confirming the presence of sellers.

- A second price reaction at the VC Zone triggered another short trade.

- This time, the selling pressure held firm, leading to a 150-point move.

🔹 Market Structure Insights from Today’s Chart

✅ Key Price Reaction & Market Equilibrium Levels:- VC Zone Short Entry: Confirmed at 23730, leading to a 100-point move.

- ABS Long Entry: Confirmed at 23661, leading to a 100-point reversal.

- VC Zone Long Failure: Stopped out with a 40-point loss at 23782.

- Second VC Zone Short: Reacted again at 23730, leading to a 150-point move.

- 23650 – First balance zone where price stabilized.

- 23680 – Key reference level in the market structure.

- 23630 – Intermediate balance level supporting the down move.

- 23628 – Final equilibrium where price found support.

✅ Session Summary & Key Takeaways

📌 First VC Zone Short Trade Provided a 100-Point Move📌 ABS Long Entry Reversed the Market for Another 100-Point Move

📌 VC Zone Long Entry Failed, Resulting in a 40-Point Loss

📌 Second VC Zone Short Trade Gave a 150-Point Move

Today’s session demonstrated the power of volume-based trading concepts, allowing traders to spot high-probability market reversals. Bell Orderflow Ultimate provided precise alerts, helping traders capture these structured moves efficiently.

🚀 Enhance Your Trading with Bell Orderflow Ultimate! 🔹 Maximize Your Trading Edge with Bell Orderflow Ultimate!Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.