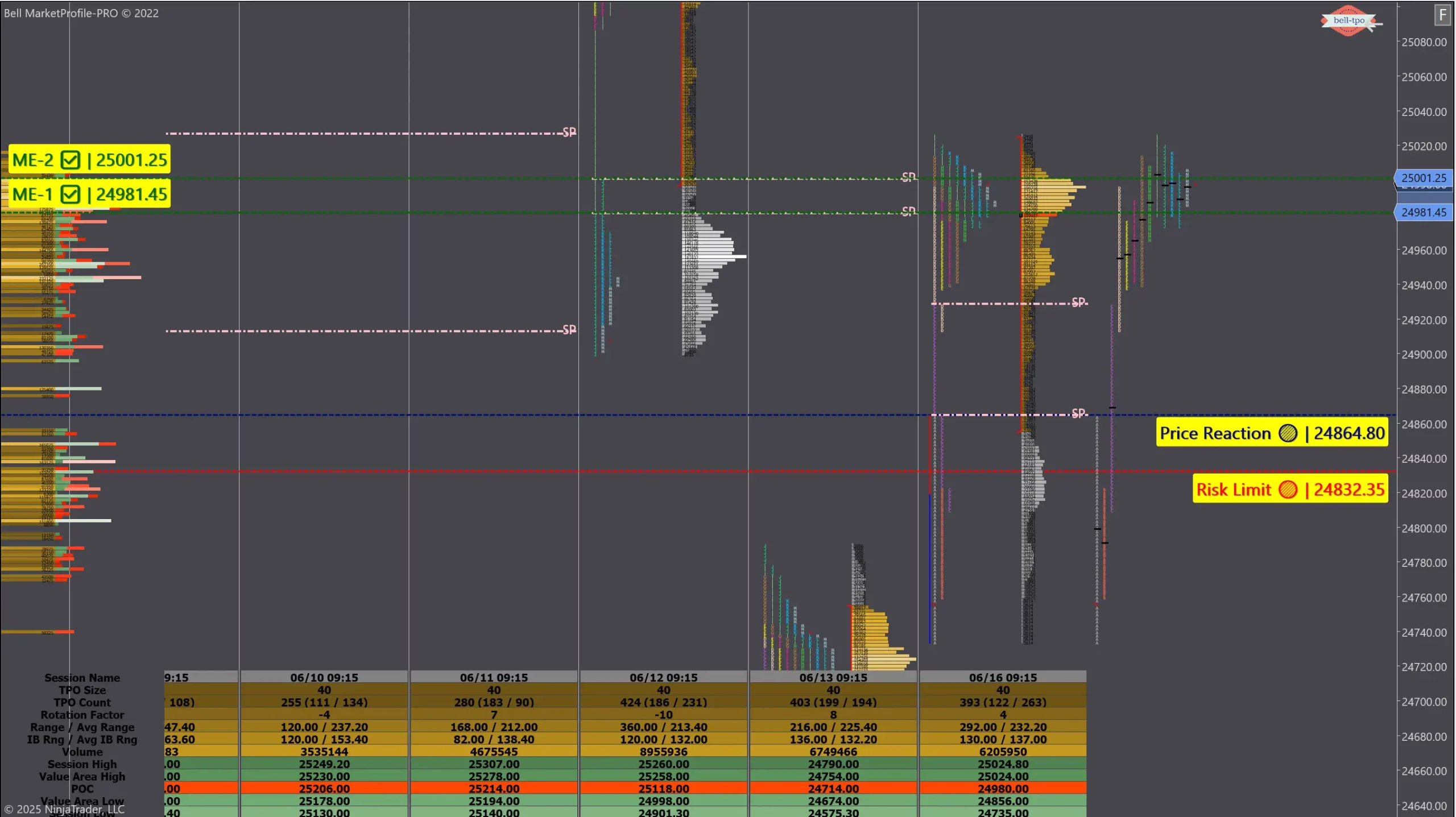

One-Time Framing & SP Zone Reaction: A 136-Point Structured Move in Market Profile

Today’s session delivered a clean example of how Market Profile concepts like Single Print Zones and One-Time Framing can visually guide a trader’s understanding of market behavior—without the need for predictions.

🧭 Structured Observation

The session began with a high confidence open in the A period, characterized by directional conviction and minimal rotational overlap. This set the tone for a controlled auction.

During C period, price reacted decisively from a low of 24864—a level that coincided with developing order flow and responsive interest.

From there, the market moved with structural clarity, advancing toward ME-1 @ 24980 and ME-2 @ 25000, both of which were Single Print Zones established on June 13th.

🔍 Historical SP Zones as Reference Anchors

The movement towards these SP zones represented a net structured move of 136 points, reinforcing the relevance of untouched SP references in directional markets.

As noted in Market Profile frameworks, Single Print Zones represent prior imbalances. Until those zones are accepted with value (i.e., new time-price opportunity formation), they tend to act as natural reaction levels or magnets.

🔁 One-Time Framing: Confidence in Continuation

What gave additional conviction to today’s move was the presence of One-Time Framing Up from B through F periods. This structure, defined by consecutive higher lows, indicates controlled upward auctioning—a sign of buyer strength and lack of opposition from the other side.

In today’s context, this framed the move as not just a random reaction, but part of a higher-timeframe guided narrative, allowing price to follow through cleanly into historical SP territory.

🧠 Educational Takeaway

The combination of a high confidence open, responsive activity at a structurally relevant level, and One-Time Framing Up created a visually clean, auction-aligned session. The 136-point move captured between the C period low and historical SP references exemplifies how market-generated information (MGI) provides clarity—not forecasts.

📌 Disclaimer: This article is purely for educational and informational purposes. It does not constitute investment advice or trade recommendations. Always refer to risk frameworks and SEBI compliance norms before making any market decisions.