Not Every Day is a Trading Day – Identifying Low Confidence Opens

Note: Not every day presents a high-probability trading opportunity. When Bell Market Profile Ultimate indicates a no-confidence open, it’s often better to stay away and preserve capital.

Market Context

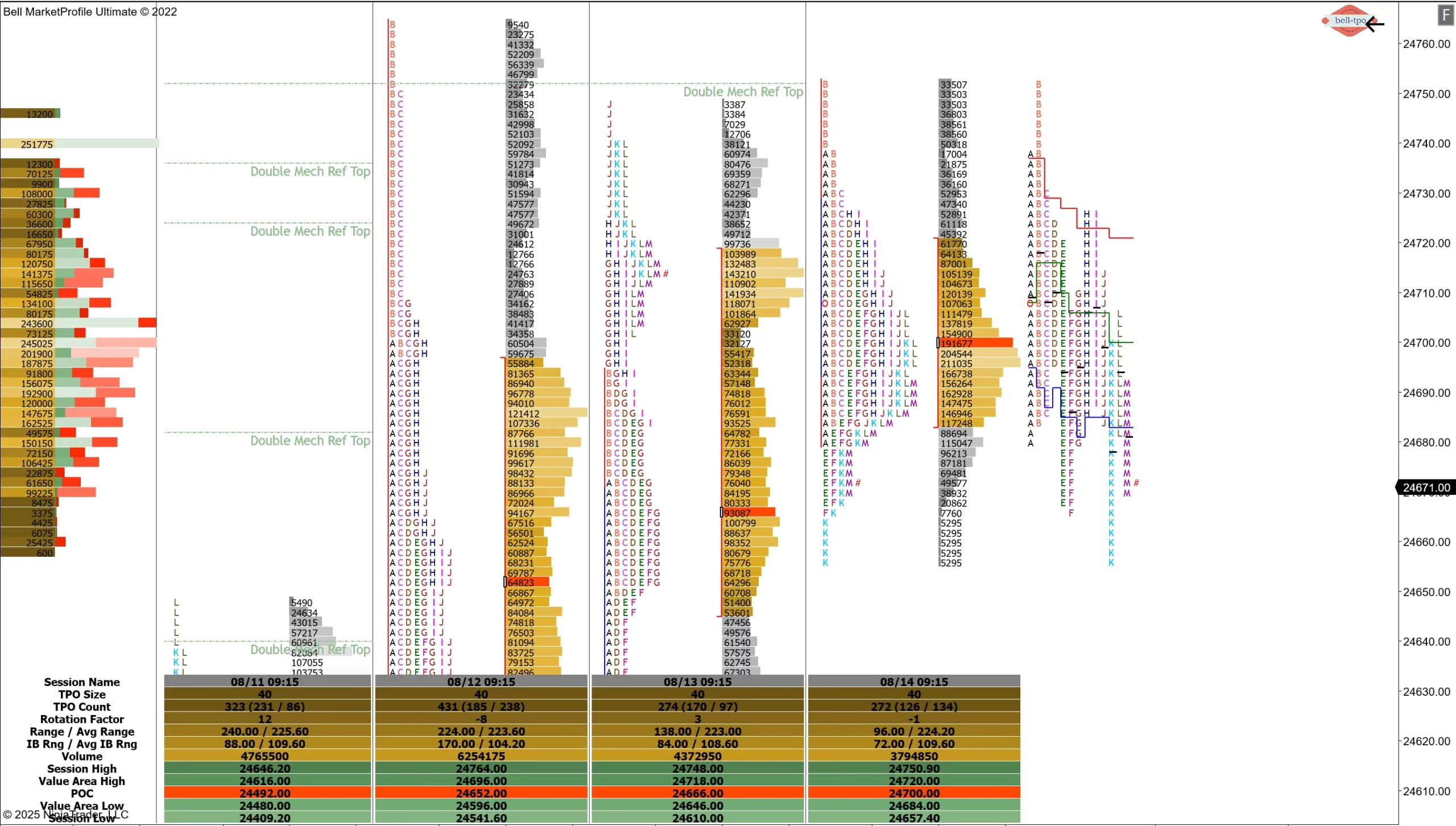

Today was a dull, balancing day with no strong conviction at the open. Bell Market Profile Ultimate clearly showed no confidence, and a Double Mechanical Reference @ 24752 acted as a firm resistance zone, keeping price within a narrow intraday range.

Scalping Opportunities

Even on low-energy market days, scalpers found multiple small-range setups.

One example:A TBTS alert combined with Unfinished Auction Buy/Sell (UA BUYSELL) signal captured a 25-point intraday move using Bell OrderFlow Ultimate.

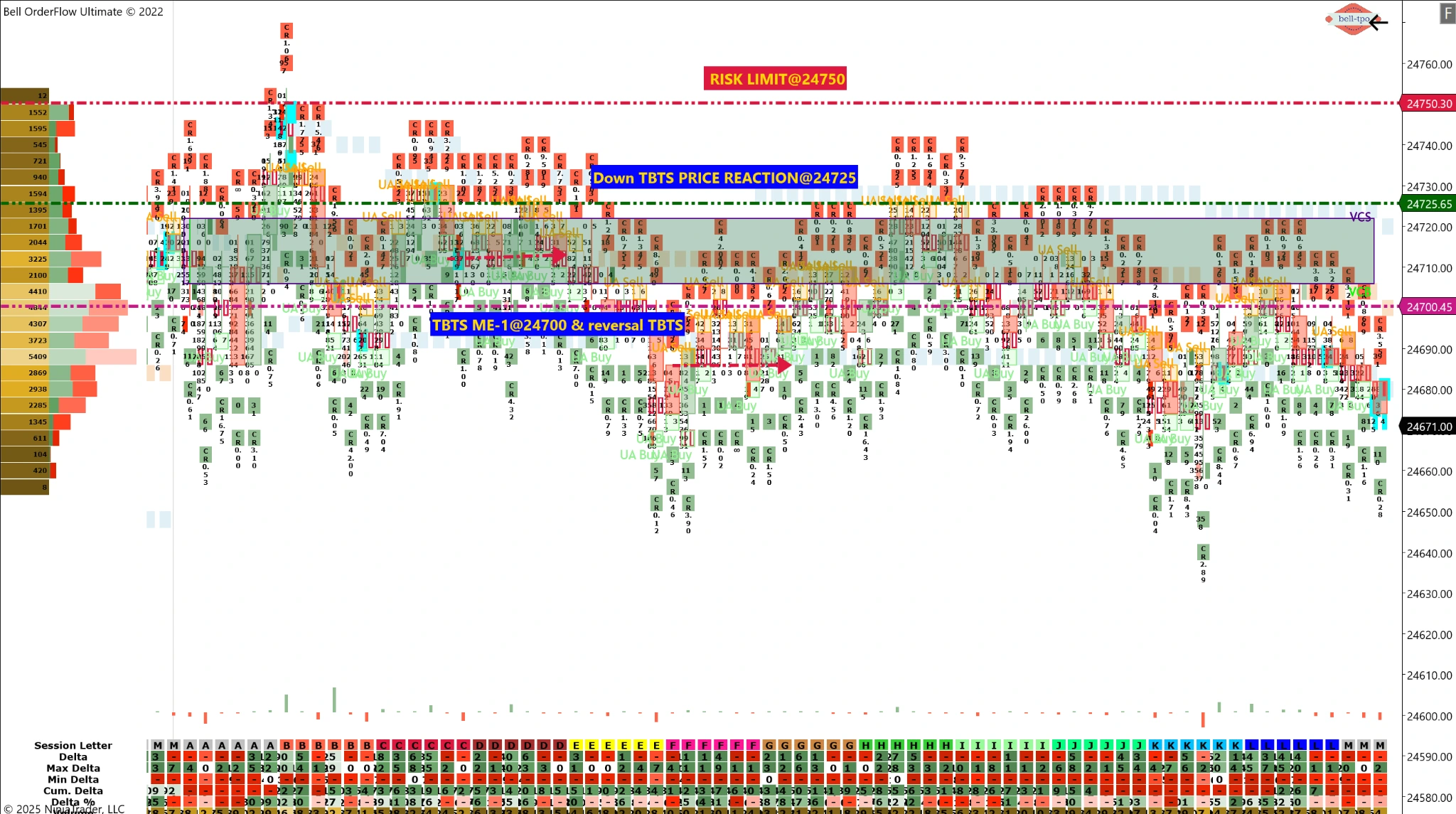

Bell OrderFlow Ultimate – Key Levels & Observations

- Risk Limit – 24750 This level defined the upper boundary where trade risk was contained, aligning with the Double Mechanical Reference from Market Profile.

- Down TBTS Price Reaction – 24725 First responsive selling appeared here, initiating a mild pullback.

- TBTS ME-1 @ 24700 & Reversal TBTS Served as a key intraday marker. The reversal setup provided an opportunity to fade short-term strength.Educational Takeaway

- Balancing markets with mechanical references near the open typically lack momentum.

- In such conditions, trade management shifts from swing targets to quick scalps with defined risk.

- Combining Market Profile context (no confidence, mechanical references) with OrderFlow execution tools (TBTS, UA BUYSELL) helps traders adapt to low-volatility sessions.

Today reinforced the principle that patience is also a trading skill. Avoid over-trading in low-confidence opens, focus on protecting capital, and wait for structured opportunities. When the market offers little follow-through, precision scalping can still extract value—but only with strict discipline and risk control.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.