Nifty Intraday Short Opportunity Using Bell Market Profile Ultimate

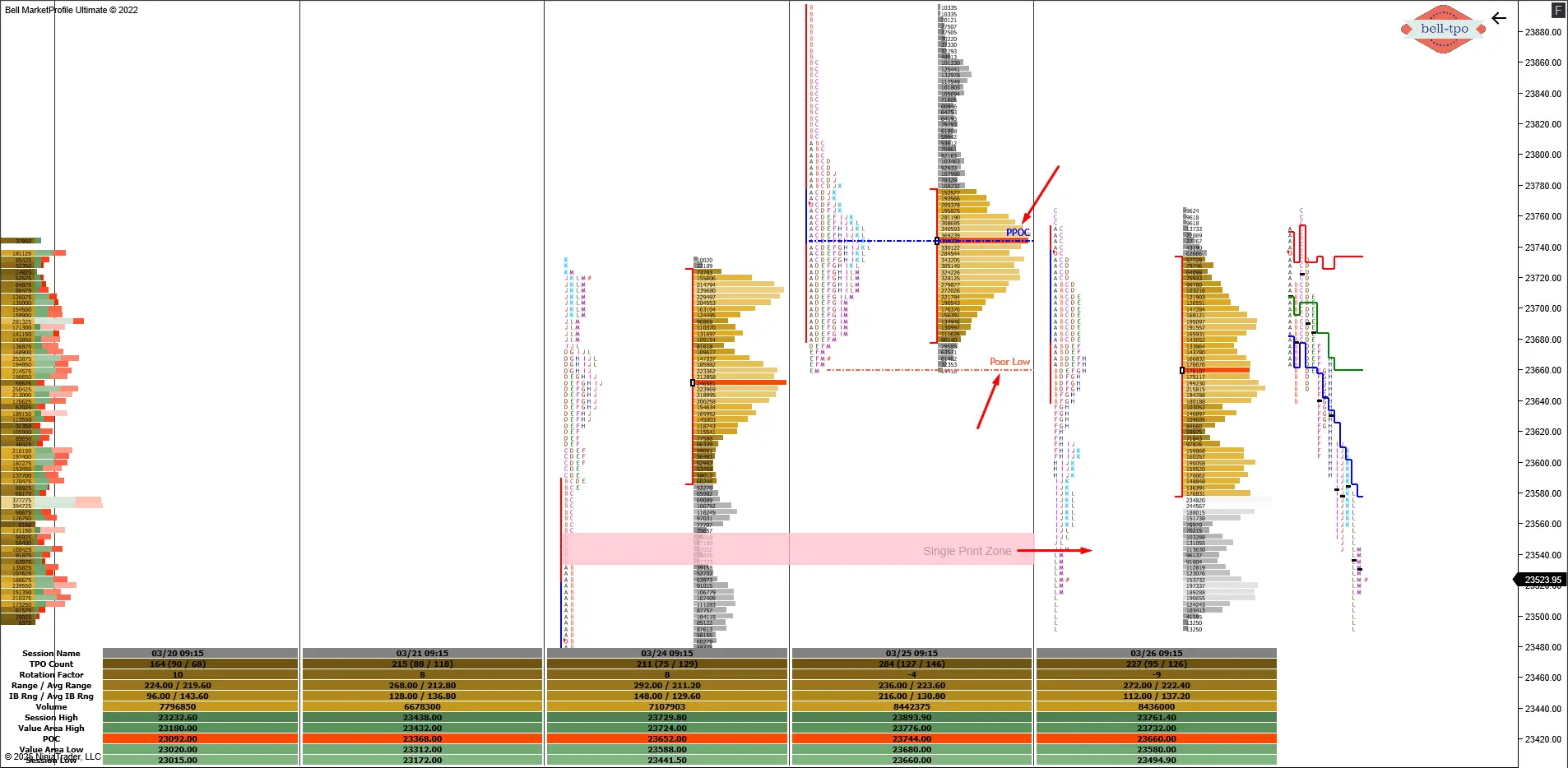

The Bell Market Profile Ultimate chart provided a fantastic 190 points shorting opportunity in Nifty-I , thanks to the automated reference lines, which make market analysis structured and systematic. Today’s setup revolved around three key Market Profile reference levels:

- Prominent Point of Control (PPOC) @ 23740

- Poor Low @ 23660

- Single Print Zone from March 24 @ 23550

These levels played a crucial role in identifying intraday trade opportunities. Let’s break down the setup and how traders could have capitalized on it.

Market Context and Trade Setup

1. PPOC @ 23740 – A Strong Resistance

The PPOC (Prominent Point of Control) represents the price where the most volume was traded, making it a critical reference for market direction. Since price rejected this level, it indicated sellers were active, making it a strong resistance.

2. Poor Low @ 23660 – A Weak Structure

A Poor Low suggests that the auction process was incomplete at lower levels, meaning sellers didn’t exhaust themselves. When price approached this level today, it was a sign that further downside was likely.3. Single Print Zone @ 23550 – A Magnet for Price

A Single Print Zone is an area where the market moved quickly without much trading. These areas often get revisited as the market seeks to fill in the inefficiencies. The March 24 Single Print Zone at 23550 became the ideal target for today’s short trade.

How the Trade Played Out

- Entry: After rejecting PPOC at 23740, a short position was initiated.

- Confirmation: Sellers showed strength as price broke below 23660 (Poor Low), confirming downside momentum.

- Target: The next key level was the Single Print Zone @ 23550, which acted as a price magnet.

This systematic approach, using Market Profile reference levels, allowed traders to anticipate the price movement rather than react emotionally.

Why Bell Market Profile Ultimate is a Game Changer?

✅ Automatic Reference Lines – No need to manually draw key Market Profile levels like PPOC, Poor High/Low, and Single Print Zones.

✅ Structured Auction Market Theory (AMT) Approach – Helps traders follow the order flow and market dynamics in real-time.

✅ No More Guesswork – Clearly defined trade plans based on volume-based market structure.

For traders looking to improve their Market Profile trading skills, this tool provides the perfect edge!

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.