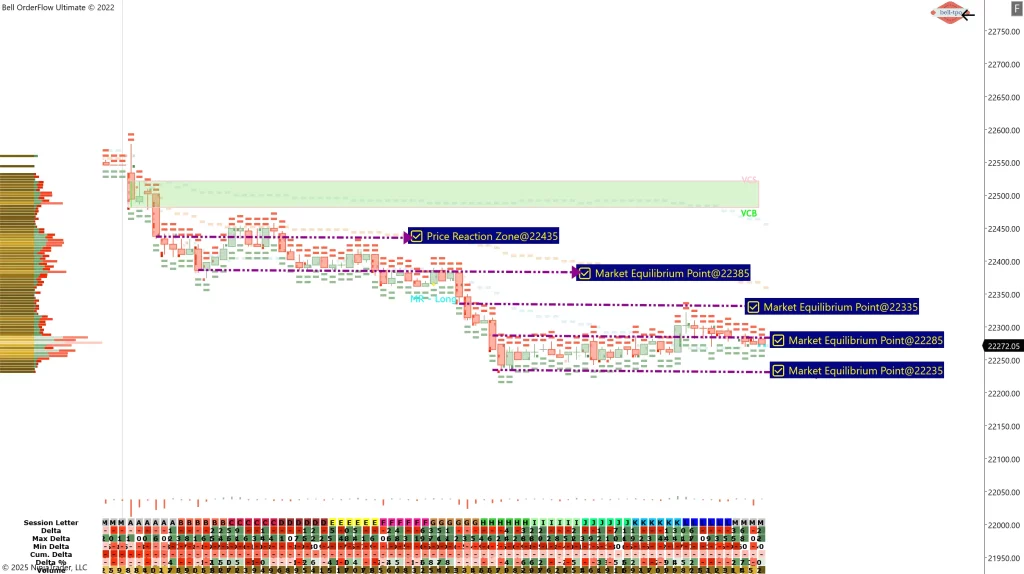

Nifty Downtrend – How Bell Orderflow Ultimate Identified a Winning Short Trade

Today’s Nifty session was dominated by selling pressure, with price action steadily moving lower. While such downtrend days offer great opportunities, many traders struggle to identify the right entry points and risk getting caught in false reversals.

How Bell Orderflow Ultimate Helped Traders Stay Ahead!

✔ Volume Cluster Zone Alert – The indicator detected high-volume selling pressure, confirming institutional participation and increasing short-trade confidence.

✔ Market Equilibrium Points – Multiple levels at 22385, 22335, 22285, and 22235 provided key areas of price reaction, enabling traders to manage their trades effectively.

✔ Delta Imbalance Confirmation – The selling momentum was supported by strong negative delta, reinforcing the bearish sentiment.

Traders using Bell Orderflow Ultimate could execute well-timed short trades, align with market sentiment, and avoid unnecessary counter-trend trades.

Why This Matters?

Not every downtrend is an easy trade, but with real-time Orderflow insights, Bell Orderflow Ultimate helps traders separate high-quality setups from noise—leading to better risk management and more consistent decision-making.

Learn More About Bell Orderflow Ultimate

Visit www.belltpo.com or contact us for more details.

Disclaimer:

- We are a software and indicator development company.

- This chart and analysis are for educational and informational purposes only.

- This is not investment advice or a recommendation to buy, sell, or trade any financial instrument.

- Users must conduct their own research before making any trading decisions.

- Past performance is not indicative of future results.