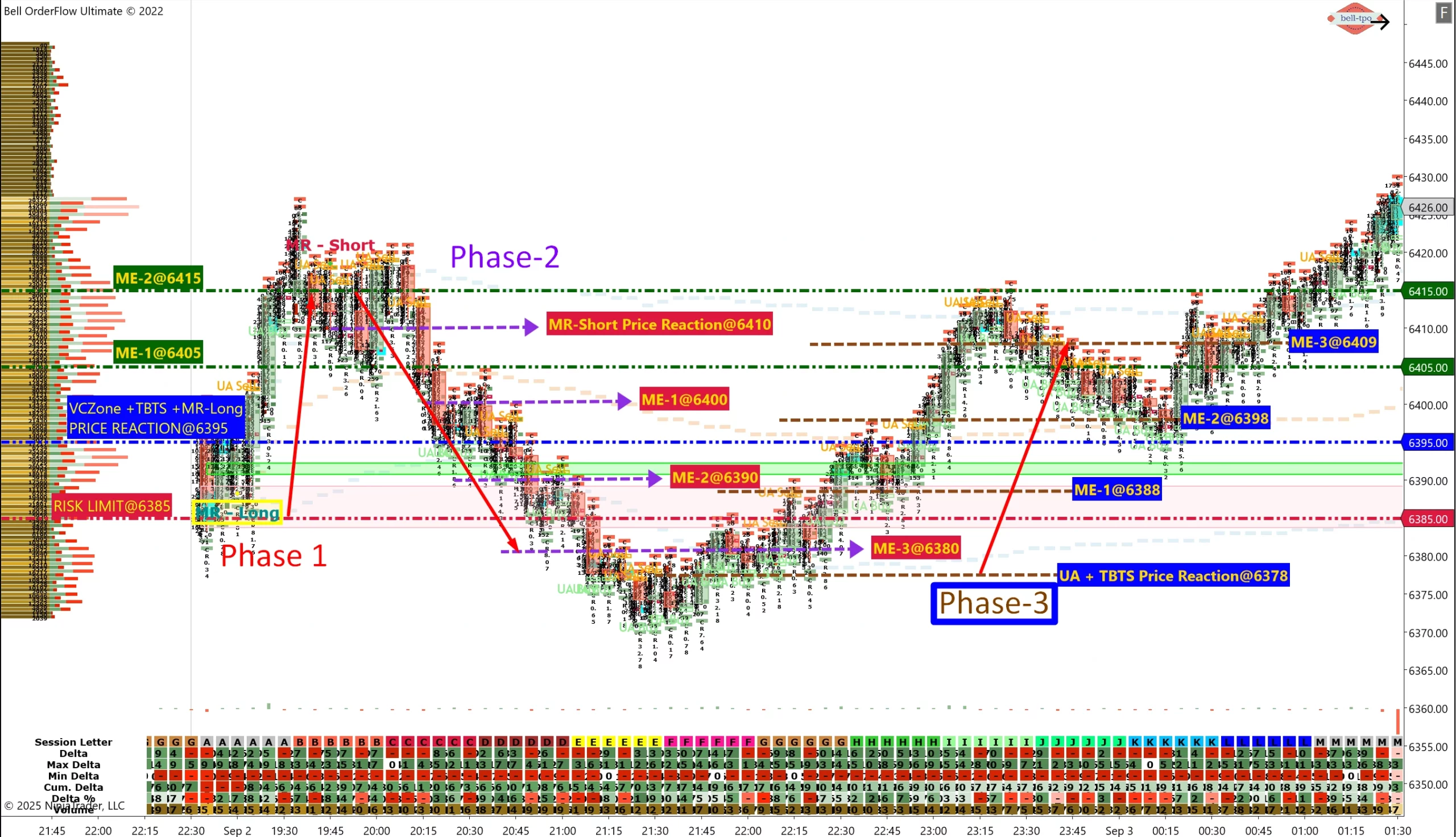

Net 80 Points Structured Gain in ESSEP25 with Bell Orderflow Ultimate (2nd September)

This chart illustrates how Bell Orderflow Ultimate helps track structured market phases using reference levels. It is intended purely for learning and market study — not as a buy/sell recommendation.

Phase 1 – Upside Move

- Risk Limit @ 6385 acted as the base level, providing downside protection.

- VC Zone + TBTS + MR-Long Price Reaction @ 6395 confirmed early upward momentum.

- ME-1 @ 6405 and ME-2 @ 6415 served as sequential milestones, mapping the continuation of the move.

Phase 2 – Downside Reaction

- MR-Short Price Reaction @ 6410 marked a shift in sentiment, triggering the corrective phase.

- ME-1 @ 6400, ME-2 @ 6390, and ME-3 @ 6380 highlighted the structured path of the retracement.

Phase 3 – Recovery Phase

- UA + TBTS Price Reaction @ 6378 signaled the turning point for recovery.

- ME-1 @ 6388, ME-2 @ 6398, and ME-3 @ 6409 captured the measured progression back to higher ground.

Key Highlight

The main driver in this session was the TBTS + MR-Long confluence in Phase 1, which provided clarity in detecting the directional intent of the market. By combining TBTS alerts with MR-Long/Short reactions, traders can study how order flow transitions across different market phases.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.