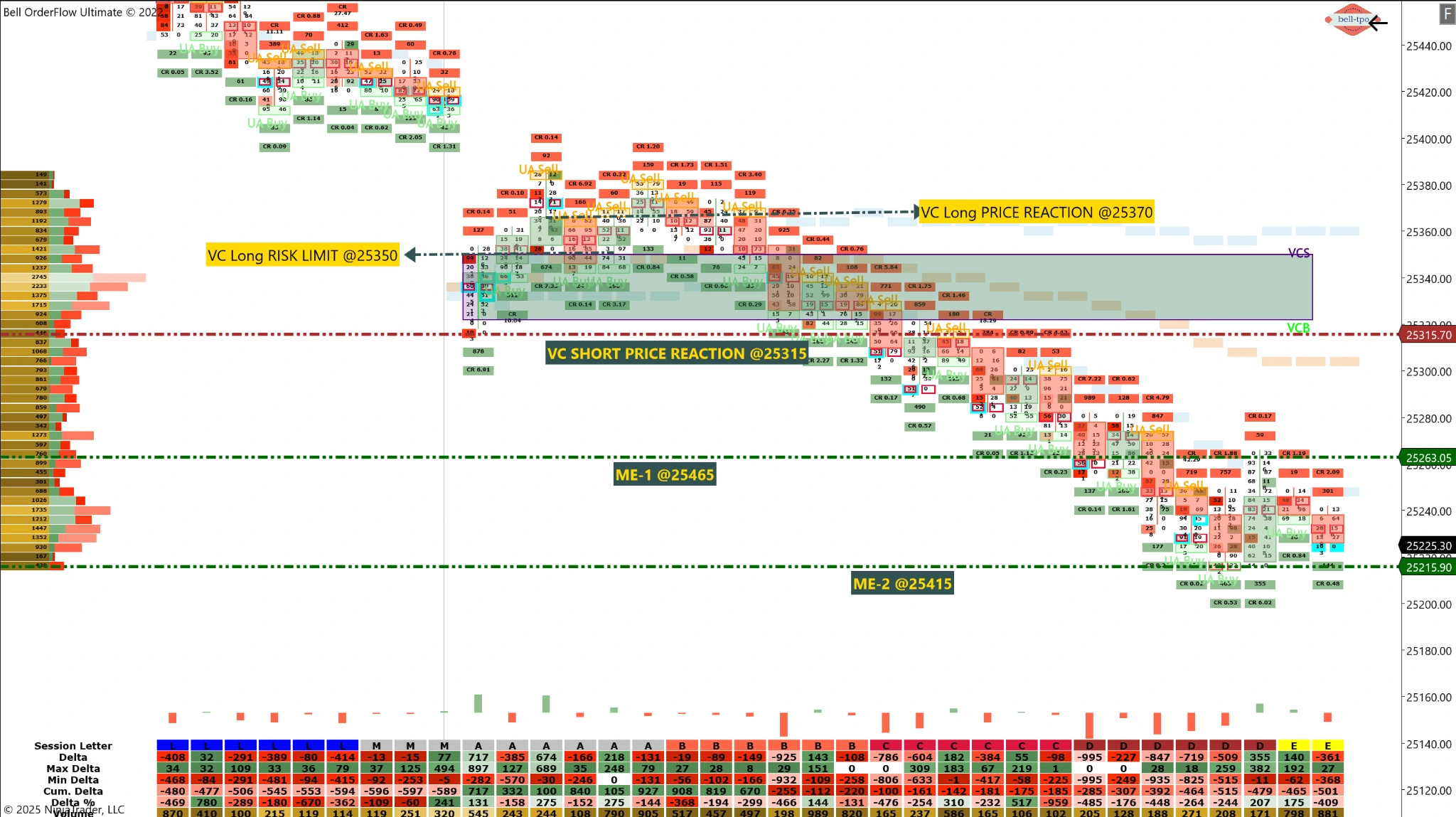

Net 80 Points Captured in 2 Phases Using Bell Orderflow Ultimate – Controlled Risk, Powerful Trend Execution

Today’s session using Bell Orderflow Ultimate unfolded in two structured phases — a controlled risk exit on a long setup followed by a high-probability short opportunity, resulting in a net capture of 80 points.

🔹 Phase 1: Long Setup – Risk Limit Hit

- The session began with a VC Long Price Reaction @25370, showing initial signs of strength.

- However, price failed to sustain and hit the VC Long RISK LIMIT @25350, resulting in a controlled 20-point loss.

- The system’s predefined risk threshold ensured traders could exit early and preserve capital for the next move.

🔹 Phase 2: Short Setup – 100 Points Captured

- Price revisited the VC SHORT PRICE REACTION @25315, which triggered strong selling momentum.

- Orderflow signals confirmed sustained pressure, as price moved through:

- ME-1 @25465

- ME-2 @25415

- The move was further validated by strong sell imbalances and consistent delta dominance.

✅ Conclusion

The session perfectly reflects the disciplined structure of Bell Orderflow Ultimate:

- Phase 1: A failed long setup with a strict 20-point risk limit protected from deeper losses.

- Phase 2: A high-conviction short trade that captured 100 points on the downside.

- Final Result: Net 80 points captured, emphasizing the edge in combining VC zones, ME levels, and orderflow-based confirmation.

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.