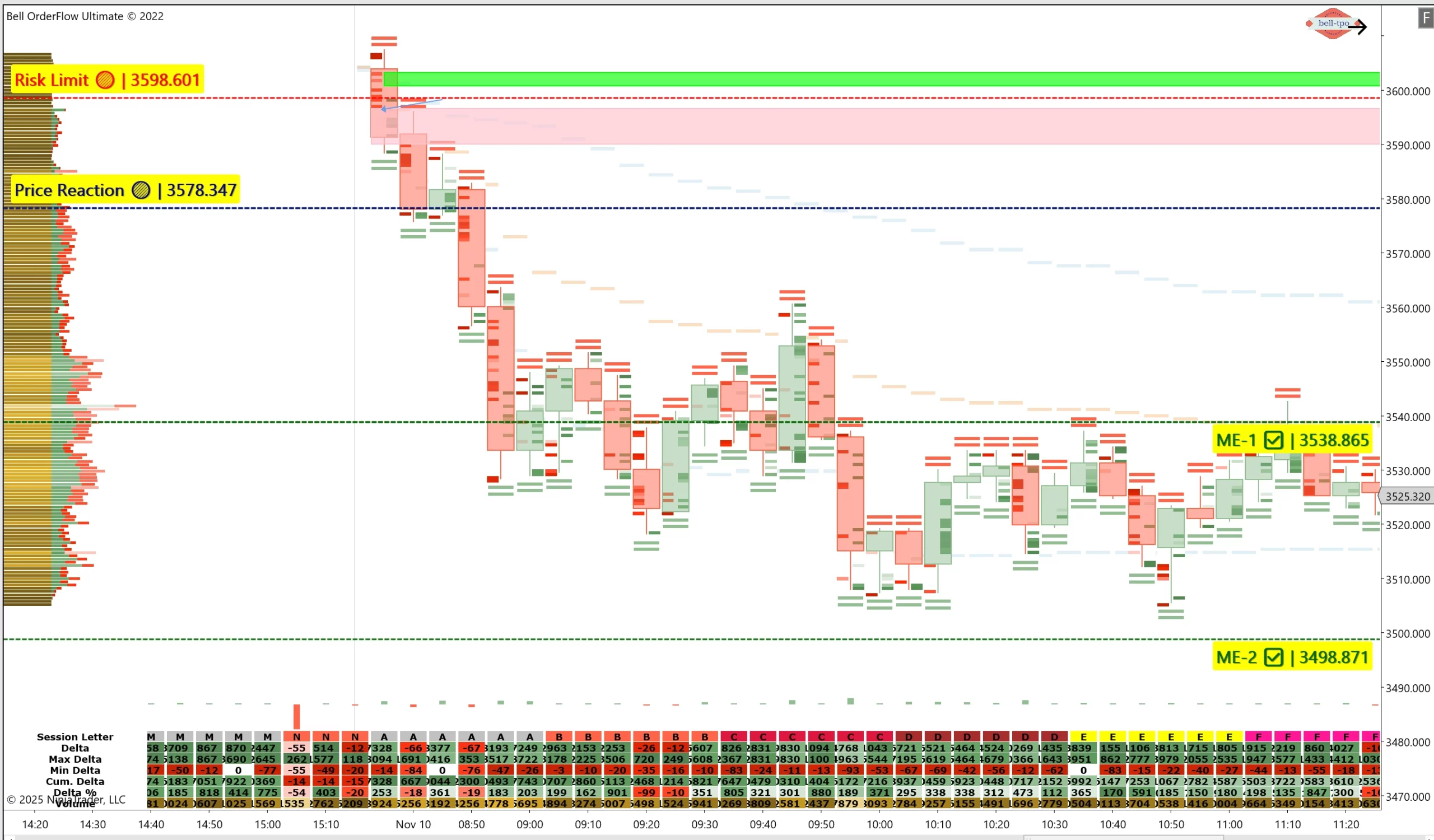

Educational Takeaway: Net 40 Points Move Captured in ETHUSD using TBTS + VC Zone using Bell Orderflow Ultimate

The move began when buying pressure weakened at the VC Zone and orderflow flipped from aggressive lifting to passive holding. TBTS highlighted the trap of late buyers, and once the pressure shifted, price began rotating lower in a controlled manner.

Phase: Reaction

Price Reaction @ 3578.347:

- At this level, aggressive buy orders were absorbed, and lifting volume failed to advance the auction.

- The orderflow print shifted from positive delta to stalled delta, indicating loss of buyer follow-through.

Phase: Risk Framework

Risk Limit @ 3598.601:

- Risk was defined above the point where aggressive sellers last lost control, ensuring invalidation only if buyer pressure regained dominance.

- This risk placement prevents emotional exits and keeps the position aligned with flow control, not noise.

Phase: Measured Exit Execution

ME-1 @ 3538.865:

- ME-1 served as the first rotation completion, calculated from the imbalance expansion.

- Partial exit here confirmed the trade followed its expected rotation path, securing realized gains while structure remained intact.

Key Understanding

This move didn’t rely on prediction. It was a reaction to a clear shift in orderflow pressure:

- Buyer aggression stalled

- Absorption took over

- Trap confirmed via TBTS

- Rotation completed into ME-1

No price action required. No candle patterns. Just flow → shift → rotate → exit.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through VC, TBTS, and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.