Market Turns Sharply After TR Alert & VC Zone Breakdown – 220 Points Captured in NIFTY_I

Today’s market session was a textbook example of how Bell OrderFlow Ultimate and Market Profile Ultimate work in synergy to decode structural moves in real time. Let’s break it down phase by phase.

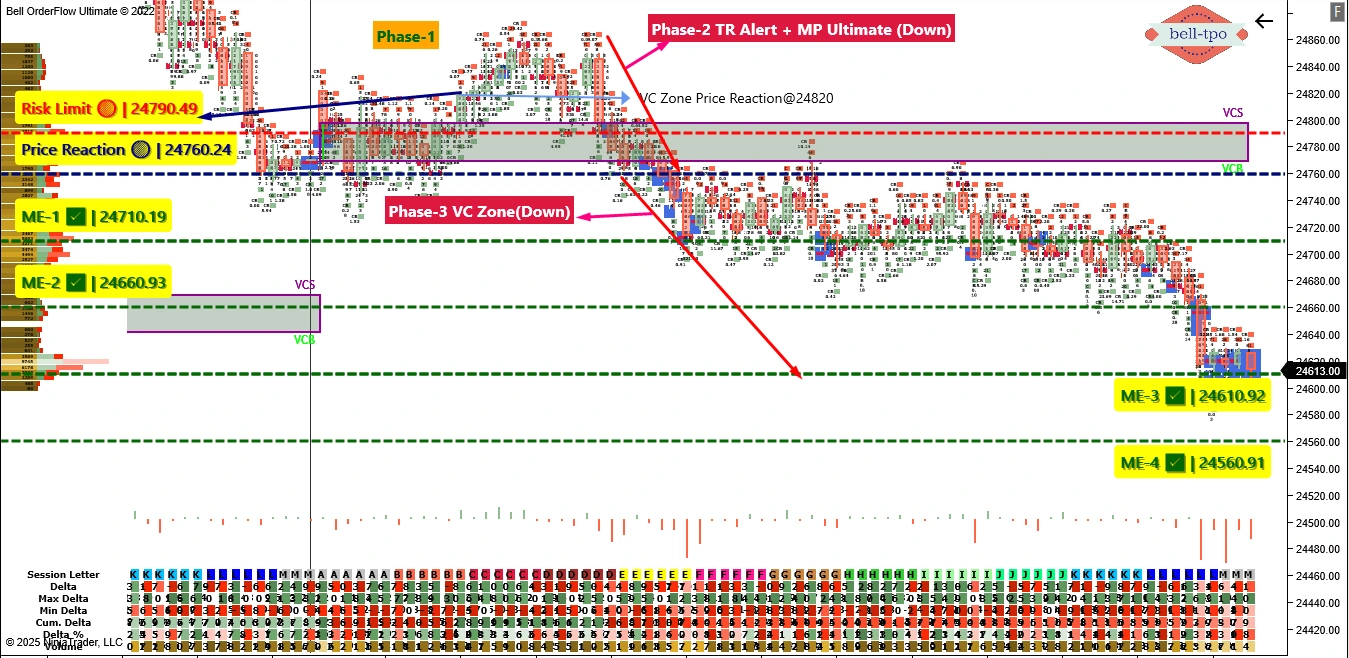

Phase 1: Initial VC Zone Attempt

- Price Reaction observed at 24820, where early signs of resistance emerged.

- Risk Limit at 24790.49 was breached, registering a 30-point controlled risk, indicating the zone did not hold.

- This failure to sustain above the VC zone initiated a shift in bias, preparing the ground for Phase 2.

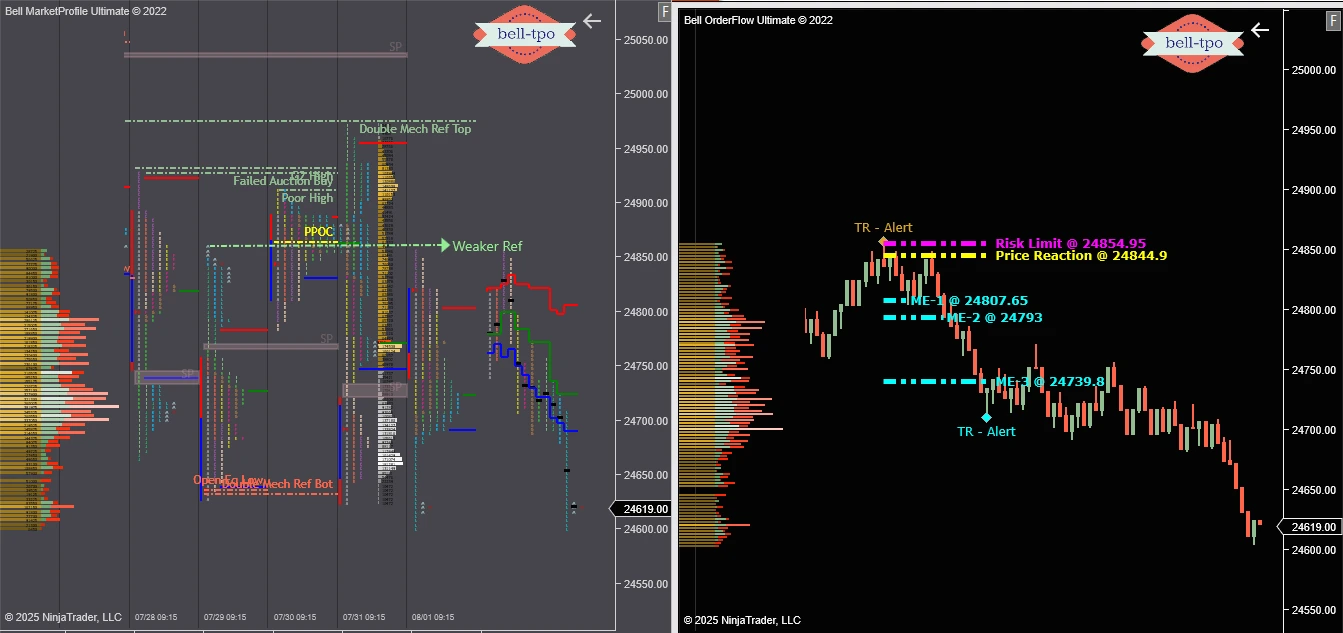

Phase 2: TR Alert + Market Profile Confirmation (Down Move Initiated)

- TR Alert triggered at Price Reaction 24844.9, identifying early sellers entering at higher levels.

- Risk Limit for this phase was 24854.95, confirming the alert’s credibility and initiating a structural breakdown.

Market Extension (ME) Levels from TR Alert

- ME-1 formed at 24807.65, indicating the first reactive sell zone.

- ME-2 at 24793, showing follow-through interest.

- ME-3 extended to 24739.8, confirming the strength of the downtrend.

Market Profile Ultimate: Weaker Reference & PPOC Confirmation

- The Weaker Reference from Market Profile Ultimate aligned with the breakdown structure.

- This overlap of weaker structural reference and TR confirmation further validated the strength of the sellers and potential continuation of trend.

Phase 3: VC Zone Breakdown

- After the TR Alert exhaustion, the market transitioned into Phase 3 with a clean breakdown from the VC Zone.

- VC Zone Price Reaction was at 24760.24, showing follow-through selling.

- Risk Limit for this phase remained at 24790.49 (same as Phase 1), making it a critical reference zone.

VC Zone Extension Levels

- ME-1 at 24710.19 acted as an immediate continuation level.

- ME-2 was marked at 24660.93, showing deepening of the down move.

- ME-3 settled at 24610.92 respectively, highlighting the momentum-led structure.

Conclusion:

From a failed VC zone attempt in Phase 1 to a clean breakdown with TR Alert and VC zone in Phases 2 and 3, the Bell OrderFlow Ultimate framework enabled traders to track and adapt to the evolving market context. Despite a 30-point hit in the initial phase, the structure delivered a net 220-point educational move with clarity, precision, and pre-defined zones.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.