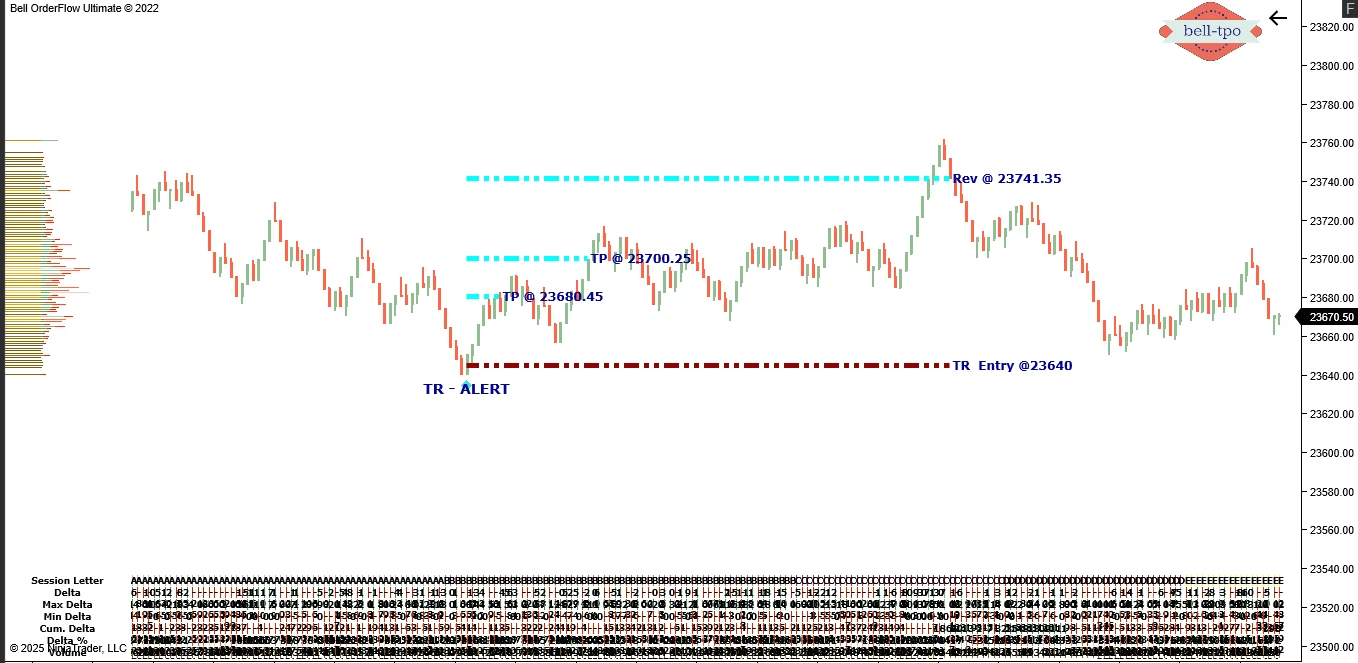

Bell Orderflow Ultimate: Market Precision with TR Alert (Delta Divergence) to Capture Strong Moves.

Today’s session showcased the effectiveness of TR Alert, a signal derived from Delta Divergence, a widely recognized market concept. This alert provided a well-timed entry at a market low, leading to a 101-point move. The session reinforced how volume-based insights can enhance decision-making in dynamic market conditions.

🔹 TR Alert (Delta Divergence): Identifying Market Turning Points

The TR Alert was triggered at a significant price reaction level, indicating a potential market bottom. This setup was supported by Delta Divergence, where selling pressure was met with strong absorption, signaling a shift in momentum.

✅ Key Observations from Today’s Session:- TR Alert identified a critical market low.

- Delta analysis confirmed strong buyer absorption.

- The market responded with a 101-point move, validating the order flow setup.

🔹 Market Structure Insights from Today’s Chart

📌 TR Alert Entry Level: 23640 – A key area where Delta Divergence confirmed a potential reversal. 📌 Market Equilibrium Levels:- 23680 – First equilibrium level where price stabilized.

- 23700 – A key balance zone reflecting volume absorption.

- 23741 – Final market equilibrium point, marking a significant reaction area.

✅ Session Summary & Key Takeaways

📌 TR Alert Entry Identified Market Reversal 📌 Delta Divergence Confirmed Buying Interest 📌 Price Moved 101 Points from TR Alert LevelThis session demonstrated the power of real-time order flow analysis, reinforcing how Bell Orderflow Ultimate helps in capturing high-probability trade setups.

🚀 Unlock the Power of Order Flow with Bell Orderflow Ultimate! 🔹 Maximize Your Trading Edge with Bell Orderflow Ultimate!Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.