How a 70-Point Move in NIFTY_I Aligned with Market Profile Structure

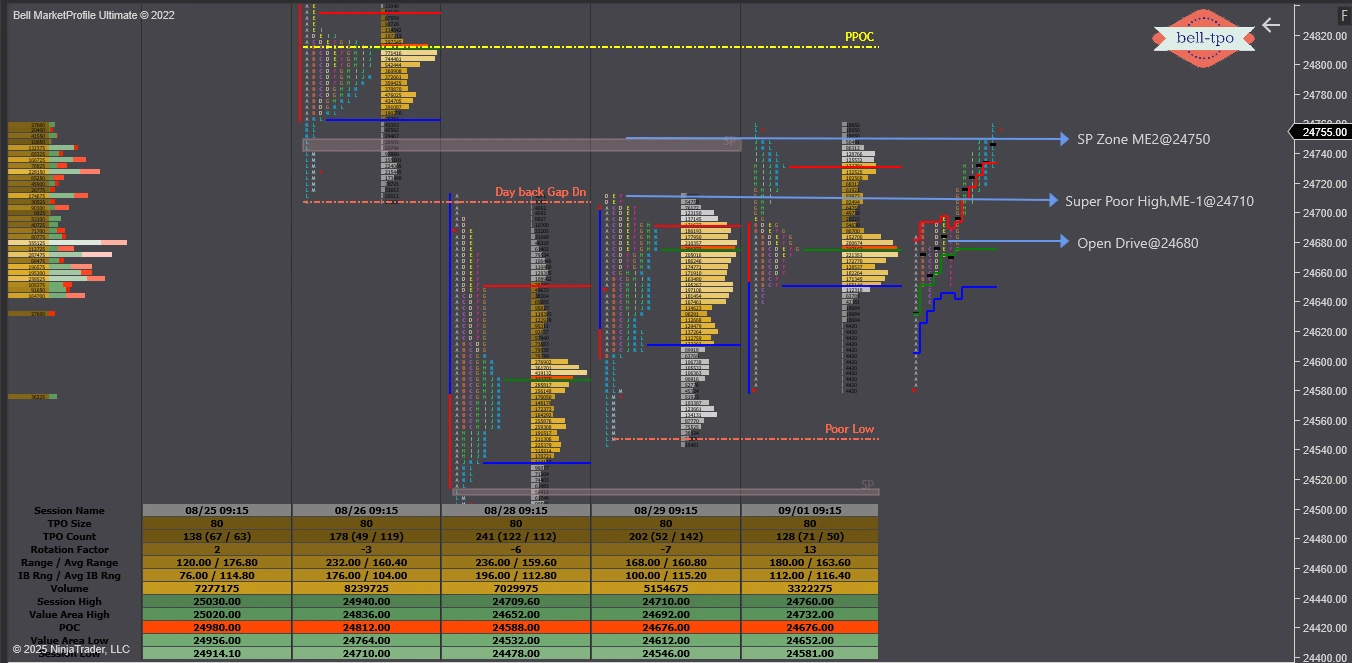

NIFTY_I displayed a high-confidence auction pattern consistent with BellTPO’s Market Profile Ultimate principles — particularly those discussed in Parts 3 and 4 of the training series. The session presented a clean directional move from the Open Drive at 24680 toward the Single Print Zone ME-2 at 24750, marking a 70-point range extension within a well-defined structure.

🔍 Key Observations from the Profile

- Auction Start: Open Drive Up from 24680 (Indicative of initiative activity from the opening bell)

- Reference Levels Tagged:

- Super Poor High (ME-1) at 24710

- Single Print Zone (SP Zone ME-2) at 24750

- Prior Structure:

- Poor Low on August 31 (A signal of weak auction closure — often followed by directional response the next day)

🧠 Structural Reasoning (AS Per Rajendran’s Trade Edged Cheat sheet )

This session checks off multiple tags from the BellTPO 58-point observation sheet:- Open Drive → Indicates directional conviction from market participants

- Single Print Zone Above → Target zone in directional moves, typically attracts re-tests

- Super Poor High (Emotional Auction End) → Often rechecked by the next confident session

- Prior Day Poor Low → Weakness that the market sought to repair in next session

📍 Sequential Movement

- Initiation Point: 24680 (Open Drive, conviction noted)

- First Response Zone: 24710 (Area of prior auction inefficiency — Super Poor High)

- Final Zone: 24750 (Single Print ME-2 — zone with minimal prior participation)

✅ Confidence Read

The confidence level for this directional movement can be considered elevated, based on:- A structurally weak previous session

- Clear initiative open

- Visibly clean single print targets above

- Absence of conflicting auction signals during the session

🧭 Educational Takeaway

This session is a strong example of how auction logic, structural references, and contextual imbalance combine to deliver high-clarity directional sessions. Understanding these layers is key to interpreting market behavior with neutrality and precision — fully in line with BellTPO’s Market Profile non-predictive, observational approach.