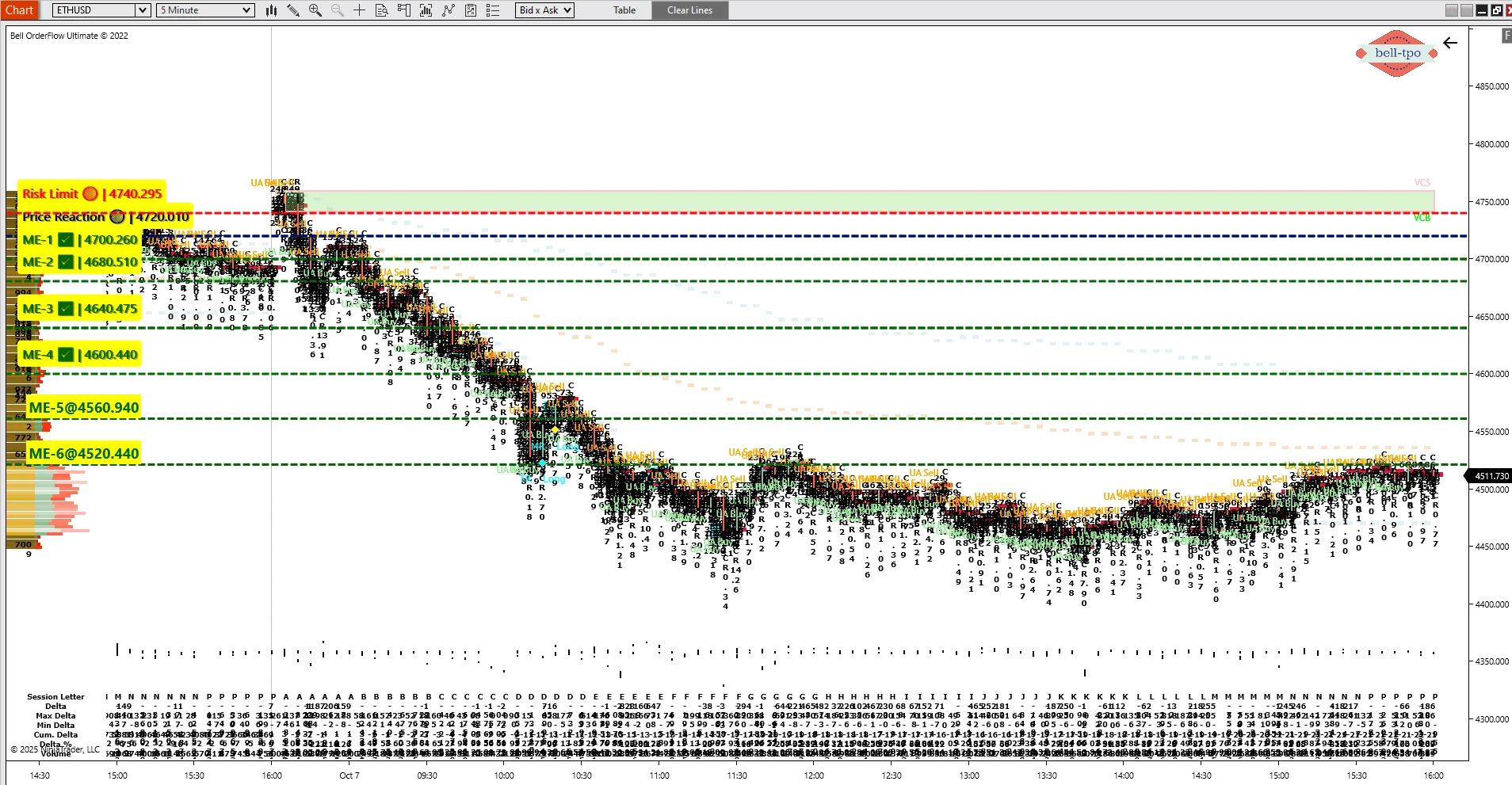

ETHUSD: 200 Points Captured with UA in Bell Orderflow Ultimate

The ETHUSD session on 8th October 2025 once again demonstrated the power of UA (Unfinished Auction) in combination with the Bell Orderflow Ultimate framework.

By integrating Risk Limit, Price Reaction, and progressive ME levels, traders were able to capture a structured 200-point downside move with precision and discipline.

Alert-Driven Start with UA Confirmation

The session began with early signs of seller dominance, highlighted by UA activity near the VC Zone, which offered a roadmap for the unfolding downside trend.- Risk Limit @ 4740.295 → Acted as the protective upper boundary, defining the level where the bearish setup would be invalidated. Remaining below it ensured traders stayed focused on the short side with conviction.

- Price Reaction @ 4720.010 → Served as the critical trigger for downside momentum, confirming that sellers had taken control of the auction. Sustaining below this level validated the continuation bias toward lower price zones.

Progressive Downside Move Guided by ME Levels

The move developed in a structured and stepwise manner, with each ME level acting as a checkpoint that validated the sustained auction flow in favor of sellers.- ME-1 @ 4700.260 → Marked the first equilibrium shift downward, reinforcing that sellers were sustaining pressure beyond the Price Reaction.

- ME-2 @ 4680.510 → Provided the next progression checkpoint, signaling that sellers remained in control as the market moved lower.

- ME-3 @ 4640.475 → Confirmed the mid-trend continuation, demonstrating that downside momentum had not exhausted yet.

- ME-4 @ 4600.440 → Highlighted persistent seller dominance, guiding traders to stay with the auction flow.

- ME-5 @ 4560.940 → Served as a deep continuation checkpoint, validating that the sellers were pushing toward session lows.

- ME-6 @ 4520.440 → Marked the culmination of the downside move, reflecting the final phase where the bearish pressure stabilized.

Net Outcome

By leveraging UA signals for early conviction, using the Risk Limit as a protective boundary, and tracking the auction flow with Price Reaction and ME levels, traders were able to capture a net 200-point downside move in ETHUSD.

Key Takeaways

- UA (Unfinished Auction) exposed areas of uncompleted market business, providing early insight into continued seller participation.

- Risk Limit and Price Reaction served as core directional and protective references, helping traders stay disciplined.

- ME Levels offered a progressive roadmap, turning the downside trend into a clearly structured sequence of opportunities.

This session reinforced that UA combined with structured market references in Bell Orderflow Ultimate removes guesswork, allowing traders to follow the auction flow with clarity and discipline.

✅ Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com to see how UA and structural tools like Risk Limit, Price Reaction, and ME levels can transform your market approach.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making any trading or investment decisions. Past performance is not indicative of future results.