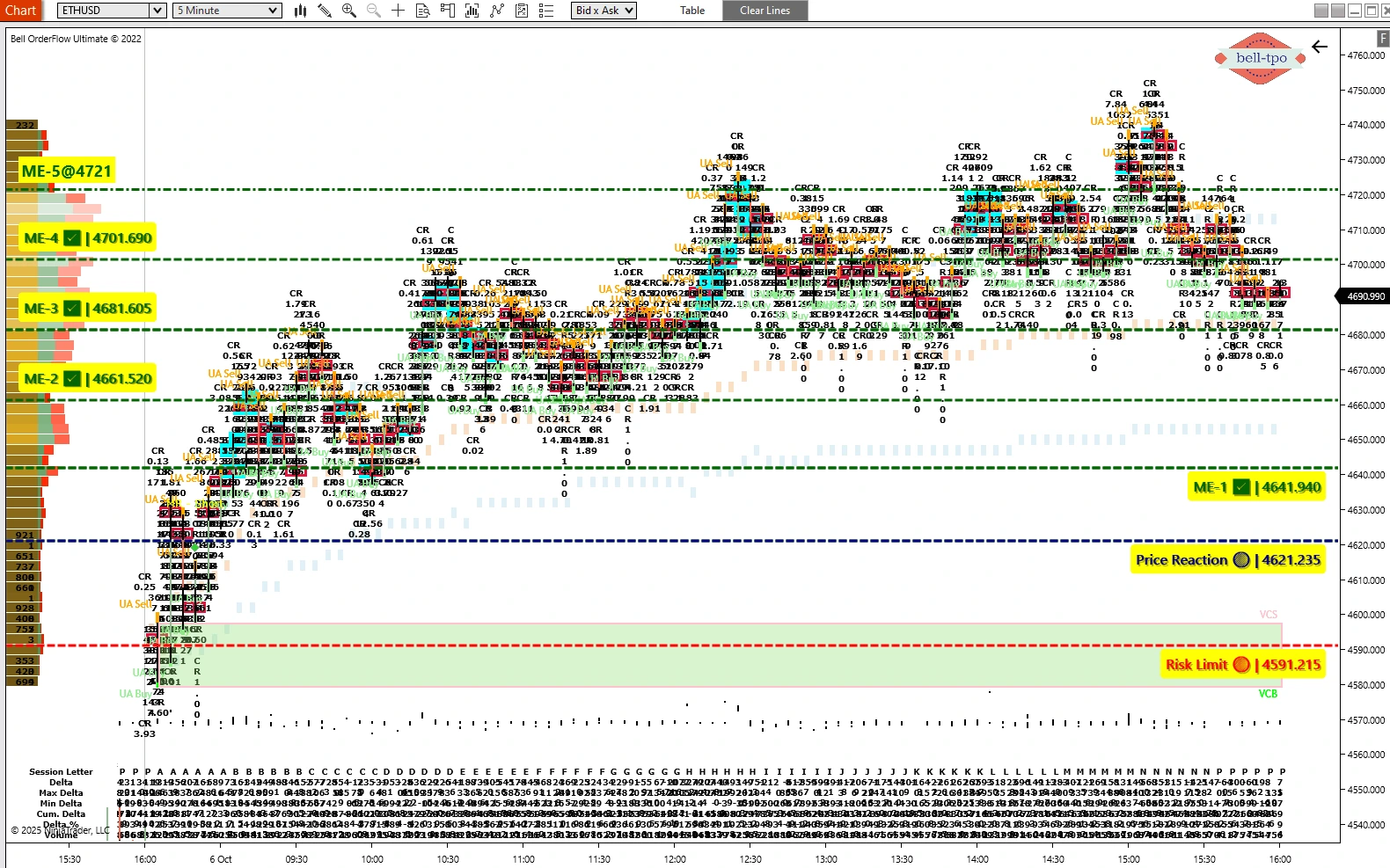

ETHUSD: 100 Points Captured with VC Zone in Bell Orderflow Ultimate

The ETHUSD session on 6th October 2025 demonstrated how VC Zone-driven insights in Bell Orderflow Ultimate can guide traders to capture structured moves with clarity and discipline.

By focusing on Price Reaction, Risk Limit, and progressive ME levels, traders achieved a clean 100-point gain in a step-by-step fashion.

VC Zone-Driven Entry and Conviction

The rally began with a decisive Price Reaction @ 4621.235, which served as the foundation for directional conviction.- It marked the initial shift in auction flow, showing that buyers were gaining control in the value area.

- Sustaining above this level signaled the strength required to focus on the upside.

- It acted as a defined boundary below which the bullish setup would be invalidated, ensuring disciplined participation.

- Staying above it allowed traders to focus confidently on upside continuation.

Progressive Upside Move with ME Levels

The upside move unfolded in a structured and disciplined manner, with ME levels acting as checkpoints to validate continuation.- ME-1 @ 4641.940 → Represented the first equilibrium shift upward, confirming that the initial Price Reaction had strength and wasn’t just a temporary bounce.

- ME-2 @ 4661.520 → Acted as the next progression checkpoint, reinforcing that buyers were maintaining control as the trend advanced.

- ME-3 @ 4681.604 → Showed further confirmation of sustained buyer activity, guiding traders to hold positions confidently.

- ME-4 @ 4701.690 → Marked the culmination of the session’s structured move, highlighting the exhaustion point of the rally where buyers had fully extended the push.

Net Outcome

By respecting the Price Reaction as the initial trigger, maintaining discipline with the Risk Limit, and following the stepwise confirmations through ME levels, traders were able to capture a 100-point upside move in ETHUSD.

Key Takeaways

- VC Zone provided the foundation for understanding where control shifted, giving clarity for directional bias.

- Price Reaction and Risk Limit offered clear boundaries for conviction and discipline, avoiding emotional decisions.

- ME Levels mapped the progressive strength of the trend, turning complex auction data into a structured roadmap.

This session reaffirmed that structured references combined with value-driven insights empower traders to participate with confidence and precision.

✅ Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com to learn how VC Zone and structured market references guide traders in capturing opportunities with clarity.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making any trading or investment decisions. Past performance is not indicative of future results.