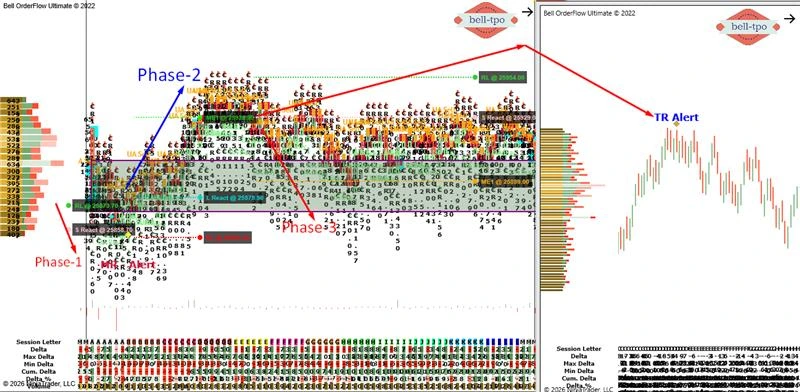

Educational Takeaway: Yesterday Net 75 Points Move Captured in NIFTY_I with VC + TR Alert + MR Alert + UA + CR + TBTS using Bell Orderflow Ultimate

Yesterday’s NIFTY_I session delivered a structured 75-point intraday move, clearly unfolding across three distinct phases. The move was identified and managed using VC, TR Alert, MR Alert, UA, CR, and TBTS, showcasing how orderflow tools align price behavior with market intent.

This breakdown focuses purely on market structure, balance, and reaction zones, highlighting how disciplined risk frameworks guide intraday decision-making.

Phase 1: Controlled Downward Rotation (15 Points)

Concepts Involved: VC + TR Alert + MR Alert + UA + CR + TBTS

Market Equilibrium (ME)

- No immediate balance was established, indicating directional discovery rather than acceptance.

- Absence of early equilibrium suggested the market was searching for responsive participation.

Price Reaction

- Price reacted sharply from the Short Price Reaction level at 25858.70, confirming responsive activity.

- The reaction validated rejection from higher levels without sustained acceptance.

Risk Limit

- The Risk Limit at 25873.70 defined the maximum adverse excursion for the phase.

- Breach of this level would have invalidated the immediate structure.

Phase 2: Expansion from Balance (50 Points)

Concepts Involved: MR Alert + UA + CR

Market Equilibrium (ME-1)

- Market Equilibrium formed at 25928.80, indicating strong acceptance at higher prices.

- This balance zone acted as a pivot for continued expansion.

Price Reaction

- Price reacted decisively from 25878.80, confirming initiative participation.

- Sustained movement away from the reaction level showed strength in continuation.

Risk Limit

- The Risk Limit at 25853.80 provided a well-defined structural invalidation point.

- Holding above this level maintained the integrity of the expansion phase.

Phase 3: Responsive Rotation from Upper Levels (40 Points)

Concepts Involved: TR Alert + UA + CR

Market Equilibrium (ME-1)

- A new Market Equilibrium developed at 25889.00, highlighting acceptance after extension.

- This level marked a transition from expansion to responsive activity.

Price Reaction

- The Short Price Reaction at 25929.00 confirmed rejection from higher prices.

- Responsive sellers emerged quickly, leading to a clean rotational move.

Risk Limit

- The Risk Limit at 25954.00 capped risk for the phase.

- Failure to sustain above this level confirmed structural weakness at the top.