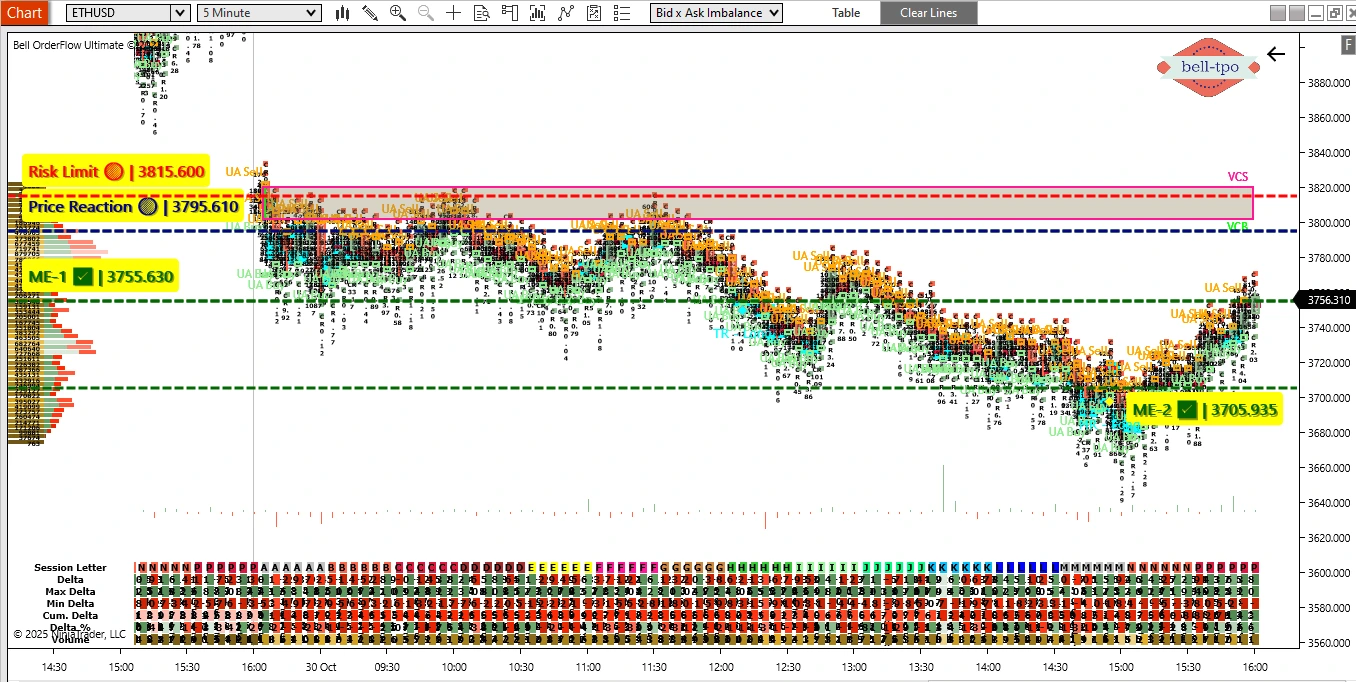

Educational Takeaway: Net 80 Points Move Captured in ETHUSD Setup Used: VC Zone + TBTS + UA + CR + TR + MR using Bell Orderflow Ultimate (30 October 2025)

ETHUSD offered a clean short setup as multiple Orderflow and structural confirmations aligned perfectly. The sequence began with a VC Zone rejection, followed by TR (Trend Reversal) and MR Short Alert, confirming that buying strength had exhausted. The TBTS continuation filter validated sustained selling activity, forming a high-confidence short opportunity.

Phase 1: Price Reaction, Risk Control & Market Equilibrium Shifts

Price Reaction @ 3795.610:

This reaction zone marked the point of value rejection, where aggressive sellers overpowered late buyers. Orderflow confirmed heavy delta imbalance and volume absorption — signaling a shift in short-term market control.

Risk Limit @ 3815.600:

Defined with Bell Orderflow’s CR logic, this limit represented the invalidation zone for the setup. It was strategically placed just beyond the reaction peak, ensuring risk remained capped while still allowing natural volatility around the entry zone. This disciplined risk framework ensured the trade began on structured logic rather than emotional anticipation.

ME-1 @ 3755.630:

The first Market Equilibrium (ME) update signaled the initial downward shift in value as selling pressure deepened. It confirmed that the short-term equilibrium had moved lower, validating the continuation of the short bias.

ME-2 @ 3705.935:

The second ME update identified the next equilibrium migration point, where sellers fully established control. This level marked the completion of the directional leg, and price began to balance — making it the ideal zone to exit and secure profits.

Each ME level represented a transition in market balance — allowing systematic tracking of where control changed hands from buyers to sellers.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through VC, TBTS, and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.