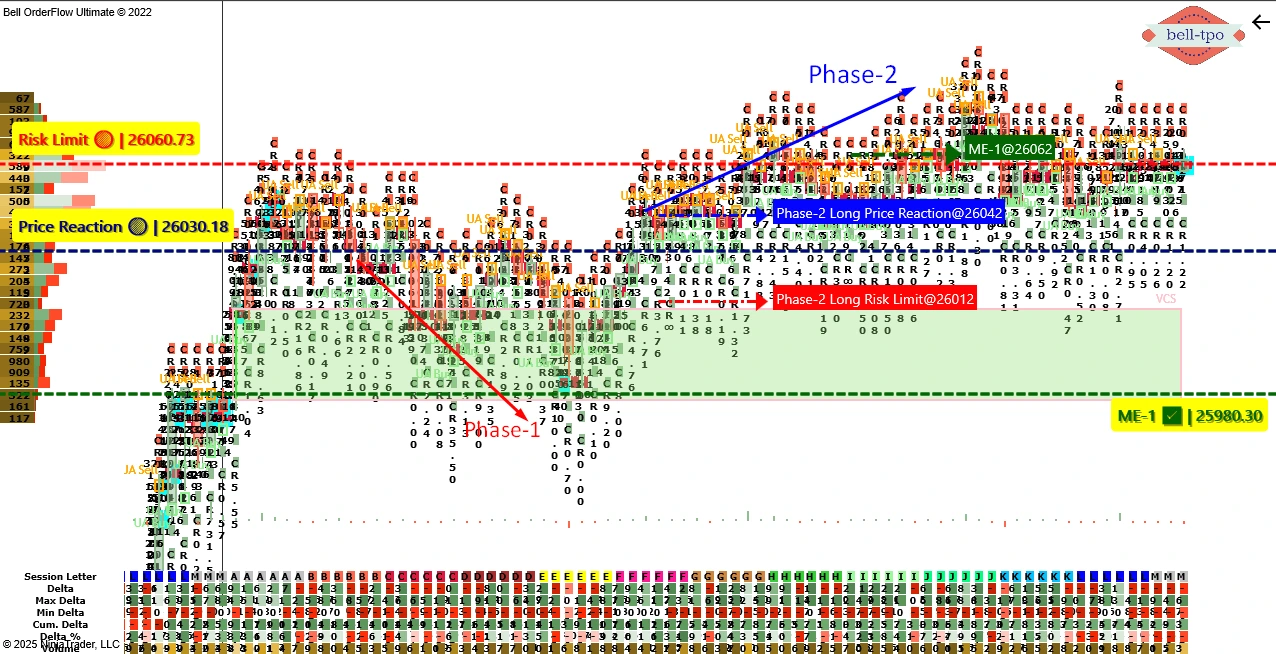

Educational Takeaway: Net 70 Points Move Captured in NIFTY_I with VC + TBTS + UA + CR using Bell Orderflow Ultimate

Today’s NIFTY_I session offered two clean, rule-based opportunities—first a strong short continuation followed by a late-session long reaction. The setup was guided entirely by VC Zone structure, TBTS alerts, UA signals, and CR confirmation, enabling disciplined execution in both phases.

Phase-1: 50 Points Short Move Captured

Price Reaction – 26030.18:

Price reacted firmly from the upper supply region, confirming aggressive sellers entering the auction. Delta weakness aligned with TBTS bias, supporting continuation toward lower liquidity pockets.

Risk Limit – 26060.73:

The predefined risk limit held cleanly, offering a safe invalidation point for short continuation. Price never challenged the risk limit, keeping confidence high throughout Phase-1 execution.

ME-1 – 25980.30:

ME-1 projected a potential 50-point downside extension, which was validated structurally. However, the system-aligned execution captured the short move only up to 50 points move, completing Phase-1.

Phase-2: 20 Points Long Move Captured (Late Session)

Price Reaction – 26042:

A late UA & VC Zone supported orderflow shift signaled buyers absorbing supply near mid-range. The long move triggered after CR confirmation, indicating a short-covering reaction.

Risk Limit – 26012:

The risk boundary provided a tight and efficient invalidation zone for the reversal attempt. Price respected this zone throughout, maintaining a favorable reward-to-risk profile.

ME-1 – 26062:

ME-1 projected a 50-point upside extension; however, price failed to follow through. Only 20 points of actual movement were captured near closing, as the session lacked continuation strength.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through VC, TBTS, and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.