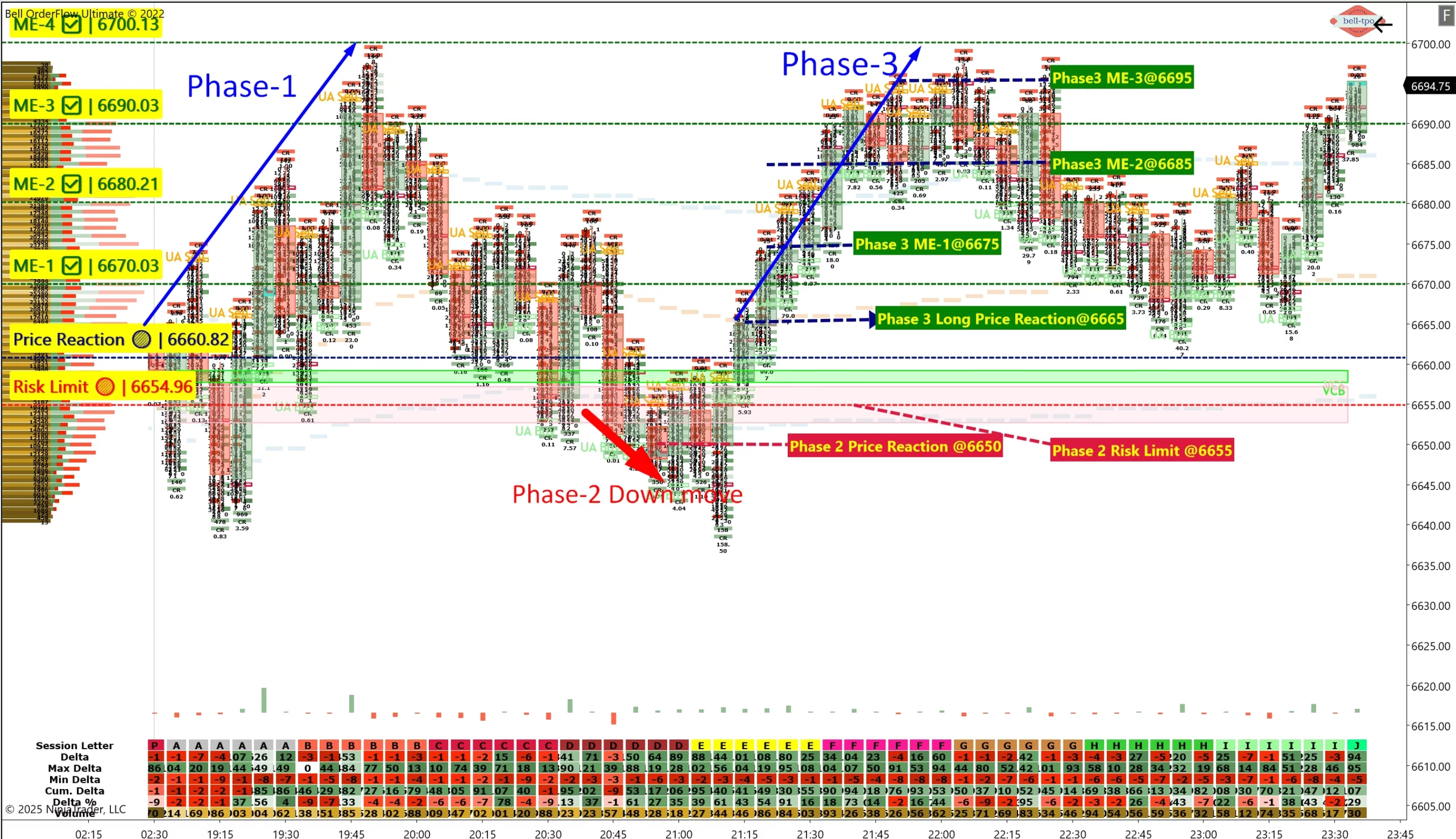

Educational Takeaway: Net 55 Points Move Captured in ESDEC25 with UA + TBTS in Bell Orderflow Ultimate (17 October 2025)

The ESDEC25 session on 17th October 2025 offered three distinct trading phases, where the UA and TBTS signals worked in synergy to capture both momentum shifts and reversal opportunities. Each phase reflects the precision of structure-based execution using Bell Orderflow Ultimate.

Phase 1 – Long Move (Net 30 Points Captured)

Price Reaction @ 6660.82:

This level marked the first sign of aggressive buying emerging from the responsive zone. The order flow tone shifted bullish, signaling initiation of a structural long opportunity.

Risk Limit @ 6654.96:

A protective boundary ensuring disciplined risk control during initial position building. Price consistently held above this zone, reaffirming the buyers’ strength.

ME-1 @ 6670.03:

The first measured exit level indicated immediate follow-through strength in the upmove. It confirmed the continuation bias and rewarded early positioning.

ME-2 @ 6680.21:

Sustained momentum reached this secondary level with controlled aggression. Traders locking partial profits here captured the core of the trend leg.

ME-3 @ 6690.03:

The final exit level marked exhaustion signs in buying pressure. A full target achievement phase reflecting clean structural alignment.

Phase 2 – Down Move (5 Points Risk Limit Hit)

Price Reaction @ 6650:

Short-term selling emerged here after prior long exhaustion, hinting at intraday correction. However, order flow lacked conviction, signaling potential failure of the short attempt.

Risk Limit @ 6655:

Defined closely above the reaction zone, it served as a tight stop boundary. Breach of this level confirmed that sellers couldn’t maintain control.

Phase 3 – Long Move (Net 30 Points Captured)

Price Reaction @ 6665:

Renewed buying emerged from this zone following the failed short attempt. It indicated re-entry of institutional activity supporting a continuation of the bullish tone.

Risk Limit @ 6660:

This tight boundary provided strong structural protection below the breakout base. Price consistently held above it, validating renewed buyer conviction.

ME-1 @ 6675:

Initial momentum confirmation level that reflected entry validation. Triggered precise partial booking for traders following Bell’s structured scaling model.

ME-2 @ 6685:

The second target represented sustained directional control by buyers. The market continued to trade with positive delta flow, extending the long bias.

ME-3 @ 6695:

Final execution zone aligning with the exhaustion of buying interest. A complete cycle of controlled scaling and profit booking to lock the 30-point move.

Summary

Across all three phases, Bell Orderflow Ultimate showcased its strength in reading institutional footprints, timing entries, and managing exits with precision. The UA + TBTS confluence delivered a net 55-point move, emphasizing structured trade execution, not speculation.

✅ Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.