Educational Takeaway: Net 55 Points Move Captured in ESDEC25 with Failed Auction & WPOC Alert in Bell Market Profile Ultimate & VC Zone + UA + CR + TBTS in Bell Orderflow Ultimate (29 October 2025)

In today’s trading session, we successfully captured a net 55-point move in ESDEC25 using a seamless combination of Bell Market Profile Ultimate and Bell Orderflow Ultimate.

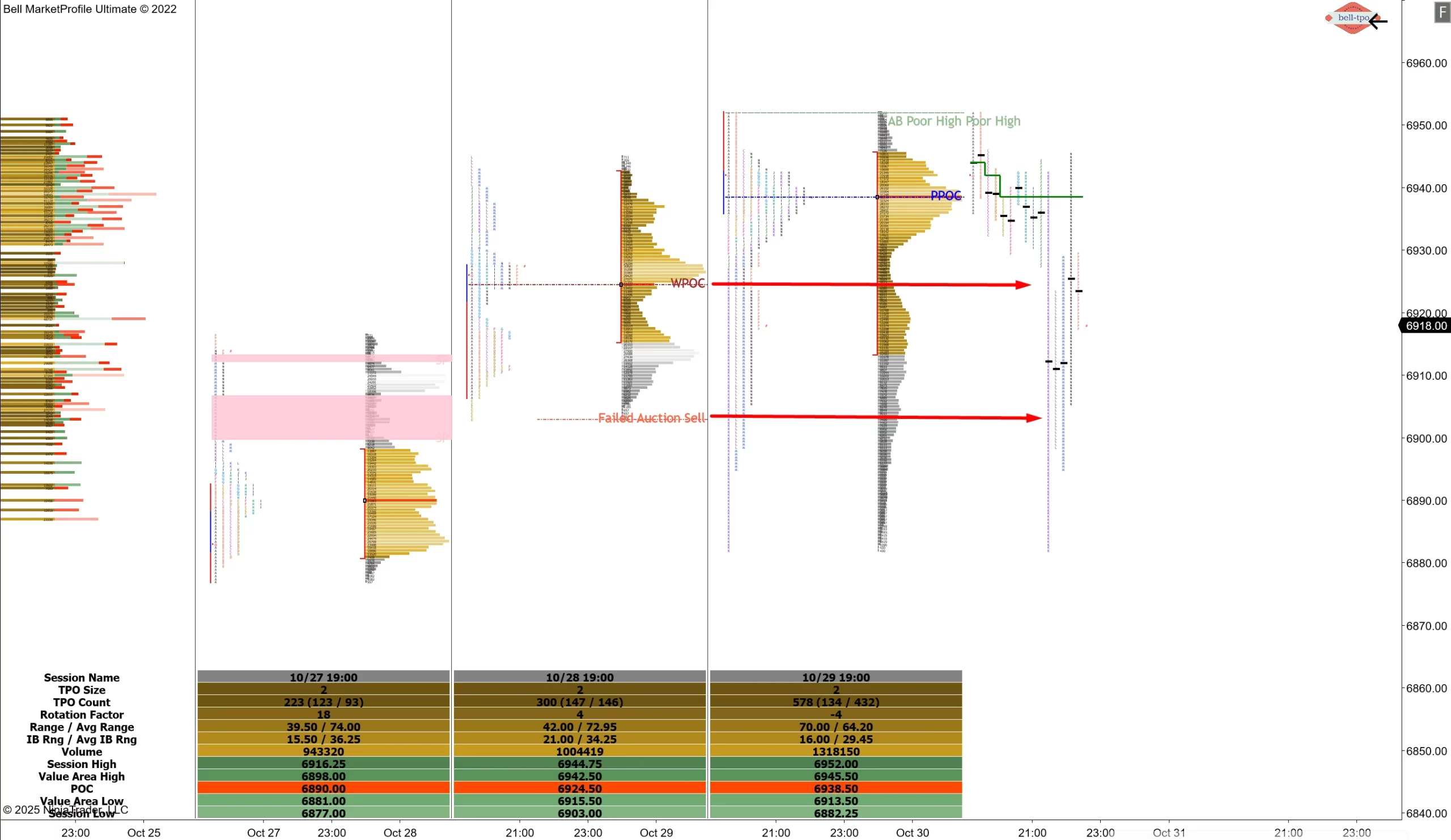

This trade setup was driven by confluence factors such as the VC Zone, UA, CR, and TBTS Alerts, along with the Failed Auction at 6902 and WPOC at 6925 from Market Profile principles.

These references once again proved their reliability during high-volatility or event-driven sessions, where directional clarity often comes from understanding auction behavior and value migration rather than just price action.

Understanding the Core Concepts

Failed Auction: A failed auction occurs when the market attempts to move beyond a prior reference (high or low) but fails to find continuation, signaling exhaustion and potential reversal. Recognizing a failed auction early helps traders identify areas where buyers or sellers lose control, offering high-probability trade setups.

Market Profile: Market Profile serves as a structural map of market behavior, revealing value zones, imbalances, and control points. During volatile or event days, it acts as a guiding framework to align short-term orderflow with longer-term context, providing superior clarity in trade planning.

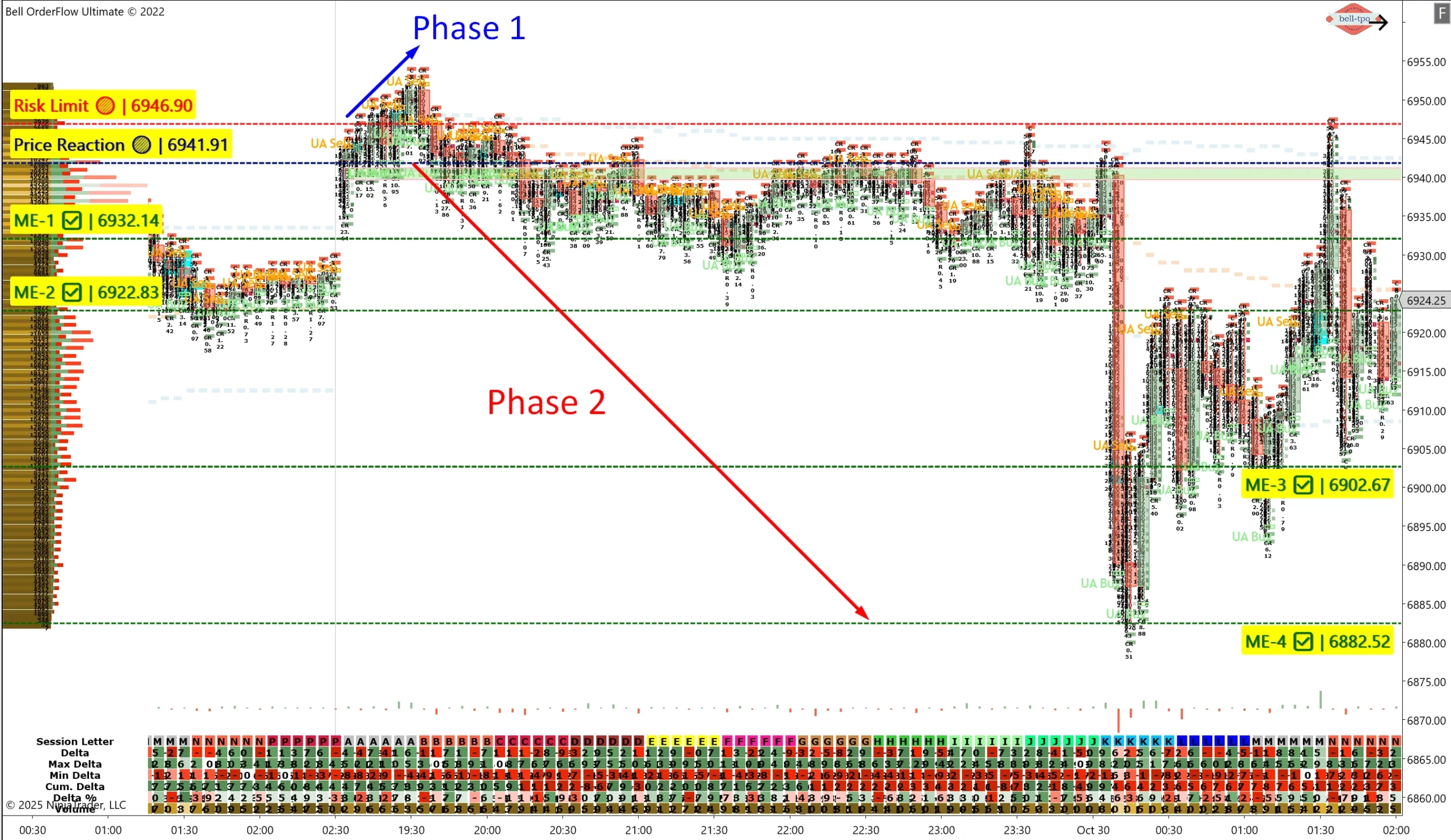

Phase-1: Initial Setup (5 Points – Risk Limit Hit)

The trade began with a test of the Price Reaction Level @6941.91, supported by the initial orderflow confirmation. However, the market volatility led to a minor pullback, triggering the Risk Limit @6946.90, resulting in a controlled 5-point stop-out.

- Price Reaction: Indicates the first zone where responsive activity (buying/selling) emerges, validating short-term sentiment.

- Risk Limit: Defines the controlled boundary for position protection — critical to maintaining discipline during erratic volatility.

- ME Levels: In Phase 1, ME levels remained untested, signaling that directional conviction was yet to form.

Phase-2: Trend Confirmation (60 Points Short Move Captured)

The real opportunity emerged in Phase-2 as the short setup aligned with the Market Profile references — particularly the failed auction near 6902 and the prominent WPOC at 6925.

Price Reaction @6941.91:

Confirmed supply dominance, acting as the trigger for the downside move.

Risk Limit @6946.90:

Was held above short entries, ensuring minimal exposure against volatility spikes.

ME Levels:

- ME-1 @6932.14: First profit booking level; confirmed continuation post-entry.

- ME-2 @6922.83: Showed follow-through momentum.

- ME-3 @6902.67: Coincided with the failed auction reference; strong support reaction zone.

- ME-4 @6882.52: Final exhaustion level, marking a complete 60-point short capture.

Each ME (Measured Extension) level represents logical profit zones derived from orderflow velocity, ensuring consistent reward mapping while protecting capital.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through VC, TBTS, and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.