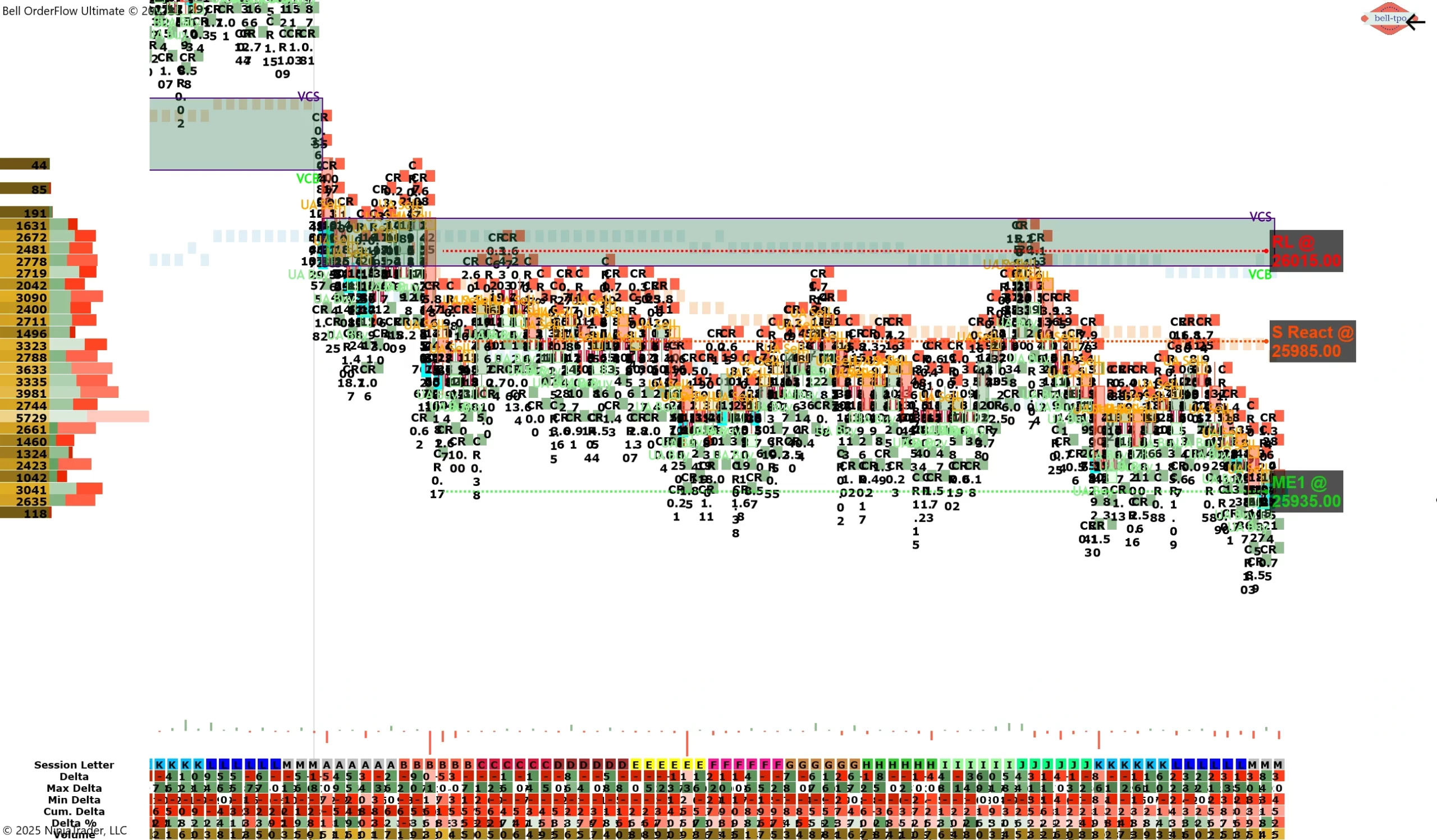

Educational Takeaway: Net 50 Points Move Captured in NIFTY_I with VC Zone + TBTS + CR using Bell Orderflow Ultimate

Today’s NIFTY_I session demonstrated a clean and controlled directional move, where Volume Cluster Zone (VC Zone), TBTS, and CR worked together to define market intent with clarity using Bell Orderflow Ultimate. The structure respected risk boundaries and unfolded systematically toward equilibrium.

Risk Limit (RL@26015)

- The Risk Limit acted as a clearly defined invalidation level, helping traders stay disciplined and protected against adverse price expansion.

- Price acceptance above this level was absent, confirming that initiative strength remained capped and risk was well controlled.

Short Price Reaction (S React@25985)

- The Short Price Reaction marked the first meaningful response zone, where supply-side interest became active with confirmation from orderflow signals.

- This level helped align traders with the prevailing intent, offering structure-based participation rather than emotional decision-making.

Market Equilibrium (ME 1@25935)

- ME-1 functioned as the natural balance point where price gravitated after directional conviction was established.

- The move into this equilibrium validated the earlier reaction and completed the structured flow of the session.