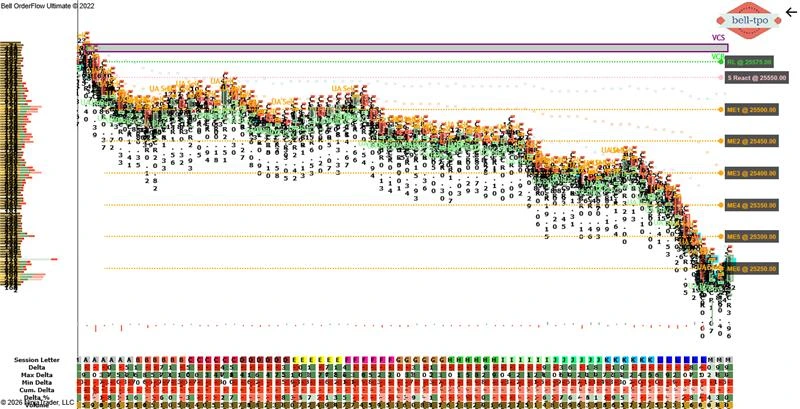

Educational Takeaway: Net 300 Points Move captured in NIFTY_I with VC Zone + TBTS + CR + UA using Bell Orderflow Ultimate

In today’s session, NIFTY_I displayed a strong directional expansion, where a sustained move of nearly 300 points unfolded with the confluence of VC Zone, TBTS, and CR concepts using Bell Orderflow Ultimate. The session highlighted how structured orderflow levels help traders stay aligned with market intent instead of reacting emotionally.

Phase Overview – Directional Expansion Phase

This phase demonstrated how controlled risk definition and step-by-step market equilibrium progression can guide traders through extended moves without over-anticipation.

Risk Limit (RL)

- The Risk Limit at 25575.00 acted as a clearly defined reference to assess whether the directional context remained valid or not.

- Price respecting this level reinforced discipline, ensuring the focus stayed on market structure rather than random volatility.

Price Reaction (S React)

- The Short Price Reaction around 25550.00 confirmed responsive participation from market participants near a critical reference area.

- This reaction validated the continuation of directional intent rather than a premature balance or reversal scenario.

Market Equilibrium Levels (ME Progression)

ME-1 @ 25500.00

- This level acted as the first equilibrium pause, where temporary balance formed before continuation resumed.

- It helped in tracking whether acceptance was developing below initial references.

ME-2 @ 25450.00

- Sustained activity around this zone showed healthy continuation without sharp counter-moves.

- It reinforced the strength of the underlying directional flow.

ME-3 @ 25400.00

- This equilibrium level reflected orderly price discovery rather than panic-driven movement.

- The market maintained structure, respecting prior references.

ME-4 @ 25350.00

- Acceptance near this zone indicated continued confidence from active participants.

- The move remained rotationally clean, without erratic spikes.

ME-5 @ 25300.00

- This level marked deeper progression into value migration, showing sustained directional conviction.

- Price behavior remained aligned with the broader orderflow context.

ME-6 @ 25250.00

- The final equilibrium highlighted completion of the extended move with structured balance.

- It helped identify exhaustion without relying on prediction or hindsight bias.

Key Educational Insight

This session clearly demonstrated that large point moves are not captured by prediction, but by following structured references, risk control, and equilibrium progression. Bell Orderflow Ultimate enables traders to stay engaged with the market’s real-time intent rather than reacting to noise.

Why Bell Orderflow Ultimate Adds an Edge

Bell Orderflow Ultimate is the world’s most advanced orderflow structure alert system, offering VC Zones, TBTS activity, CR logic, and systematic Market Equilibrium tracking. This continuous structural guidance helps traders observe high-probability market behavior with clarity and discipline.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through TBTS and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.