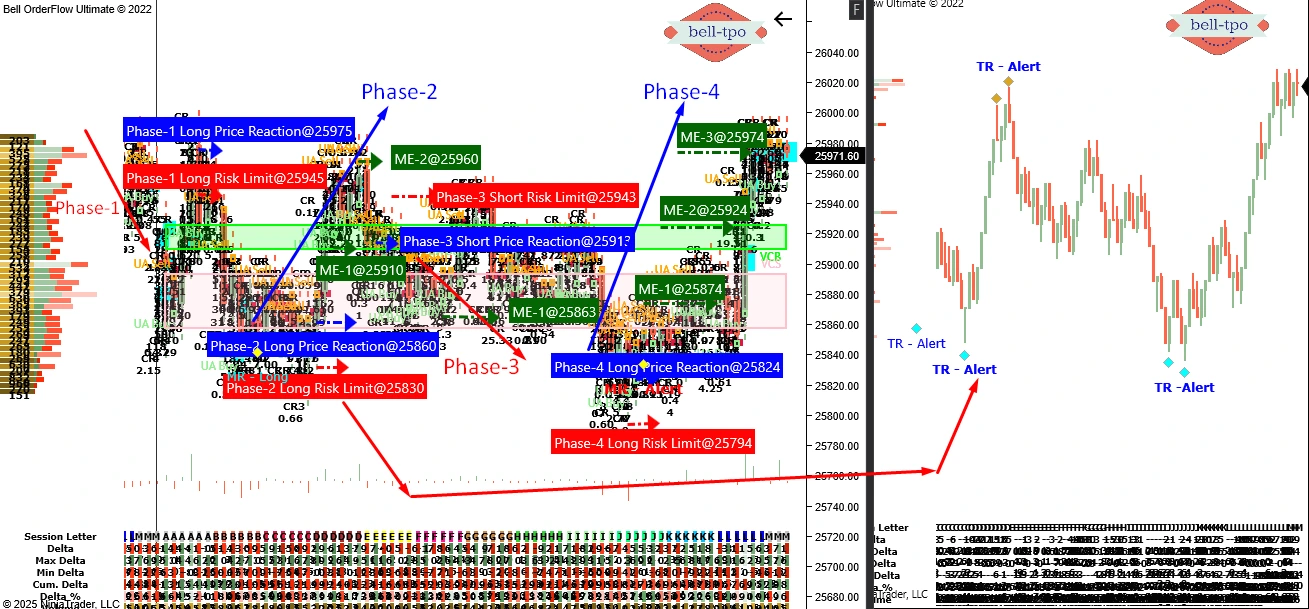

Educational Takeaway: Net 270 Points Move Captured in NIFTY_I using VC Zone + TBTS + MR + TR + UA + CR with Bell Orderflow Ultimate

Today’s session delivered a textbook example of structured, rule-based trading using Bell Orderflow Ultimate. Multiple phases aligned perfectly with TR (Trend Reversal) Alerts, UA shifts, and CR confirmation, enabling clean entries with controlled risk and precise ME level. Each phase respected price reaction and risk management rules, highlighting the power of disciplined execution.

Phase-1 — 30 Points, Risk Limit Hit

Price Reaction:

- Buyers initially attempted to defend 25975, showing mild absorption but without strong follow-through.

- Orderflow weakened quickly, indicating insufficient commitment from aggressive buyers.

Risk Limit:

- The long position failed to hold the 25945 risk line, signalling structural weakness.

- Violation of the risk limit confirmed that continuation strength was missing and phase-1 had to be closed.

ME Levels:

- No ME levels triggered since the trade exited at risk limit before momentum confirmation.

- Session context shifted into consolidation, preparing grounds for the next directional move.

Phase-2 — 100 Points Long Move Captured (with TR Alert)

Price Reaction:

- A strong upward rejection from 25860 marked the start of bullish intent.

- TR Alert validated the shift as aggressive delta aligned with responsive buyers.

Risk Limit:

- The long trade held firmly above 25830, confirming controlled downside risk.

- Sustained acceptance above risk limit added confidence to hold for next ME levels.

ME Levels:

- ME-1 @ 25910: Indicated continuation strength with positive delta confirmation.

- ME-2 @ 25960: Delivered the momentum burst, completing the phase with clean upside.

Phase-3 — 50 Points Short Move Captured (with TR Alert)

Price Reaction:

- Sellers reacted sharply from 25913, displaying clear absorption at the highs.

- TR (Trend Reversal) flipped bias as negative delta accelerated into the zone.

Risk Limit:

- Short trade stayed safe below 25943, respecting the structural failure of buyers.

- Risk containment allowed the trade to follow through towards ME-1 smoothly.

ME Levels:

- ME-1 @ 25863: Triggered as downside momentum expanded with heavy selling imbalances.

- Price paused after ME-1, signalling phase completion before next directional shift.

Phase-4 — 150 Points Long Move Captured (with TR Alert)

Price Reaction:

- A strong bullish reaction emerged from 25824, showing aggressive buyers.

- TR Alert confirmed the reversal as delta flipped strongly positive from the lows.

Risk Limit:

- Stability above 25794 validated long-side control with disciplined risk management.

- Market maintained acceptance above the risk band, encouraging scale-in continuation.

ME Levels:

- ME-1 @ 25874: Confirmed the first burst of upward momentum.

- ME-2 @ 25924: Extended the trend beautifully.

- ME-3 @ 25974: Completed the phase with a powerful rally.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through VC, TBTS, and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.