Educational Takeaway: Net 250 Points Captured in NIFTY_I with IBH in Bell Market Profile Ultimate & TBTS+UA+CR+TR in Bell Orderflow Ultimate

NIFTY_I presented two well-structured phases that highlighted how BellTPO tools bring clarity and discipline in capturing market moves.

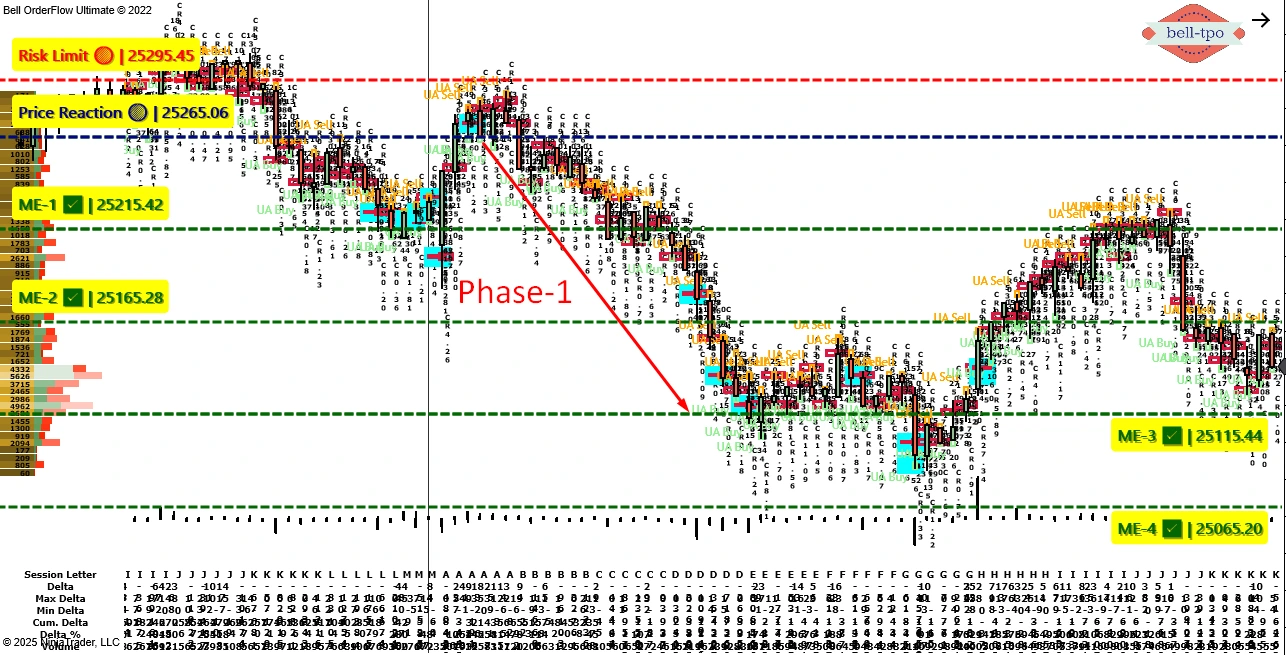

Phase-1: Downside Move – 150 Points Captured with TBTS + UA + CR (Bell Orderflow Ultimate)

The initial downside move was driven by a strong combination of TBTS (Trapped Buyers & Sellers), UA (Unfinished Auction), and COT Ratio (CR) signals.- Risk Limit @ 25295.45: Defined the upper protective boundary. Breaching this would invalidate the downside setup. Helped to anchor the bearish bias with discipline.

- Price Reaction @ 25265.06: Marked the turning point where sellers regained control. Sustaining below it confirmed bearish continuation.

- ME-1 @ 25215.42: Served as the first equilibrium checkpoint, guiding the short bias. Staying below this level signaled that sellers remained dominant.

- ME-2 @ 25165.28: Strengthened downside momentum as price held below this equilibrium zone. Reinforced the conviction for further bearish move.

- ME-3 @ 25115.44: Acted as a progressive reference where continuation pressure increased. Holding below this validated sustained selling interest.

- ME-4 @ 25065.20: Marked the session’s lower extreme equilibrium. Indicated completion of the structured downside phase.

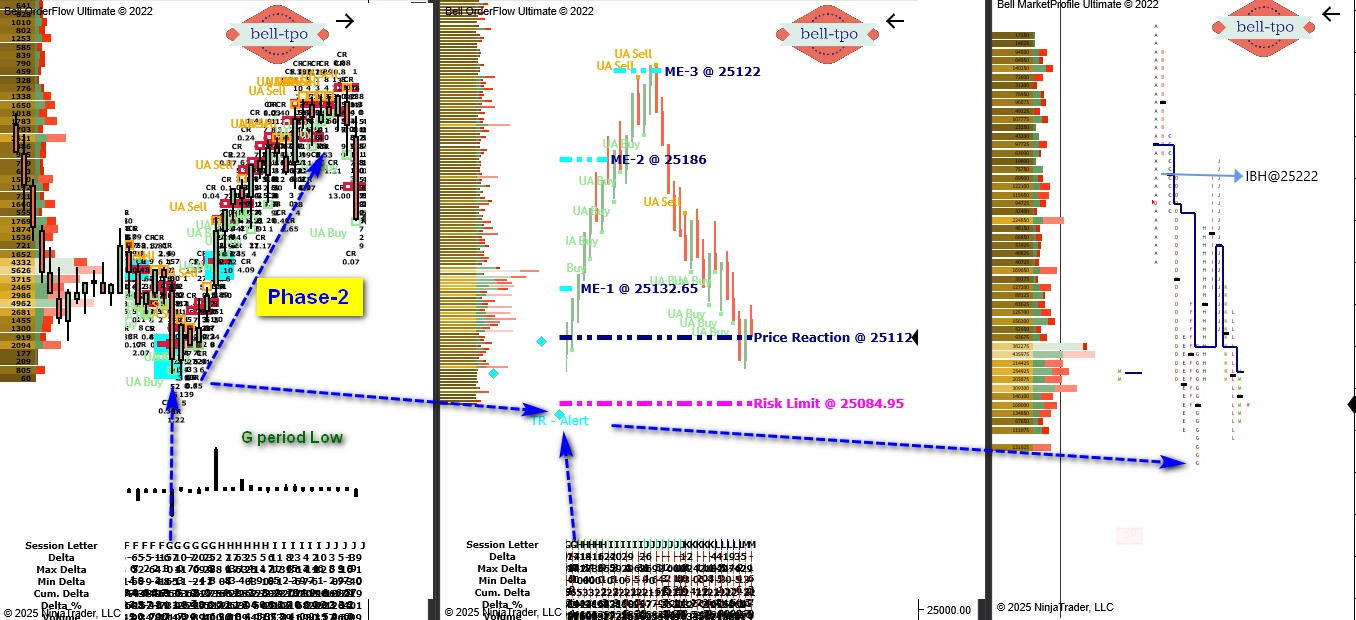

Phase-2: Upside Reversal – 100 Points Captured with TBTS + UA + TR (Bell Orderflow Ultimate)

The reversal move unfolded in the second half, guided by TBTS + UA activity and the TR (Trend Reversal) Alert, with confluence from IBH (Initial Balance High) in Bell Market Profile Ultimate.- Risk Limit @ 25084.95: Provided a clear protective reference for the upside setup. Remaining above this confirmed the shift to bullish momentum.

- Price Reaction @ 25112: Became the trigger point for the long side move. Sustaining above indicated buyers gaining control.

- ME-1 @ 25132.65: Validated the early upside continuation. Showed growing confidence among buyers to drive prices higher.

- ME-2 @ 25186: Acted as a mid-phase checkpoint confirming sustained buying pressure. Reinforced conviction for holding the upside move.

- ME-3 @ 25122: Captured the later equilibrium resistance. Completion near this level highlighted structured closure for the phase.

Key Educational Insights

- TBTS + UA + CR: Highlighted trapped participants and unfinished auctions driving directional momentum.

- TR Alert: Helped time the reversal and secure the second phase move.

- IBH in Bell Market Profile Ultimate: Gave confluence to the upside bias in Phase-2.

- ME Levels & Price Reaction: Acted as progressive checkpoints ensuring clarity and discipline in both phases.