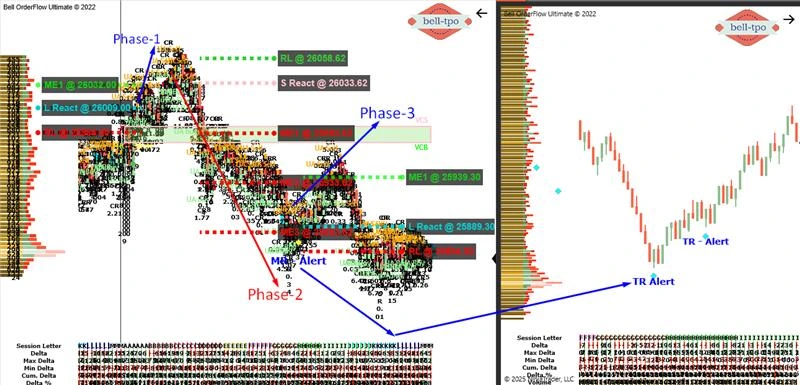

Educational Takeaway: Net 223 Points Move Captured in NIFTY_I with VC + TR Alert + MR Alert + TBTS + CR using Bell Orderflow Ultimate

Today’s market action delivered a precise 223-points move captured through a combination of VC Zone, TR Alert, MR Alert, TBTS, and CR — the core strength of Bell Orderflow Ultimate. Each phase showcased how alerts guide directional bias, while Risk Limits (RL), Price Reactions, and Market Equilibrium (ME) levels help in managing position structure with precision.

Phase-1: 23 Points Long Move Captured

(Long attempt failed to reach ME-1, hence closed early and view shifted to Phase-2 short.)

Key Concept Highlights

Risk Limit (RL@25984)

- Defines the protective boundary of the trade.

- A breach or failure near RL signals weakening momentum in the chosen direction.

Long Price Reaction (L React@26009)

- Indicates where demand-side participants showed an initial response.

- Acts as the first confirmation that the long bias attempted to establish control.

ME-1 (Market Equilibrium@26032)

- The point where the market should ideally reach if the long move is healthy.

- Failure to achieve ME-1 confirmed weakening upside inventory → exit triggered.

Phase-2: 150 Points Short Move Captured

Triggered by CR + TBTS indicating reversal attempt.

Key Concept Highlights

Risk Limit (RL@26058.62)

- Protects the short position by defining max allowable risk.

- Staying below the RL confirmed supply-side participants were firmly in control.

Short Price Reaction (S React@26033.62)

- First sign of aggressive supply-side response.

- Establishes the validation zone for the short entry.

ME-1, ME-2, ME-3 (25983.62, 25933.60, 25883.62)

- Sequential Market Equilibrium levels showing value migration downward.

- Each ME break confirmed continuation strength → enabling a smooth 150-point downside capture.

Phase-3: 50 Points Long Move Captured

A clean transition into Long position guided by TR Alert + MR Alert + CR.

Key Concept Highlights

Risk Limit (RL@25864.30)

- Defined the lower boundary protecting the new long entry.

- Holding above RL signaled exhaustion of supply-side pressure.

Long Price Reaction (L React@25889.30)

- First place where responsive demand-side participants stepped in strongly.

- Validated that the market was preparing for upward rotation.

ME-1 (Market Equilibrium@25939.30)

- Target equilibrium zone confirming acceptance of higher prices.

- Once ME-1 was reached, the 50-point move was secured and booked.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through TBTS and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.