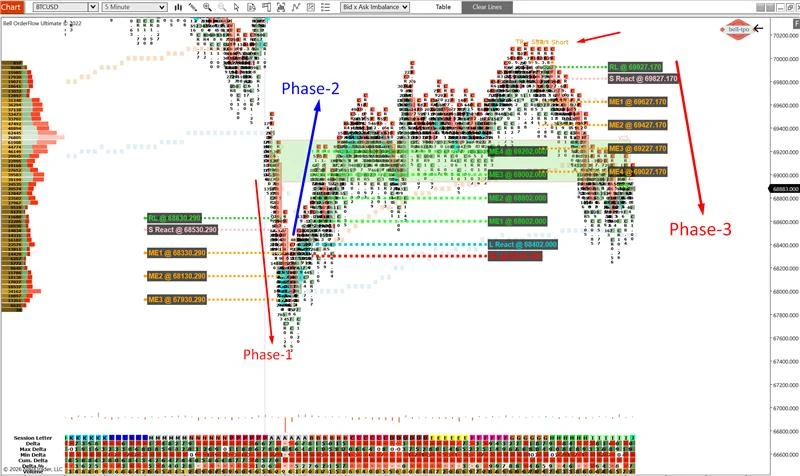

Educational Takeaway: Net 2200 Point Move Captured in BTCUSD with VC + TBTS +TR + CR using Bell Orderflow Ulimtate on 10/02/2026

On 10th February 2026, a powerful 2200-point move unfolded in BTCUSD, structured clearly through institutional orderflow behavior. Using VC + TBTS + TR + CR inside Bell Orderflow Ultimate, the session delivered a clean multi-phase opportunity built around equilibrium rotations and structured reactions.

Phase 1: Initial Distribution & Structured Rotation

RL (Risk Limit @ 68630.290)

- Risk Limit defined the structural invalidation zone for this leg of the move.

- Price respecting this boundary confirmed controlled participation rather than random volatility.

S React (Short Price Reaction @ 68530.290)

- The Short Price Reaction indicated immediate supply response near the upper structure.

- This reaction validated the presence of trapped inventory and early imbalance confirmation.

ME-1 (Market Equilibrium @ 68330.290)

- Market Equilibrium levels act as balance points where price seeks fair value.

- ME-1 served as the first magnet level, drawing price into rotational stability.

ME-2 (Market Equilibrium @ 68130.290)

- As momentum expanded, ME-2 provided the next structured pause zone.

- Price acceptance below prior balance increased directional conviction.

ME-3 (Market Equilibrium @ 67930.290)

- This equilibrium marked deeper value exploration within the structure.

- Sustained trading around this zone confirmed institutional participation.

Phase 2: Expansion & Upside Repricing

ME-4 (Market Equilibrium @ 69202.000)

- A fresh equilibrium formed after repricing higher.

- This indicated transition from distribution to expansion.

ME-3 (Market Equilibrium @ 69002.000)

- This level acted as a rotational checkpoint during continuation.

- Holding structure around ME-3 signaled sustained momentum.

ME-2 (Market Equilibrium @ 68802.000)

- Price rebalanced briefly here before further extension.

- It served as a structured reference rather than random pullback.

ME-1 (Market Equilibrium @ 68602.000)

- This became the final defensive equilibrium during this leg.

- Maintaining structure around this zone confirmed continuation bias.

L React (Long Price Reaction @ 68402.000)

- The Long Price Reaction showed responsive demand entering the structure.

- Absorption behavior at this zone prevented deeper retracement.

RL (Risk Limit @ 68302.000)

- This Risk Limit defined the structural boundary of continuation.

- Price respecting this level confirmed controlled volatility.

Phase 3: High-Timeframe Repricing & Final Leg

RL (Risk Limit @ 69927.170)

- A new Risk Limit was established as price expanded into higher value.

- This level defined the upper structural threshold for the session.

S React (Short Price Reaction @ 69827.170)

- Short Price Reaction marked immediate supply response at elevated levels.

- This reaction helped confirm exhaustion behavior in the final stretch.

ME-1 (Market Equilibrium @ 69627.170)

- First equilibrium during the final rotation phase.

- It acted as a stabilizing magnet within expanding volatility.

ME-2 (Market Equilibrium @ 69427.170)

- Price acceptance around ME-2 confirmed balanced rotation before extension.

- This zone structured the final directional move.

ME-3 (Market Equilibrium @ 69227.170)

- Deeper rebalancing zone before renewed participation.

- It reflected institutional value reassessment.

ME-4 (Market Equilibrium @ 69027.170)

- The last equilibrium reference in this sequence.

- Price interaction here confirmed completion of the structured cycle.

Indicator Components Used

- VC (Cluster Zone) – Identified institutional volume concentration

- TR (Trend Reversal) – Highlighted directional shift

- TBTS (Trapped Buyers / Trapped Sellers) – Exposed inventory imbalance

- CR (COT Ratio) – Confirmed structural positioning bias

Key Learning

This 2200-point BTCUSD move was not random volatility — it was a structured equilibrium-to-equilibrium rotation, guided by:- Risk-defined boundaries

- Price reaction confirmations

- Institutional cluster behavior

- Systematic equilibrium migration