Educational Takeaway: Net 220 Points move Captured in NIFTY_I using VC Zone + TBTS + UA + CR + TR-Alert in Bell Orderflow Ultimate

The Bell Orderflow Ultimate once again demonstrated its precision by identifying multiple high-probability trade opportunities through the synergy of VC Zone, TBTS, UA, CR, and TR alerts. Across three trading phases, the strategy effectively managed risk and captured a total of 220 points in NIFTY_I.

Phase 1: VC Zone + TBTS Long Move

Price Reaction @ 25664.90:

The day began with a long opportunity as price reacted positively near the VC Zone and TBTS confluence, indicating buyer interest. Early entry zones confirmed accumulation, though a minor retracement followed.

Risk Limit @ 25634:

The trade was protected with a tight 30-point stop, ensuring disciplined risk management. The move initially reversed, hitting the defined risk limit before structure regained balance.

Outcome:

30 points risk limit hit, marking a controlled exit that set the tone for subsequent phases with improved confluence and confirmation setups.

Phase 2: TBTS + UA + CR Long Move

Price Reaction @ 25725:

Renewed long signals emerged as TBTS, UA, and CR aligned, suggesting fresh buying continuation. The orderflow structure supported upward momentum with strong volume absorption.

Risk Limit @ 25695:

The trade maintained a calculated 30-point risk band, allowing smooth progression without triggering stops. Bell’s dynamic validation ensured the signal held strength throughout the move.

ME Levels:

- ME-1 @ 25775: First measured extension achieved, validating upward breakout strength.

- ME-2 @ 25825: Second measured extension reached, locking in a substantial portion of the move.

Outcome:

100 points move captured in this long phase as Bell Orderflow’s TBTS + UA + CR synergy perfectly tracked trend continuation and momentum flow.

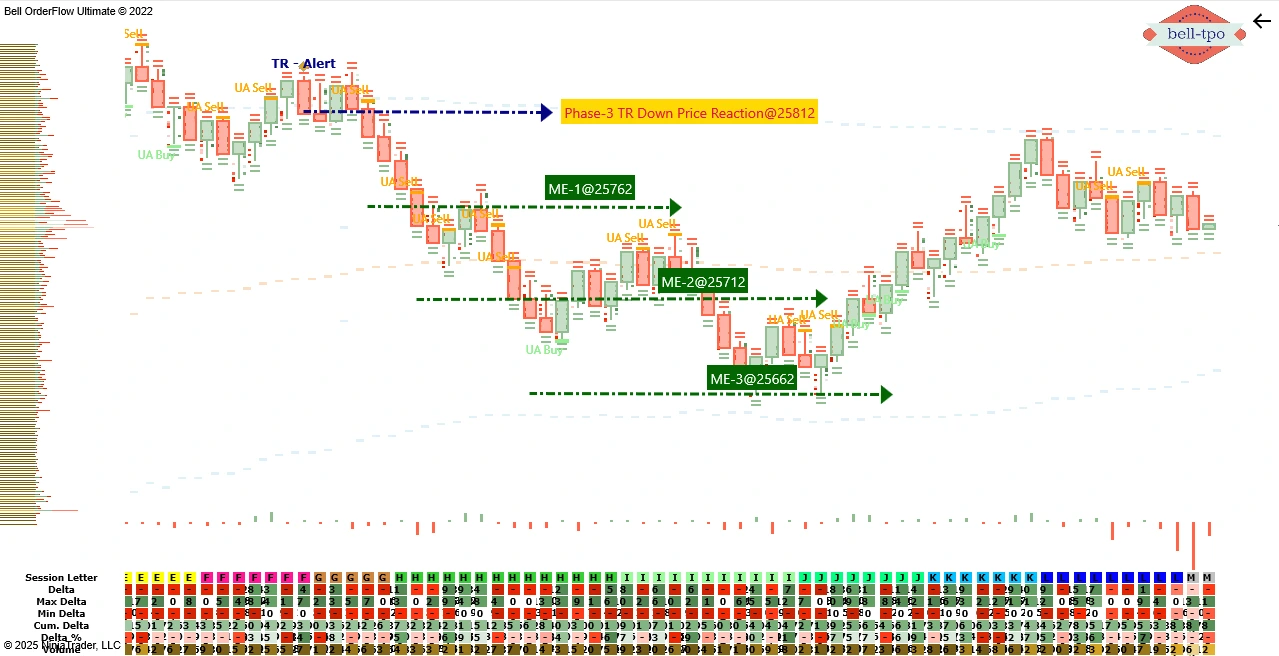

Phase 3: TR + UA + CR Alert – Short Move

Price Reaction @ 25812:

A TR (Trade Reversal) alert followed by UA and CR signals marked exhaustion of the long move and initiation of short bias. The orderflow clearly transitioned from buyer dominance to seller control.

ME Levels:

- ME-1 @ 25762: Price achieved the first extension swiftly, confirming short pressure.

- ME-2 @ 25712 & 25662: Both extensions were achieved as momentum intensified, reflecting a clean trend reversal.

Outcome:

150 points move captured in this phase, powered by a precise TR-Alert confirmation that flipped the market bias with perfect timing.

Overall Summary

- ✅ Phase-1: Risk limit hit with 30 points control move.

- ✅ Phase-2: 100 points long move captured with TBTS + UA + CR confluence.

- ✅ Phase-3: 150 points short move captured with TR-Alert confirmation.

- ✅ Total Net Move: 220 Points in NIFTY_I.

Each phase demonstrated how Bell Orderflow Ultimate integrates Volume Clusters, Trade Reversals, and Confirmation signals to provide structured and rule-based trading opportunities.

✅ Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.