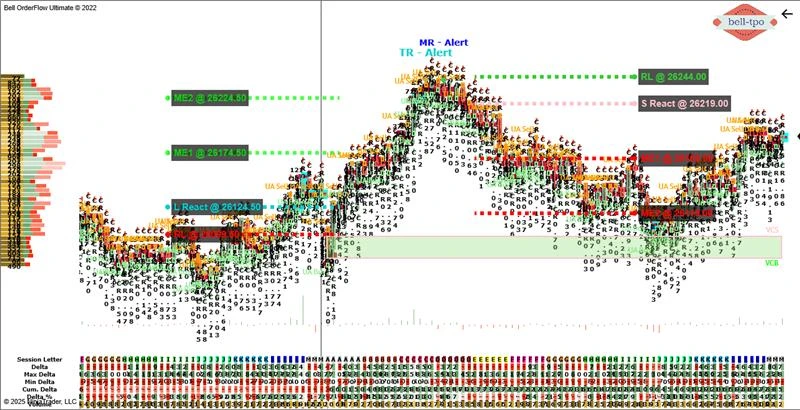

Educational Takeaway: Net 200 Points Move Captured in NIFTY_I with VC Zone + TR Alert + MR Alert + TBTS + CR using Bell Orderflow Ultimate

This breakdown highlights how structured orderflow references and alert logic help interpret market transitions across both phases.

Phase 1 – 100-Point Upside Move with VC Zone + CR Alert

L React (Long Price Reaction) — 26124.50

- This is the first meaningful reaction zone where directional intent becomes visible.

- It helps determine whether demand-side participants are stepping in with conviction as the auction shifts.

L RL (Long Risk Limit) — 26099.50

- This boundary serves as the structural invalidation point for the early long-side narrative.

- Holding above it indicates that responsive participants are still active.

LME-1 (Long Market Equilibrium) — 26174.50

- Represents the immediate balance area the market accepts during the upward structure.

- Moving away from it with strength confirms that demand-side participants are maintaining control.

LME-2 (Long Market Equilibrium) — 26224.50

- A deeper equilibrium layer signalling continuation of the upward imbalance.

- It often acts as the next logical zone where auction flow stabilizes before expanding further.

Key Insight: VC Zone + CR alert alignment created a smooth contextual framework for capturing the first 100-point structured movement.

Phase 2 – 100-Point Downside Move with TBTS + TR Alert + CR + MR Alert

S React (Short Price Reaction) — 26219.00

- This level shows where significant supply-side interest first responded against the prior upward auction.

- It confirms the presence of active supply participating at higher prices.

S RL (Short Risk Limit) — 26244.00

- Functions as the structural boundary beyond which the downside thesis weakens.

- Staying below S RL indicates supply-side pressure remains dominant.

SME-1 (Short Market Equilibrium) — 26169.00

- The first balance zone formed after the downside transition begins.

- Holding below it shows that the auction is accepting lower value areas.

SME-2 (Short Market Equilibrium) — 26119.00

- A deeper equilibrium area showing advanced acceptance of the downward imbalance.

- It acts as a structural zone commonly tested when momentum strengthens.

Key Insight: TBTS combined with TR Alert, CR, and MR Alert supported a clean and structured 100-point downside phase.

TR Alert & MR Alert — The Heroes of the Day

The most impactful concepts in today’s 200-point educational breakdown were:

TR Alert (Trend Reversal Alert)

- Provided early identification of a shift in trend, helping transition cleanly from the long-side structure in Phase 1 to the short-side structure in Phase 2.

MR Alert (Momentum Reversal Alert)

- Confirmed weakening momentum at key turning points, validating that the reversal had strong participation behind it.

Together, TR Alert and MR Alert showcased how Bell Orderflow Ultimate enhances clarity during directional transitions and helps users interpret market intent with precision.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through TBTS and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.