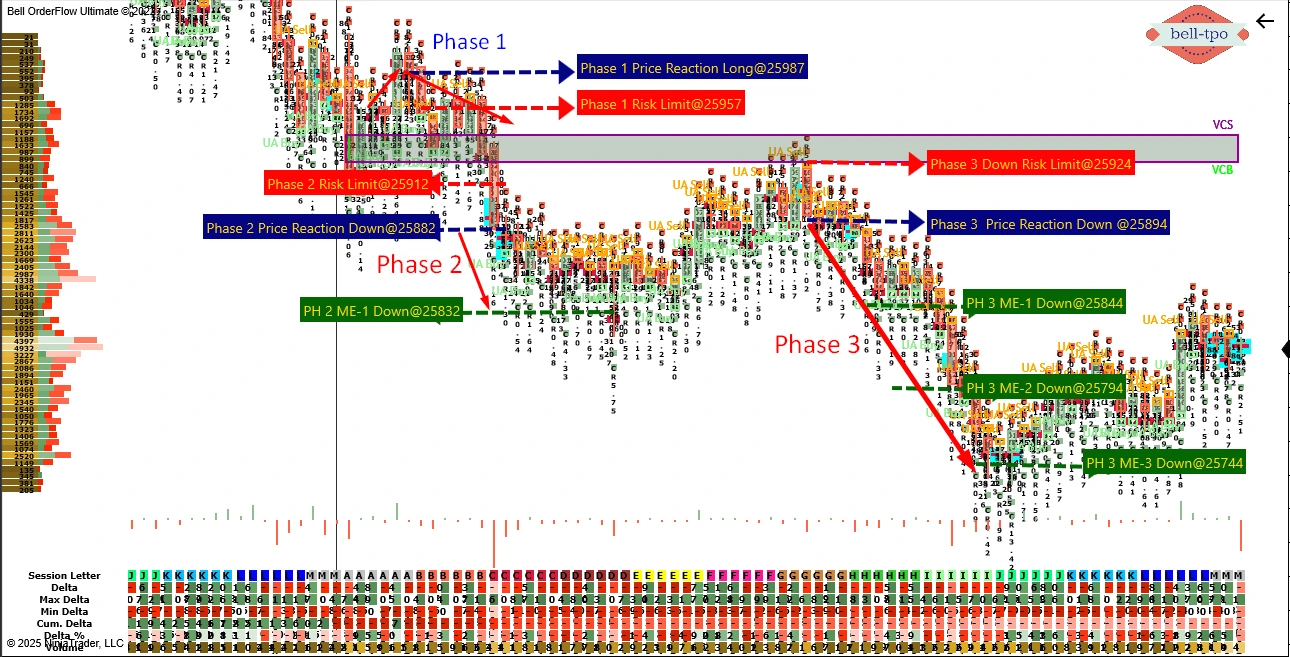

Educational Takeaway: Net 170 points move captured in NIFTY_I with VC zone + TBTS + UA + CR alert in Bell Orderflow Ultimate

Phase 1: Long Move (30 points Risk Limit hit)

The initial upward phase began with a strong Price Reaction at 25987, signaling early strength within the VC Zone. This move highlighted potential upward intent but lacked sustained momentum beyond the immediate reaction area.

The Risk Limit at 25957 marked a key control point for phase evaluation. A breach of this level confirmed exhaustion in buying pressure, setting the stage for a shift in directional bias.

Phase 2: Down Move (50 points move captured on downside)

A decisive Price Reaction emerged at 25882, confirming seller strength and triggering a continuation of the downward momentum. This area reflected a controlled response aligned with TBTS and UA alerts for structured participation.

The Risk Limit at 25912 acted as a decisive boundary defining phase integrity. Sustained trade activity below this zone validated the ongoing bearish control.

ME-1 Down @25832:

This indicated the first momentum expansion on the downside. This extension reflected efficient orderflow behavior, marking an early reward for disciplined trade management.

Phase 3: Down Move (150 points move captured on downside)

The Price Reaction at 25894 confirmed renewed selling participation and reinforced bearish continuation from prior structure. This level also aligned with VC Zone behavior and CR alert validation, ensuring a systematic flow in directional conviction.

The Risk Limit at 25924 held as the upper containment zone for this phase. Rejection from this area validated the sustained bearish flow, allowing participants to manage risk boundaries effectively.

ME-1 Down @25844:

This showcased the first meaningful momentum leg in this phase. It confirmed the transition from reaction to expansion within a controlled selling environment.

ME-2 Down @25794:

This highlighted the mid-phase continuation within the existing flow. Price efficiency and volume clustering reflected institutional-level execution patterns.

ME-3 Down @25744:

This represented the terminal leg of this structured move. It concluded the sustained orderflow momentum, effectively completing the 150-point controlled directional phase.

Educational Takeaway

A Net 170 points move was captured in NIFTY_I using VC Zone + TBTS + UA + CR Alert in Bell Orderflow Ultimate, showcasing a structured approach to identifying and managing multi-phase directional opportunities.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making trading or investment decisions. Past performance is not indicative of future results.