Educational Takeaway: Net 170 Points Captured with MR + TR + UA + CR in Bell Orderflow Ultimate

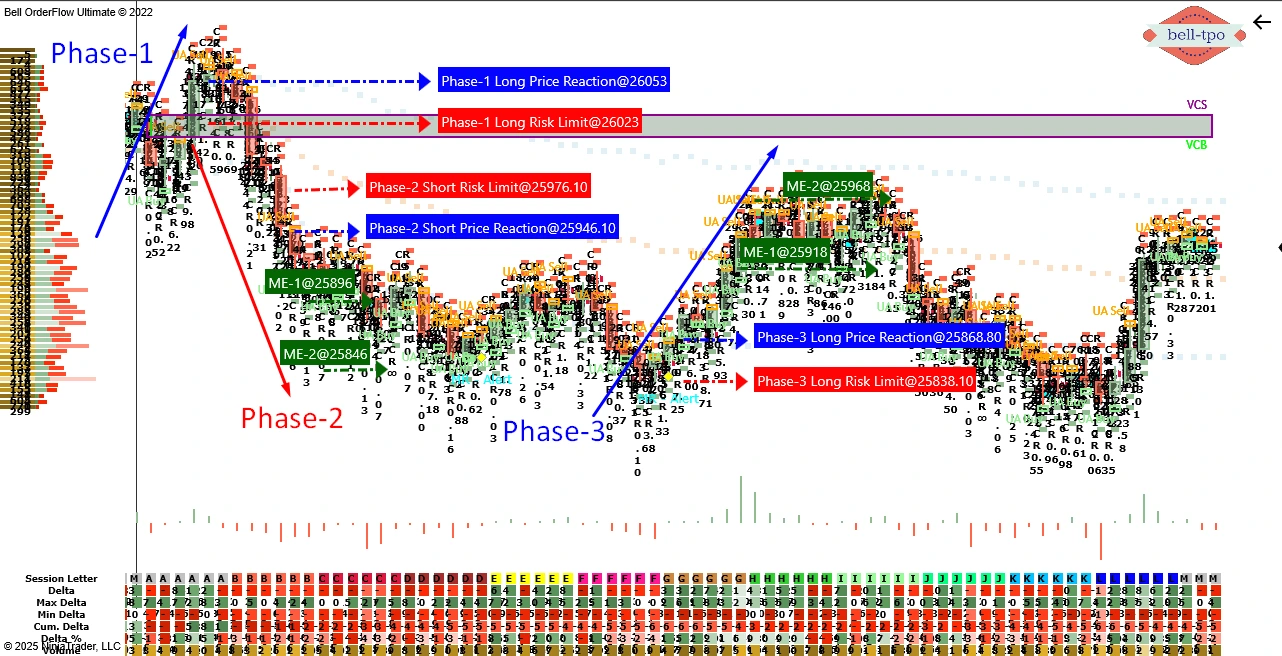

A total of 170 points move was captured in NIFTY_I using a confluence of Momentum Reaction (MR), Trend Reversal (TR), Unfinished Auction (UA), and Cumulative Ratio (CR) signals from Bell Orderflow Ultimate. The day displayed three distinct trading phases, each showcasing the efficiency of price reaction and risk limit levels with ME targets for structured intraday execution.

Phase-1: Long Move (30 Points Stoploss Hit)

Price Reaction @26053:

The initial long signal triggered a strong buying intent, but momentum failed to sustain above the reaction zone. Price reaction levels help identify the immediate response of market participants, validating short-term demand strength.

Risk Limit @26023:

The stop loss was placed 30 points below the reaction level, protecting against premature reversals. Risk limit levels are key for disciplined trade exits, ensuring drawdown control in uncertain market conditions.

Phase-2: Down Move (100 Points Captured)

Price Reaction @25976.10:

The shift from long to short bias was confirmed as price reacted sharply below this level. Price reaction indicated a clear rejection of higher value, favoring a strong bearish continuation.

Risk Limit @25946.10:

Defined risk ensured controlled entry management with minimal exposure. The disciplined use of risk limit enabled traders to ride the move confidently without emotional interference.

ME Levels:

ME-1 @25896 | ME-2 @25846: ME levels acted as precise intraday targets, where profit booking and order absorption were observed. These measured extension levels helped capture nearly the full extent of the short trend with precision.

Phase-3: Long Move (100 Points Captured)

Price Reaction @25868.80:

A new long bias emerged as price found strong reaction from lower levels. The reaction confirmed short covering and initiation of fresh long positions around key absorption points.

Risk Limit @25838.10:

Placing the risk limit below structural support ensured optimal reward-to-risk alignment. Controlled trade management at this level prevented unnecessary drawdowns during pullbacks.

ME Levels:

ME-1 @25918 | ME-2 @25968: Both ME targets were achieved smoothly, indicating trend continuation strength. ME levels once again demonstrated their accuracy in marking extension zones for intraday exits.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through VC, TBTS, and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.