Educational Takeaway: Net 153 Points Move in NIFTY_I with VC Zone + TBTS + CR + UA using Bell Orderflow Ultimate

The NIFTY_I session showcased a classic multi-phase orderflow sequence, where early risk limit interactions set the context, followed by a strong directional expansion. The move was supported by VC Zone, TBTS, CR, and UA concepts from Bell Orderflow Ultimate, with broader confirmation from Bell Market Profile Ultimate and BellTrend Analyzer.

Overall, despite initial whipsaws, the session delivered a net 153 points educational move, highlighting the importance of patience, structure, and contextual alignment.

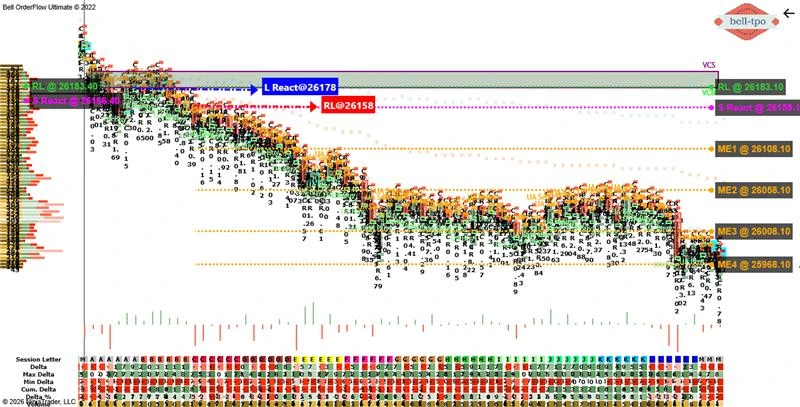

Phase-1: Initial Risk Interaction (17 Points Move)

Risk Limit (RL)

- The Risk Limit at 26183.40 acted as an immediate rejection zone, clearly defining the boundary of acceptance.

- This early RL hit signaled unstable participation and warned against over-commitment.

Price Reaction

- The Short Price Reaction at 26166.40 showed a quick response away from the risk boundary.

- However, the limited follow-through indicated a probing phase rather than a committed move.

Phase-2: Opposite Side Risk Test (20 Points Move)

Risk Limit (RL)

- The Risk Limit at 26158 was tested soon after, confirming continued two-way trade and lack of directional clarity.

- Multiple RL interactions reinforced the importance of respecting predefined risk zones.

Price Reaction

- The Long Price Reaction at 26178 reflected a responsive move, but strength remained capped.

- This phase remained rotational, serving more as positioning than expansion.

Phase-3: Directional Expansion (190 Points Move)

Risk Limit (RL)

- The Risk Limit at 26183.10 became the defining reference for the session’s expansion.

- Once acceptance shifted away from this level, sustained movement unfolded with clarity.

Price Reaction

- The Short Price Reaction at 26158.10 confirmed initiative activity and continuation.

- Reactions were cleaner and more decisive compared to earlier phases.

Market Equilibrium (ME) Structure

ME-1 & ME-2

- Market Equilibrium-1 at 26108.10 and ME-2 at 26058.10 acted as intermediate balance references.

- These levels helped track orderly price migration during the move.

ME-3 & ME-4

- ME-3 at 26008.10 and ME-4 at 25968.10 highlighted deeper acceptance zones.

- The progression through these equilibria reflected strong directional control and reduced counter-rotation.

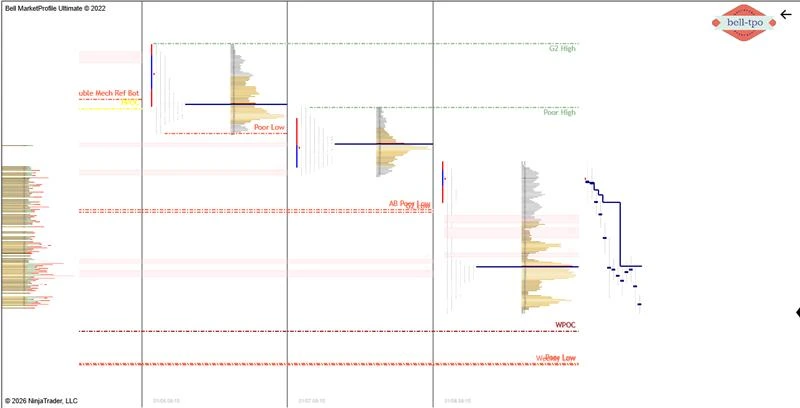

Market Profile & Sentiment Context

As per Bell Market Profile Ultimate, the session carried a strong reference of a Poor High, indicating unfinished business at the upper end. This structural weakness aligned well with the negative market sentiment identified by BellTrend Analyzer, adding higher-timeframe confirmation to the intraday orderflow behavior.

When orderflow signals align with Market Profile references and broader trend sentiment, the quality of directional moves improves significantly.

Key Learning

This session reinforces a critical lesson: Early risk limit hits are not failures—they are information. When combined with Market Profile structure and sentiment tools, they often precede the most meaningful moves of the day.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through TBTS and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.