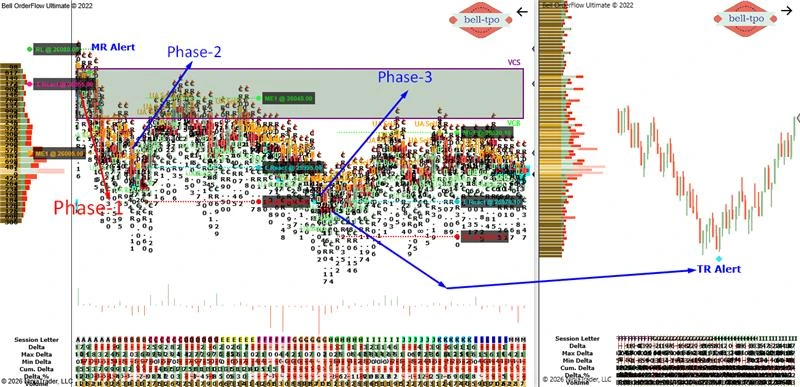

Educational Takeaway: Net 150 Points Move Captured in NIFTY_I with TR + MR + TBTS + CR + UA using Bell Orderflow Ultimate

Today a structured 150-point move unfolded in NIFTY_I, clearly driven by layered orderflow confirmations and disciplined equilibrium rotations. Using TR + MR + TBTS + CR + UA inside Bell Orderflow Ultimate, the session delivered a clean three-phase opportunity built around defined Risk Limits, precise Price Reactions, and ME level rotations.

Let’s break down the phases.

Phase-1: 50 Points Move Captured

Confluence: MR + TBTS + CR

RL (Risk Limit @ 26080.00)

- Risk was clearly defined before participation.

- This level acted as the invalidation boundary for the setup.

S React (Short Price Reaction @ 26055.00)

- Price showed immediate reaction from the reaction level.

- Orderflow confirmation strengthened conviction in continuation.

ME-1 (Market Equilibrium @ 26005.00)

- This equilibrium level acted as a structured magnet for price.

- Balanced orderflow around ME-1 confirmed healthy rotation.

Phase-2: 50 Points Move Captured

Confluence: TBTS + CR + UA

RL (Risk Limit @ 25970.00)

- Risk was tightly defined to protect capital.

- Holding above this level kept the structure intact.

L React (Long Price Reaction @ 25995.00)

- Strong response from reaction level signaled fresh participation.

- Follow-through confirmed trapped inventory adjustment.

ME-1 (Market Equilibrium @ 26045.00)

- Price gravitated toward equilibrium as expected.

- Orderflow balance at this level validated continuation.

Phase-3: 50 Points Move Captured

Confluence: TR + CR

RL (Risk Limit @ 25945.10)

- Defined invalidation helped maintain disciplined exposure.

- As long as this level remained protected, structure stayed strong.

L React (Long Price Reaction @ 25970.10)

- Clean reaction confirmed strength in participation.

- Momentum alignment supported sustained directional activity.

ME-1 (Market Equilibrium @ 26220.10)

- Equilibrium acted as a structured target zone.

- Balanced rotation near ME-1 completed the final leg.

Indicator Components Explained

- VC (Cluster Zone) – Identifies volume concentration zones.

- MR (Momentum Reversal) – Signals exhaustion and directional shift.

- TR (Trend Reversal) – Indicates higher-probability structural shift.

- UA (Unfinished Auction) – Highlights pending price discovery.

- TBTS (Trapped Buyers/Trapped Sellers) – Shows inventory imbalance.

- CR (Cot Ratio) – Institutional positioning confirmation.

Key Learning

- Clear phase-wise structure

- Pre-defined Risk Limit in every move

- Reaction levels confirming participation

- Equilibrium levels acting as structured magnets

- Multi-layer confluence improving probability

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.Today a structured 150-point move unfolded in NIFTY_I, clearly driven by layered orderflow confirmations and disciplined equilibrium rotations. Using TR + MR + TBTS + CR + UA inside Bell Orderflow Ultimate, the session delivered a clean three-phase opportunity built around defined Risk Limits, precise Price Reactions, and ME level rotations. Let’s break down the phases.Phase-1: 50 Points Move

Confluence: MR + TBTS + CR

RL (Risk Limit @ 26080.00)

- Risk was clearly defined before participation.

- This level acted as the invalidation boundary for the setup.

S React (Short Price Reaction @ 26055.00)

- Price showed immediate reaction from the reaction level.

- Orderflow confirmation strengthened conviction in continuation.

ME-1 (Market Equilibrium @ 26005.00)

- This equilibrium level acted as a structured magnet for price.

- Balanced orderflow around ME-1 confirmed healthy rotation.

Phase-2: 50 Points Move

Confluence: TBTS + CR + UA

RL (Risk Limit @ 25970.00)

- Risk was tightly defined to protect capital.

- Holding above this level kept the structure intact.

L React (Long Price Reaction @ 25995.00)

- Strong response from reaction level signaled fresh participation.

- Follow-through confirmed trapped inventory adjustment.

ME-1 (Market Equilibrium @ 26045.00)

- Price gravitated toward equilibrium as expected.

- Orderflow balance at this level validated continuation.

Phase-3: 50 Points Move

Confluence: TR + CR

RL (Risk Limit @ 25945.10)

- Defined invalidation helped maintain disciplined exposure.

- As long as this level remained protected, structure stayed strong.

L React (Long Price Reaction @ 25970.10)

- Clean reaction confirmed strength in participation.

- Momentum alignment supported sustained directional activity.

ME-1 (Market Equilibrium @ 26220.10)

- Equilibrium acted as a structured target zone.

- Balanced rotation near ME-1 completed the final leg.

Indicator Components Explained

- MR (Momentum Reversal) – Signals exhaustion and directional shift.

- TR (Trend Reversal) – Indicates higher-probability structural shift.

- UA (Unfinished Auction) – Highlights pending price discovery.

- TBTS (Trapped Buyers/Trapped Sellers) – Shows inventory imbalance.

- CR (Cot Ratio) – Institutional positioning confirmation.

Key Learning

- Clear phase-wise structure

- Pre-defined Risk Limit in every move

- Reaction levels confirming participation

- Equilibrium levels acting as structured magnets

- Multi-layer confluence improving probability