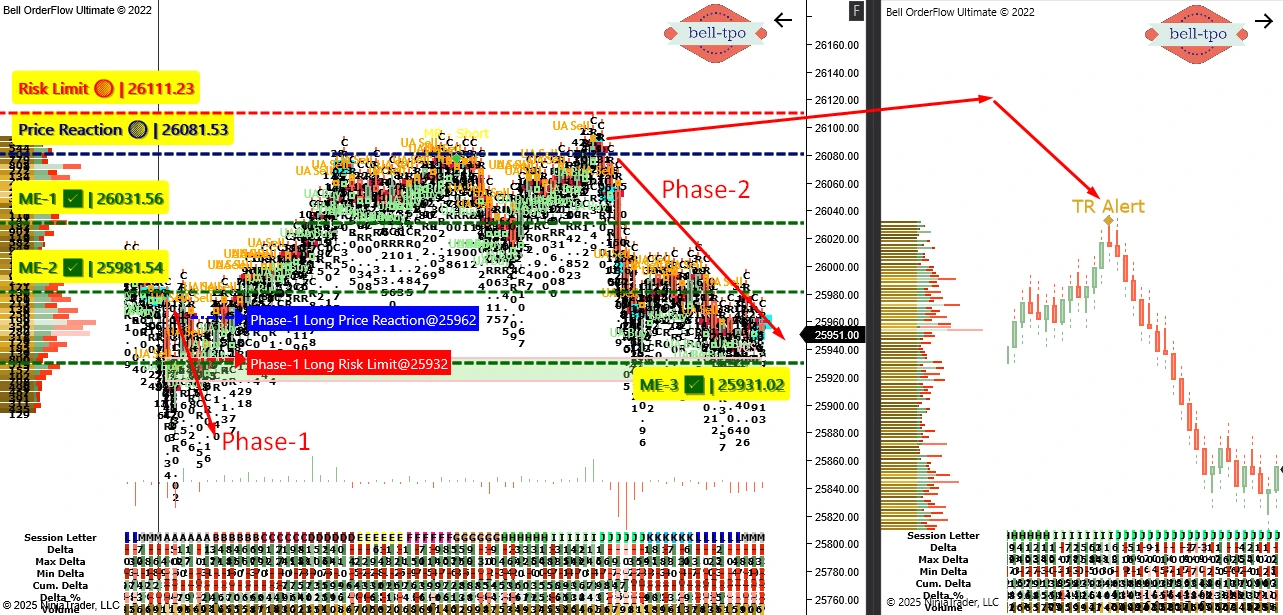

Educational Takeaway: Net 120 Points Move Caputred in NIFTY_I with VC Zone + TBTS + UA + CR + TR using Bell Orderflow Ultimate

Today’s NIFTY_I session delivered a clean, structured execution using Bell Orderflow Ultimate. With VC Zone bias, TR Alert, TBTS confirmation, UA alerts, and clear CR alignment, the market offered a high-probability setup across two phases. The move unfolded precisely around our predefined risk limits and ME levels, resulting in a total of 120 points captured.

Phase-1 — 30 Points | Risk Limit Hit

Price Reaction: Price reacted sharply from 25962, aligning with our pre-defined response zone. Orderflow confirmed the rejection with strong delta exhaustion at the reaction point. Risk Limit: The initial protective level at 25932 was tagged, validating the early phase stop placement. Hitting the risk limit signaled that Phase-1 lacked continuation strength. ME Levels: ME levels were monitored but not triggered due to price failing to sustain above reaction levels. Absence of ME validation reinforced the early halt of Phase-1.Phase-2 — 150 Points Short Move Captured

Price Reaction: A powerful short-side reaction emerged from 26081.53, confirming exhaustion at the upper zone. TR + UA alignment strengthened the bearish bias right from the reaction point. Risk Limit: The protective level at 26111.23 remained safely above price throughout the move. Stability around the risk limit confirmed sustained bearish control. ME Levels:- ME-1 @ 26031.56: Provided the first continuation checkpoint with clean delta flow.

- ME-2 @ 25981.54: Offered progressive confirmation as sellers dominated the session.

- ME-3 @ 25931.02: Confirmed sustained bearish momentum completion.