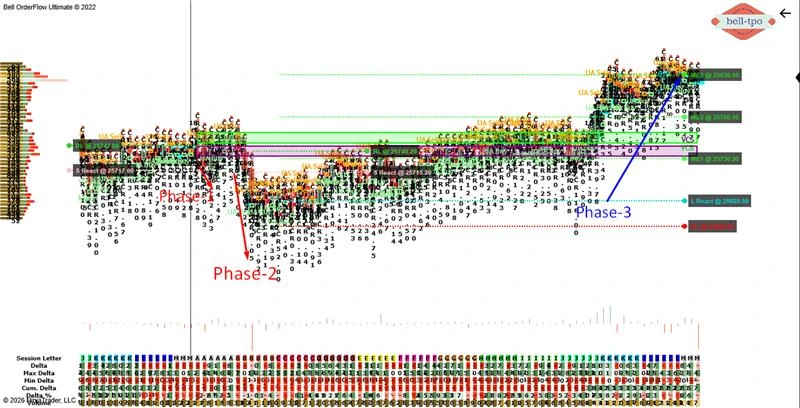

Educational Takeaway: Net 120 Points Move Captured in NIFTY_I with VC + TBTS + CR + UA using Bell Orderflow Ultimate

In this session, NIFTY_I delivered a structured 120 points opportunity through a combination of VC , TBTS , CR and UA confirmations.

This analysis is presented purely for educational and structural understanding of Orderflow behaviour.

Maximize Your Trading Edge with Bell Orderflow Ultimate Visit www.belltpo.com or reach out to us for more details.

Phase 1 – Controlled Volatility & Structured Reaction Risk Limit Hit (30 Points)

Risk Limit (RL @ 25747.00)

- Risk Limit defines the invalidation boundary of the structure.

- Once this level was tested, price behaviour confirmed controlled volatility within defined limits.

Price Reaction – S React (@ 25717.00)

- Price reacted precisely from the reaction zone, validating orderflow imbalance.

- This reaction indicated structured participation rather than random movement.

Phase 2 – Structural Shift with Validation Change in Trend

Initially, price attempted continuation in the same direction. However, TBTS + CR validation signalled absorption and sentiment shift.Risk Limit (RL @ 25740.20)

- The Risk Limit acted as a structural decision boundary.

- Price respecting this zone confirmed that aggressive continuation was weakening.

Price Reaction – S React (@ 25715.20)

- Reaction from this level showed effort vs result divergence.

- Absorption signs indicated that trapped positioning was building up.

Phase 3 – 150 Points Expansion Move

With TBTS + CR + UA alignment, the market transitioned into expansion mode.Market Equilibrium Levels

ME-3 (@ 25830.90)

- ME-3 represented the upper equilibrium distribution area.

- Acceptance above this level confirmed expansion continuation.

ME-2 (@ 25780.90)

- ME-2 acted as an intraday balance pivot.

- Sustained activity around this level confirmed structural strength.

ME-1 (@ 25730.90)

- ME-1 served as the early equilibrium anchor.

- Holding above this level maintained bullish orderflow alignment.

Price Reaction – L React (@ 25680.90)

- Price reacted with strong participation from this reaction level.

- The reaction confirmed absorption below equilibrium before expansion.

Risk Limit – RL (@ 25650.90)

- This level defined the structural invalidation for the expansion phase.

- As long as price respected this boundary, the structure remained intact.

Maximize Your Trading Edge with Bell Orderflow Ultimate Visit www.belltpo.com or reach out to us for more details.