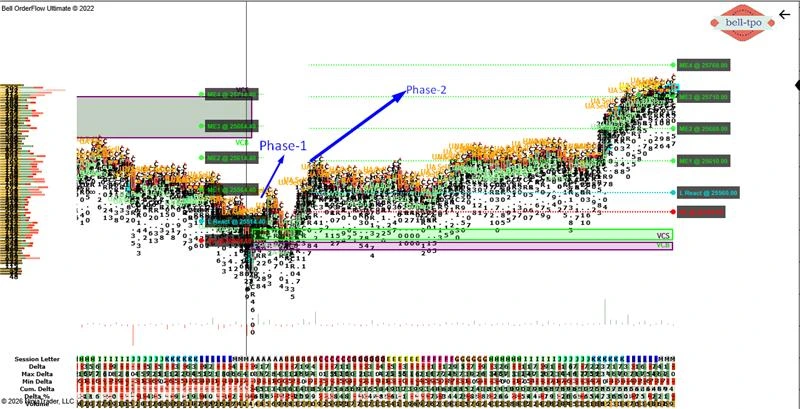

Educational Takeaway: Net 120 Points move captured in NIFTY_I with VC + TBTS + CR + UA using Bell Orderflow Ultimate

The recent session in NIFTY_I captured a structured 120-point directional move, identified through confluence signals from VC, TBTS, CR, and UA using Bell Orderflow Ultimate.

This move unfolded in two clearly defined phases with disciplined risk structure and equilibrium mapping.

Phase 1 – 30 Points Risk Structure Play

Risk Limit (RL @ 25484.40)

- The Risk Limit acted as the invalidation boundary, defining the structural edge of the setup.

- Price respecting this level confirmed that orderflow imbalance remained intact without structural breakdown.

L React – Long Price Reaction (@ 25514.40)

- This level marked the first decisive price response after risk stabilization.

- It confirmed responsive activity from dominant participants near the cluster zone.

ME-1 – Market Equilibrium (@ 25564.40)

- The first equilibrium acted as a balance checkpoint where rotation was expected.

- Acceptance above this equilibrium suggested continuation strength within Phase 1.

Phase 1 Summary

Cluster-based absorption + trapped positioning + cot imbalance created a clean 30-point structured opportunity while respecting defined risk.Phase 2 – 120 Points Expansion Move

(VC + UA + CR Continuation Confluence)

After Phase 1 stabilization, continuation signals emerged through unfinished auction persistence and cluster re-acceptance.Risk Limit (RL @ 25530.00)

- The revised Risk Limit tightened structural exposure and maintained capital discipline.

- Holding above this level confirmed continuation bias and strong orderflow alignment.

L React – Long Price Reaction (@ 25560.00)

- This reaction level marked fresh participation after pullback absorption.

- It validated that buyers were defending structure with renewed momentum.

ME Levels in Phase 2

ME-1 (@ 25610.00)

- The first equilibrium acted as an intraday balance zone.

- Clean acceptance above it signaled range expansion readiness.

ME-2 (@ 25660.00)

- This level represented secondary balance where short-term rotation was possible.

- Strong continuation through this level indicated initiative dominance.

ME-3 (@ 25710.00)

- The third equilibrium served as an extended distribution checkpoint.

- Sustained movement beyond it confirmed a full expansion cycle completion.

Confluence Breakdown

- VC (Cluster Zone) – Absorption & institutional footprint

- UA (Unfinished Auction) – Incomplete auction signaling continuation

- TBTS – Trapped positioning adding fuel

- CR (Cot Ratio) – Directional strength confirmation

Key Educational Insight

- Structured moves emerge when multiple orderflow signals align — not from isolated indicators.

- Risk Limit defines survival; Equilibrium defines structure; Price Reaction defines participation.

- Phase-based thinking prevents emotional decisions and promotes systematic execution.

- Expansion moves often follow controlled compression near equilibrium levels.

Conclusion

The 120-point expansion in NIFTY_I was not random volatility — it was a structured auction process guided by:- Defined Risk

- Clear Reaction Levels

- Progressive Equilibrium Mapping

- Strong Orderflow Confluence