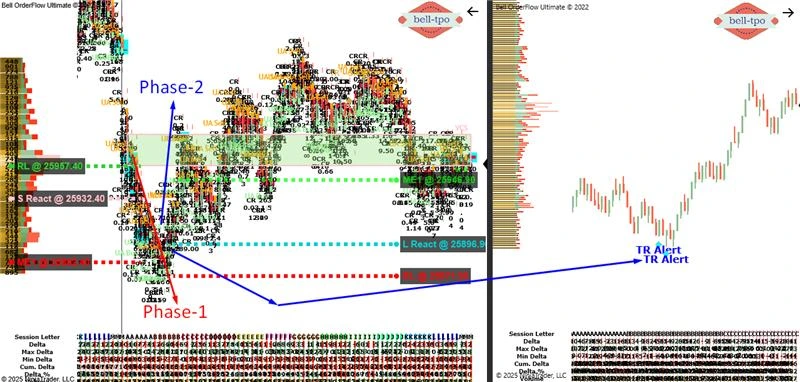

Educational Takeaway: Net 100 Points Move Captured in NIFTY_I with VC + TR Alert + TBTS + CR + UA using Bell Orderflow Ultimate

A total 100 points of directional movement was captured in NIFTY_I today using a powerful confluence of VC Zone, TR Alert, TBTS, CR, and UA signals within Bell Orderflow Ultimate. Price behaviour across both phases showed clean orderflow-driven reactions, allowing structured execution with predefined risk and equilibrium targets.

Phase–1: 50-Points Short Move Captured

Risk Limit (RL @ 25957.40)

- The RL defines the protected boundary for the phase, ensuring the short-side intent remains intact as long as price stays below this line.

- It acts as the invalidation zone where aggressive activity should not return if the move is genuine.

S React (Short Price Reaction @ 25932.40)

- This marks the point where the first responsive supply-side pressure appeared, validating the signal cluster (TBTS + CR).

- Price reacting here confirms initiative supply-side participants stepping in, setting the tone for directional continuation.

ME-1 (Market Equilibrium @ 25882.40)

- ME-1 is the natural gravitational line for this phase, where price statistically seeks balance after displacement.

- Reaching ME-1 signifies completion of the expected equilibrium test for the short leg.

Phase-1 Summary: Completed a clean 50-points short-side move from reaction to equilibrium.

Phase–2: 50-Points Long Move Captured

Risk Limit (RL @ 25871.90)

- The RL here defines the protected lower boundary for the long-side intent; price staying above this zone keeps the upside continuation valid.

- This level also marks where long-side orderflow should remain dominant without deep rejection.

L React (Long Price Reaction @ 25896.90)

- This is where fresh responsive demand-side activity emerged, confirming the shift in orderflow after Phase-1 completion.

- Price reacting from this point shows supportive demand entering the market, strengthening the long-side case.

ME-1 (Market Equilibrium @ 25946.90)

- ME-1 serves as the equilibrium target for the upward phase, where price is statistically pulled after a reaction.

- Hitting ME-1 completes the long-phase expectation and validates the strength of the orderflow sequence.

Phase-2 Summary: Delivered another 50-points move, completing a strong two-phase rotation.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through TBTS and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.