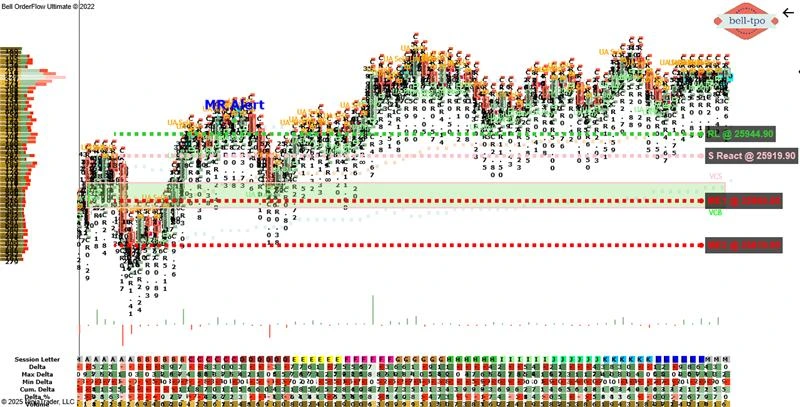

Educational Takeaway: Net 100 Points Move Captured in NIFTY_I with VC + MR Alert + TBTS + CR using Bell Orderflow Ultimate

A powerful intraday opportunity unfolded today, delivering a clean 100-points short move captured using VC Zone + TBTS Alert + CR + MR Alert on the Bell Orderflow Ultimate. The flow was clear, the intentions were visible, and the alerts aligned perfectly to support an informed execution.

Phase-1: 100 Points Short Move Captured

Risk Limit (RL @ 25944.90)

- The RL established the structural boundary for the short idea, helping define the maximum acceptable adverse movement.

- It also acted as the reference point to validate directional conviction based on real-time orderflow pressure.

S React (Short Price Reaction @ 25919.95)

- The price reaction confirmed supply-side aggression exactly at a responsive zone, validating the continuation bias.

- This reaction also served as the operational trigger to strengthen confidence in holding the short.

ME-1 (25869.90) & ME-2 (25819.90)

- ME-levels helped track the auction’s balance shift and validated that the market was transitioning into a more dominant supply-side environment.

- Each ME zone acted as an intraday checkpoint, confirming that the auction was migrating lower with sustained volume acceptance.

Phase-2: Position Closed After MR Alert Confirmation

The MR Alert signaled a clear shift in market intention, indicating exhaustion of the downward momentum. Rather than anticipating continuation, the confirmed MR alert helped secure profits at the right time and exit with precision.

Summary

A disciplined approach—powered by VC Zone, TBTS, CR, and MR Alerts—delivered a clean and controlled 100-point move. Each component contributed to high-confidence execution, showcasing the strength of Bell Orderflow Ultimate in capturing market intention without relying on buy/sell predictions.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through TBTS and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.