Educational Takeaway: Net 100 Points Move Captured in NIFTY_I with VC + TBTS + CR + UA using Bell Orderflow Ultimate

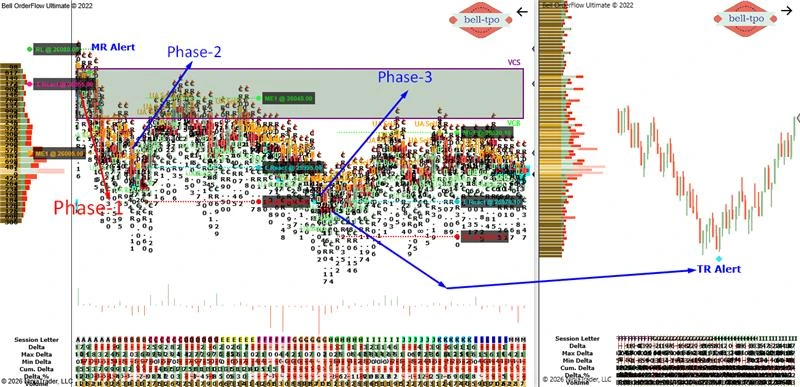

In today’s session, a clean 100-point structured move unfolded in NIFTY_I, built purely on institutional orderflow logic using VC + TBTS + CR + UA inside Bell Orderflow Ultimate. The move developed in two well-defined phases, each offering precision-based execution around reaction zones and equilibrium shifts.

Let’s break down the structure.

Maximize Your Trading Edge with Bell Orderflow Ultimate Visit www.belltpo.com or reach out to us for more details.

Let’s break down the structure.

Phase 1 – 50 Points Structured Move

Confluence: TBTS + CR

The first phase was driven by trapped positioning (TBTS) along with Cot Ratio (CR) confirmation. This created a controlled directional expansion from a defined reaction point toward equilibrium.RL – Risk Limit @ 25670.40

- Risk Limit acted as the structural invalidation reference for this phase.

- Price respecting this level confirmed continuation strength and maintained directional bias.

S React – Price Reaction @ 25645.40

- The Short Price Reaction zone marked the initial institutional response area.

- This reaction confirmed trapped positioning and initiated the first structured expansion.

ME-1 – Market Equilibrium @ 25595.40

- ME-1 served as the first equilibrium shift zone where price gravitated after reaction.

- This level defined the completion of the first rotation and offered structured profit booking behavior.

Phase 2 – 50 Points Continuation Move

Confluence: VC + TBTS + CR + UA

The second phase developed with stronger confirmation as Volume Cluster (VC) aligned with trapped participants, Cot Ratio structure, and an Unfinished Auction (UA). This created momentum continuation toward the next equilibrium.RL – Risk Limit @ 25592.00

- Risk Limit in Phase 2 acted as a structural guardrail for continuation.

- Holding below this reference maintained orderflow alignment and prevented structural failure.

S React – Price Reaction @ 25567.00

- The second reaction zone confirmed renewed participation within the cluster structure.

- This reaction validated continuation and sustained pressure toward lower equilibrium.

ME-1 – Market Equilibrium @ 25517.00

- ME-1 marked the next institutional balancing area after expansion.

- Price reached this equilibrium completing the structured 50-point continuation leg.

Indicator Logic Used

- VC (Volume Cluster) – Institutional participation zone

- UA (Unfinished Auction) – Incomplete auction signaling continuation probability

- TBTS (Trapped Buyers/Trapped Sellers) – Aggressive participants caught on the wrong side

- CR (Cot Ratio) – Commitment structure alignment

Structural Insight

This 100-point move was not random volatility. It was a two-phase, orderflow-driven expansion, built on reaction → equilibrium → continuation sequencing. When cluster structure, trapped participation, and auction logic align, the market delivers clean rotational legs with defined risk and measurable targets.Maximize Your Trading Edge with Bell Orderflow Ultimate Visit www.belltpo.com or reach out to us for more details.