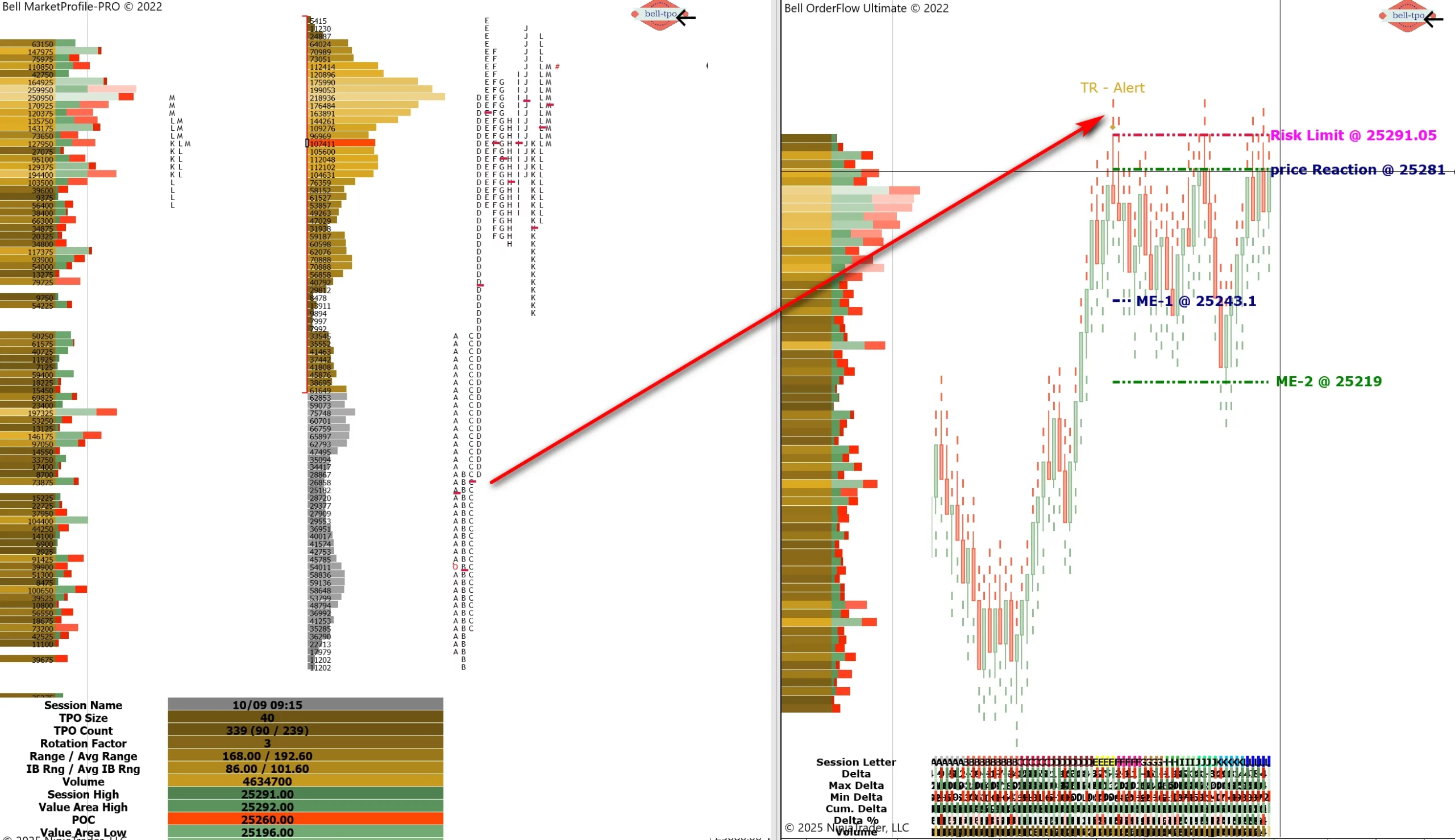

Educational Takeaway: 62 Points Move Captured in NIFTY_I with IBH & TR-Alert using Bell Orderflow Ultimate and Bell Market Profile Ultimate

The NIFTY_I session once again demonstrated the precision and synergy between Bell Orderflow Ultimate and Bell Market Profile Pro. A structured 62-point move unfolded as the session transitioned from consolidation to an impulsive breakout, guided by IBH (Initial Balance High) and a perfectly timed TR-Alert confirmation.

Phase Overview

- The session initially balanced within the defined value range before a breakout above IBH signaled potential directional expansion.

- The TR-Alert confirmation provided the confidence to align with the upward momentum, resulting in a well-structured 62-point move.

Risk Limit @ 25291.05

- The Risk Limit acted as a predefined upper boundary to safeguard the trade framework.

- Holding within this threshold ensured that the position remained within a structured bias zone, preserving control over the setup’s integrity.

Price Reaction @ 25281

- This level marked the reaction zone where market momentum began to shift decisively in favor of buyers.

- Sustaining above this price validated the strength of the breakout, confirming buyer dominance supported by orderflow alignment.

ME-1 @ 25243.10

- The first Market Equilibrium checkpoint served as the foundation for the phase structure.

- Price holding above this level reflected a smooth transition from balance to breakout, guiding the bias shift toward the upper value range.

ME-2 @ 25219

- The second Equilibrium Level reinforced structural strength and confirmed that buyers retained control throughout the move.

- It acted as a mid-phase validation point, supporting the continuation bias until the TR-Alert signaled a decisive momentum surge.

Key Educational Insights

- IBH (Initial Balance High) helped identify the early breakout zone and directional bias.

- TR-Alert provided confirmation of trapped seller exhaustion, signaling the beginning of the upward impulse.

- Price Reaction and Risk Limit established structured control and disciplined execution boundaries.

- ME Levels acted as dynamic checkpoints, maintaining clarity through equilibrium transitions.

Conclusion

The NIFTY_I session emphasized the value of combining Bell Orderflow Ultimate with Bell Market Profile Pro to decode structure, bias, and timing with precision. By aligning IBH breakout context with TR-Alert confirmation, traders captured a 62-point structured move, all while maintaining clarity through Risk Limit, Price Reaction, and ME references.

This session perfectly encapsulates how equilibrium analysis and orderflow synergy bring clarity to complex market behavior — transforming uncertainty into structure.

Maximize Your Trading Edge: www.belltpo.com

🚨 Disclaimer: This analysis is intended solely for educational purposes. It does not constitute investment or trading advice. Traders should always conduct their own due diligence before making financial decisions.