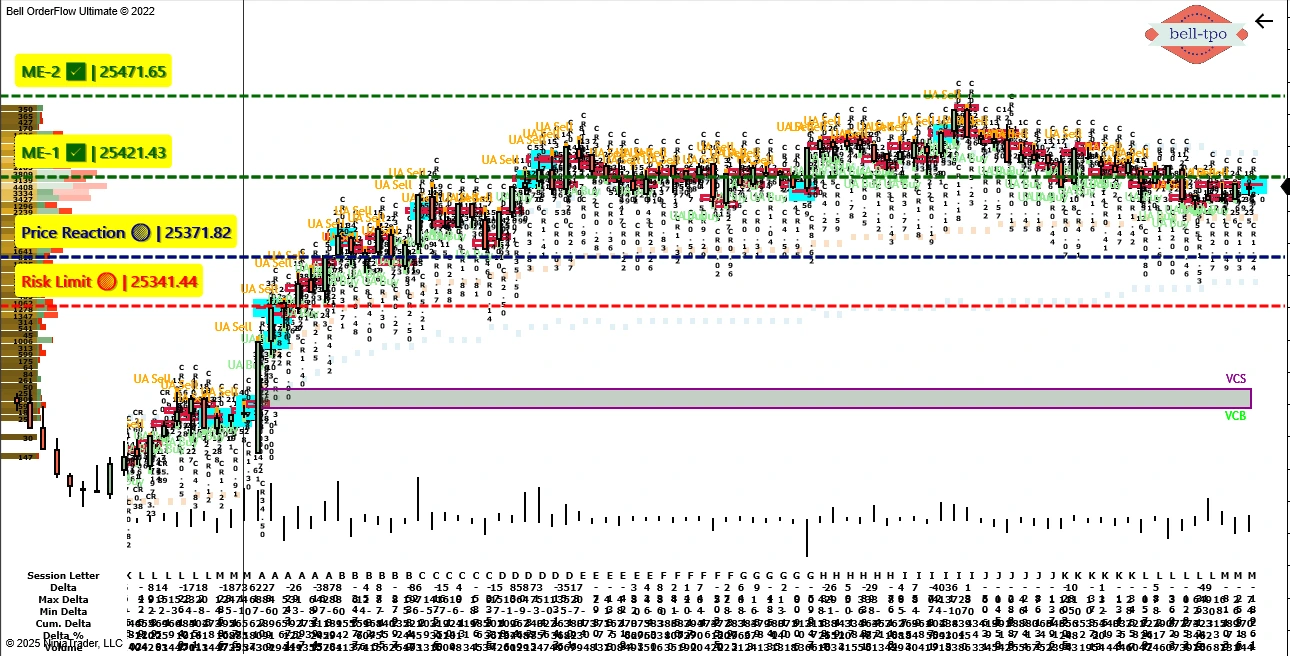

Educational Takeaway: 50 Points Move Captured in NIFTY_I with TBTS, VC Zone & UA Alert in Bell Orderflow Ultimate

The NIFTY_I demonstrated how orderflow precision combined with structured reference zones can turn a balanced market into a directional opportunity. Using Bell Orderflow Ultimate, traders captured a clean 50-point move with the confluence of TBTS Alert, VC Zone, and UA Activity, revealing a perfect blend of auction logic and execution clarity.

Phase Overview

The session began with balanced auction behavior around the VC Zone, where buyers gained strength following a UA Buy sequence. Soon after, a TBTS Alert confirmed trapped activity at lower levels — setting the tone for a steady upward continuation. With orderflow alignment and momentum confirmation, price reacted precisely from the Price Reaction Zone, advancing smoothly through each Market Equilibrium (ME) level.

Risk Limit @ 25341.44

- This acted as the protective boundary defining the trade’s risk management framework.

- Price holding above this zone confirmed that buyers maintained control, keeping the setup structurally valid and disciplined.

Price Reaction @ 25371.82

- The Price Reaction level acted as the ignition point for momentum expansion.

- Sustaining above this region validated the bullish bias, signaling that aggressive sellers were getting absorbed by stronger buyers.

ME-1 @ 25421.43

- The first Market Equilibrium level confirmed a stable transition phase from accumulation to expansion.

- Maintaining this level indicated a firm buyer base, providing confidence for phase continuation.

Key Educational Insights

- VC Zone effectively identified the early value boundary where directional intent shifted.

- TBTS Alert revealed trapped sellers, confirming orderflow imbalance favoring buyers.

- UA Activity pinpointed absorption points, helping validate follow-through strength.

- Risk Limit, Price Reaction, and ME Levels collectively built a structured narrative, from setup to execution.

Conclusion

The NIFTY_I session highlighted how TBTS, VC Zone, and UA Alerts work together to provide clarity, precision, and risk-defined trading opportunities within Bell Orderflow Ultimate. By integrating auction structure (VC Zone) with orderflow dynamics (TBTS + UA), traders effectively navigated intraday momentum, capturing a 50-point structured move with confidence and control. Every reference — from Risk Limit to ME Levels — reinforced the importance of systematic analysis over speculation.

Learn more: www.belltpo.com

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making any trading or investment decisions. Past performance is not indicative of future results.