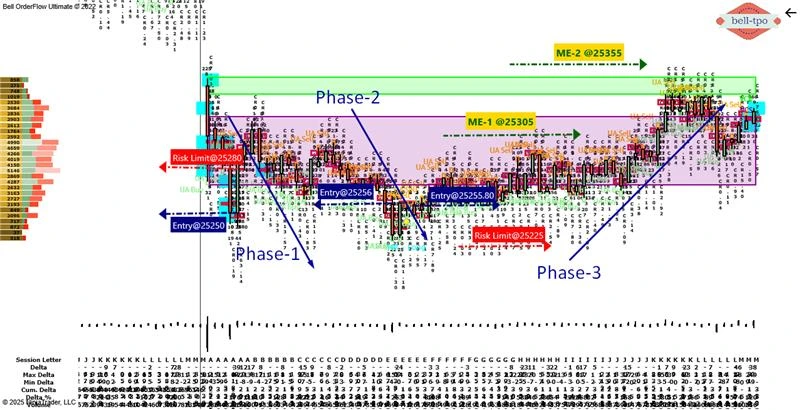

Educational Takeaway: 50 Points Captured in NIFTY_I with VC Zone + TBTS + UA + CR + MR in Bell Orderflow Ultimate

The NIFTY_I perfectly demonstrated the layered precision of the Bell Orderflow Ultimate framework — blending VC Zone, TBTS, UA, CR, and MR concepts to navigate both downside traps and upside continuation. Across three distinct phases, the market structure offered clear entries, reactive price validation, and risk-defined trade zones — resulting in a net 50 points structured move.

Phase-1: Short Bias with VC Zone & TBTS Confirmation

The session began with a bearish bias within the VC Zone, supported by TBTS Alert confirming trapped buyers at higher levels. Price quickly reacted lower, establishing early directional control and validating the zone’s selling intent.- Entry @ 25250 Initiated around the VC zone as trapped buyer activity was identified through TBTS confirmation. The downside setup maintained clarity through early UA sell sequences.

- Risk Limit @ 25280 Served as a tight structural control point for the short bias. Holding below this boundary ensured the bearish context remained intact and protected.

Phase-2: Controlled Rotation within VC Zone

After the initial drop, the market entered a controlled consolidation phase, respecting the VC zone boundaries. UA activity and CR (COT Ratio) readings showed balance between buyers and sellers, keeping the structure neutral but ready for continuation.- Entry @ 25256 This entry aligned with equilibrium retest during compression, indicating seller absorption. It acted as a bridge setup leading into the next impulsive leg.

Phase-3: Upside Momentum with MR Alert and UA Confirmation

A shift in control occurred as MR (Momentum Reversal) and UA Buy signals confirmed absorption of selling pressure. This transition from balance to expansion brought precision to the long bias, culminating in a steady upside push.- Entry @ 25255.80 Entry aligned with structural MR confirmation and UA Buy flow, marking a fresh participation of buyers. The level provided strong follow-through potential with orderflow alignment.

- Risk Limit @ 25225 Protected the setup against false reversals and maintained risk integrity. Price holding above confirmed the strength of the recovery leg.

- ME-1 @ 25305 Defined the upper market equilibrium checkpoint, marking transition from rotational balance to renewed upside bias. Sustaining above this level later validated the reversal from consolidation to continuation.

Key Educational Insights

- VC Zone highlighted the critical auction range where bias definition originated.

- TBTS Alert pinpointed trapped participants, offering high-probability reversal signals.

- UA + CR combination confirmed liquidity absorption during the transition phase.

- MR Alert timed the momentum shift precisely at the recovery stage.

- ME Levels and Risk Limits structured the trade boundaries, ensuring discipline and clarity.

Conclusion

This NIFTY_I session exemplified how a multi-layered analytical framework like Bell Orderflow Ultimate turns market noise into structure. From the initial short bias to mid-phase equilibrium and final reversal, each component — VC Zone, TBTS, UA, CR, and MR — added clarity and control. The session concluded with a net 50 points structured capture, reinforcing the strength of orderflow-based trading precision.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.