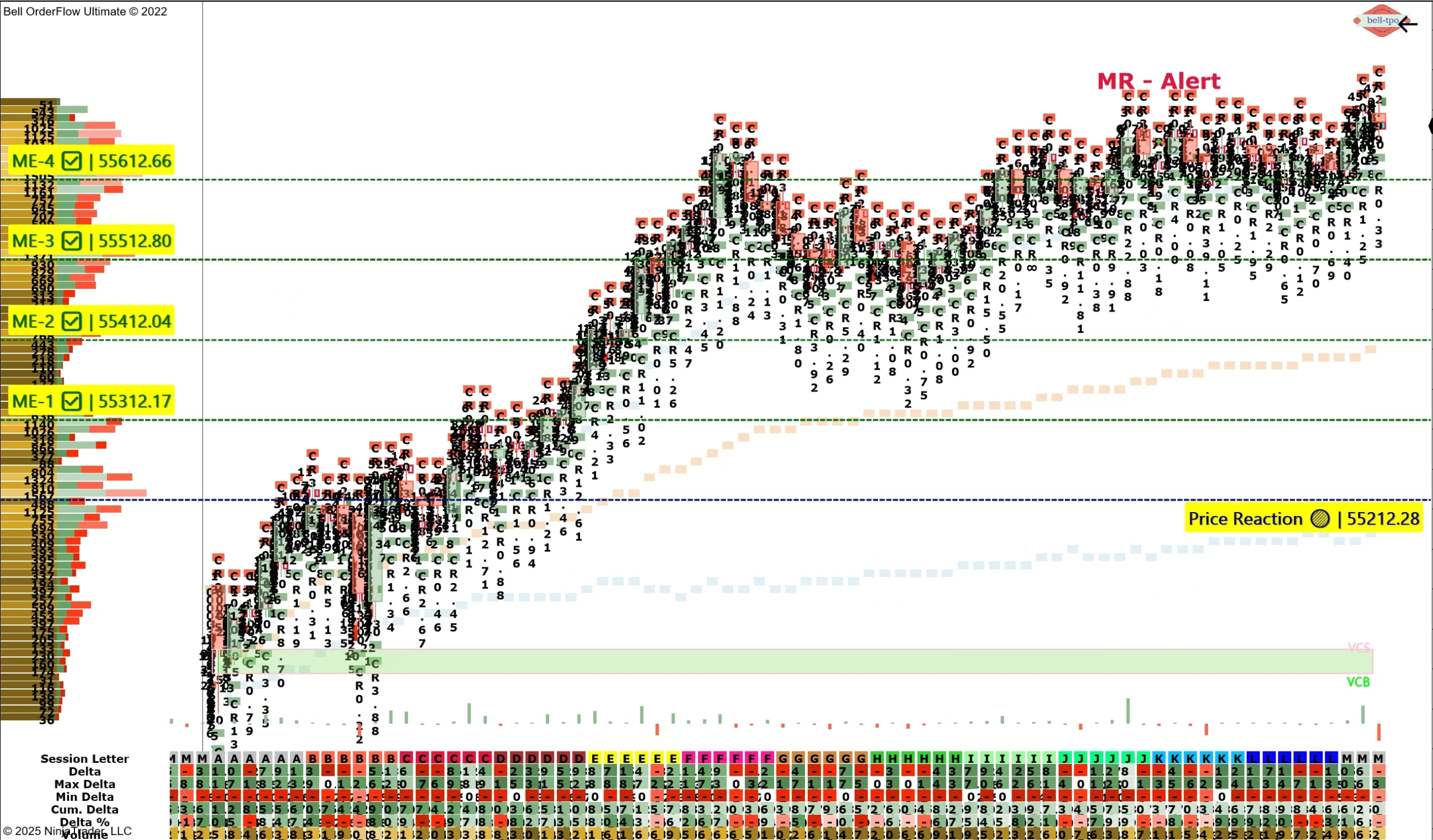

Educational Takeaway: 400 Points Observed Move in BANKNIFTY_I with VC Zone & MR-Alert in Bell Orderflow Ultimate

In today’s BANKNIFTY_I session, a 400 points observed move unfolded with the confluence of VC zone, UA alert, and the critical MR alert. Market Equilibrium (ME) levels offered precise checkpoints where orderflow aligned with exhaustion and continuation cues.

Price Reaction @ 55212.28Initial reaction zone that established responsive activity and prepared the base for the next upward tests.

ME-1 (Market Equilibrium) @ 55312.17

First ME level confirmed steady continuation, validating the developing trend.

ME-2 (Market Equilibrium) @ 55412.04

Supportive buying observed here, reinforcing conviction and sustaining the flow upward.

ME-3 (Market Equilibrium) @ 55512.80

Momentum continued with absorption of counter pressure, showing demand stability.

ME-4 (Market Equilibrium) @ 55612.66

Price slowed near this zone, reflecting signs of exhaustion after the extended move.

MR-Alert: Trend Exhaustion & Reversal Signal

The MR alert played a decisive role—it captured exhaustion of extended long moves and highlighted potential reversal. Acting as a safeguard, it signaled when to shift from trend-following to protective observation.

Educational Insight

Market Equilibrium levels structure the path of price discovery, while alerts like MR provide an additional layer of confirmation. Together, they help in identifying both continuation and exhaustion phases with clarity.

Conclusion

A 400 points observed move was structured through ME checkpoints, guided by VC and UA zones, and capped with the MR alert showing exhaustion. This reinforces how systematic use of orderflow tools can enhance disciplined and educational market observation.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.