Educational Takeaway: 120 Points Captured in ETHUSD with TBTS + MR Alert + UA in Bell Orderflow Ultimate

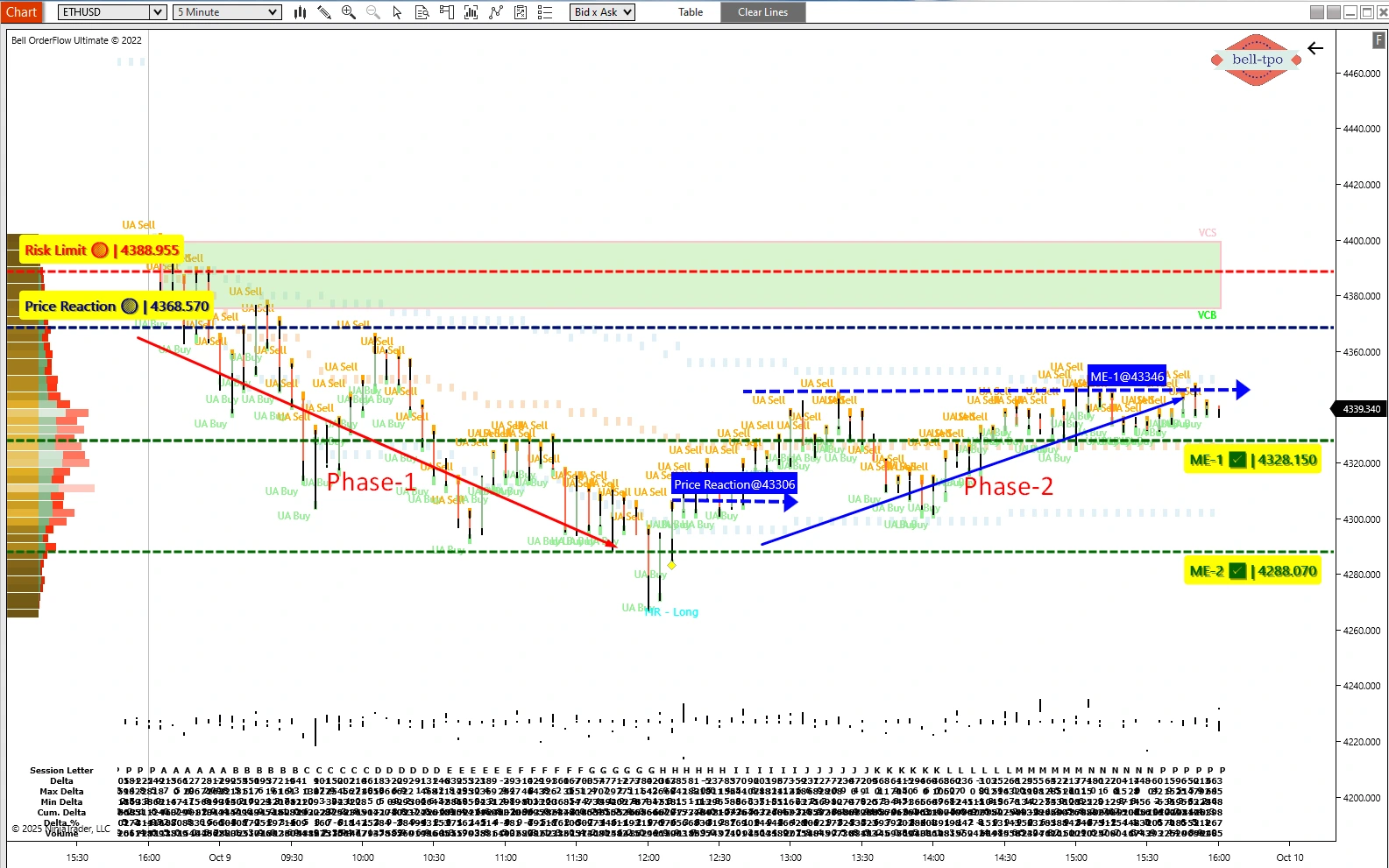

The ETHUSD session delivered a textbook example of how to interpret structural reversals and continuation setups using Bell Orderflow Ultimate. With a combination of TBTS Alert, MR Alert, and UA Activity, the session captured a net 120-point move, divided across two distinct phases — a controlled downside phase followed by a measured reversal and recovery.

Phase-1: Structured Downside Reaction

The initial session displayed a controlled downward move, testing the lower levels within a predefined structure. This phase offered valuable insights into identifying risk zones, where early exhaustion of selling was visible through UA Buy activity and delta shifts.- Risk Limit @ 4388.955 Defined the upper resistance threshold for the session. Maintaining below this level confirmed the dominance of sellers and preserved downside integrity.

- Price Reaction @ 4368.570 Acted as the reaction point where the first wave of momentum emerged. Price failing to sustain above this zone signaled continued seller control until deeper value zones were tested.

- ME-1 @ 4328.150 Represented the initial equilibrium shift confirming progression into lower auction areas. Buyers began accumulating around this level, suggesting early signs of potential reversal.

- ME-2 @ 4288.070 Served as the base equilibrium level of the downside move. The stabilization here formed a critical support foundation that would later trigger Phase-2 recovery momentum.

Phase-2: Reversal and Controlled Upside with TBTS + MR Alert + UA

After sellers exhausted around ME-2, the market established a reversal structure guided by TBTS (Trapped Buyers & Sellers), MR (Momentum Reversal), and UA Buy Alerts, confirming directional bias shift. The sustained bid strength transitioned the session into a measured bullish continuation, capturing clean structural progression.- Price Reaction @ 43306 Identified the momentum confirmation zone where buyers took over decisively. This shift marked the beginning of the upside continuation as absorption of selling became evident.

- ME-1 @ 43346 Served as the higher equilibrium checkpoint that confirmed sustained buying control. Holding above this level validated the completion of the 120-point recovery phase.

Key Educational Insights

- TBTS Alert pinpointed the exhaustion of trapped participants, highlighting reversal intent.

- MR Alert confirmed momentum reversal, aligning perfectly with equilibrium and delta confirmation.

- UA (Unfinished Auction) provided microstructural insight into where buying interest sustained.

- Price Reaction and ME Levels ensured structured tracking of every phase transition.

Conclusion

The ETHUSD session exemplified how orderflow structure, when combined with alerts like TBTS, MR, and UA, creates actionable clarity in volatile conditions. While Phase-1 established a disciplined downside structure, Phase-2 leveraged precise reversal signals to capture the recovery, leading to a net 120-point structured gain. This case study underlines the importance of risk-defined frameworks, equilibrium tracking, and alert-based confirmation — key pillars in the Bell Orderflow Ultimate approach.

Learn more: www.belltpo.com

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making any trading or investment decisions. Past performance is not indicative of future results.