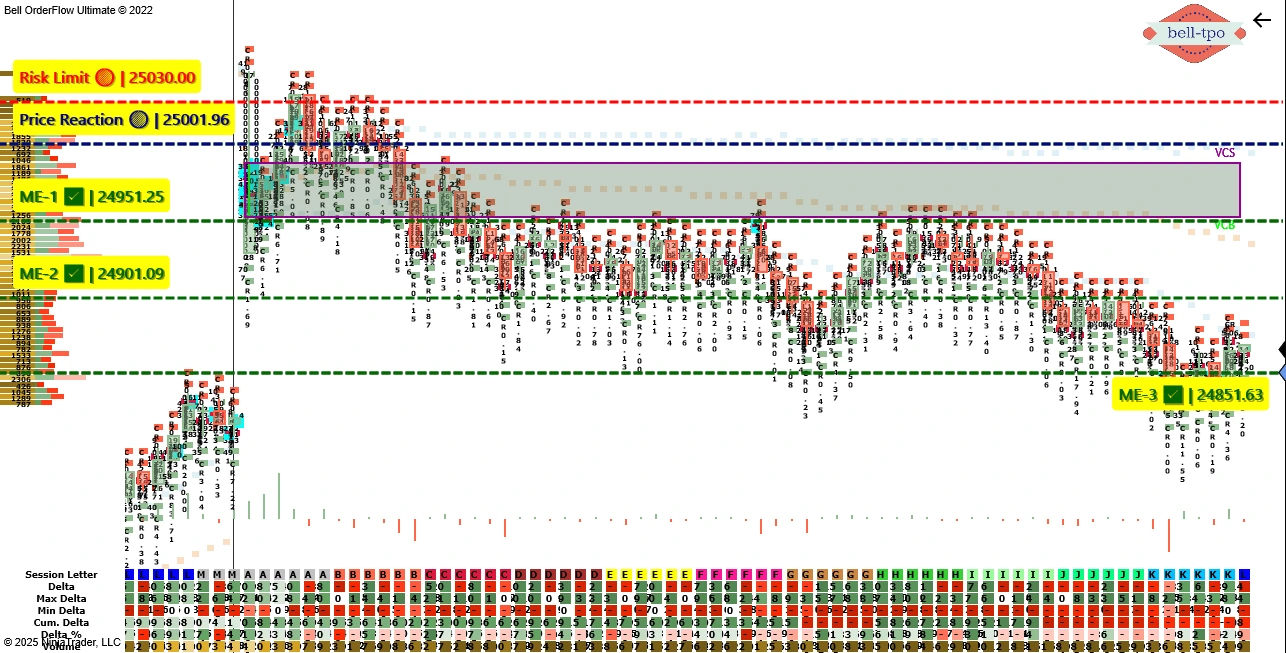

Educational Insight: 150 Points Captured with TBTS + VC Zone Concept in NIFTY_I using bell orderflow ultimate.

Today’s session highlighted how structured reference levels combined with the TBTS (Trapped Buyers/Trapped Sellers) and VC Zone (Volume Cluster Zone) concepts can provide a clear framework for interpreting intraday moves. By aligning the Risk Limit, Price Reaction, and ME ladder, traders can observe price behavior with discipline and clarity to capture 150 points move.

Risk Limit @ 25030.00

Risk Limit serves as the upper boundary for risk management, helping to define when market conditions are stretched. It acts as a protective reference to control exposure.

Price Reaction @ 25001.96

Price Reaction indicates where supply and demand imbalance was first recognized. It is an important pivot level to monitor whether momentum continues or fades.- ME-1 @ 24951.25 – The first step in the measured move ladder, giving early confirmation of directional follow-through.

- ME-2 @ 24901.09 – The next checkpoint, showing continued order flow strength and validating the move.

- ME-3 @ 24851.63 – Extends the ladder, illustrating how order flow helps track progress phase by phase.

Key Takeaway

This case demonstrates how TBTS alerts + VC Zone alignment simplify intraday analysis. Rather than guessing, traders can reference structured levels (RL, PR, and ME ladder) to interpret market behavior. Such educational frameworks help reduce noise and improve discipline when analyzing order flow.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.