Capturing Structured Moves in a Low Volatility Session with Bell OrderFlow Ultimate

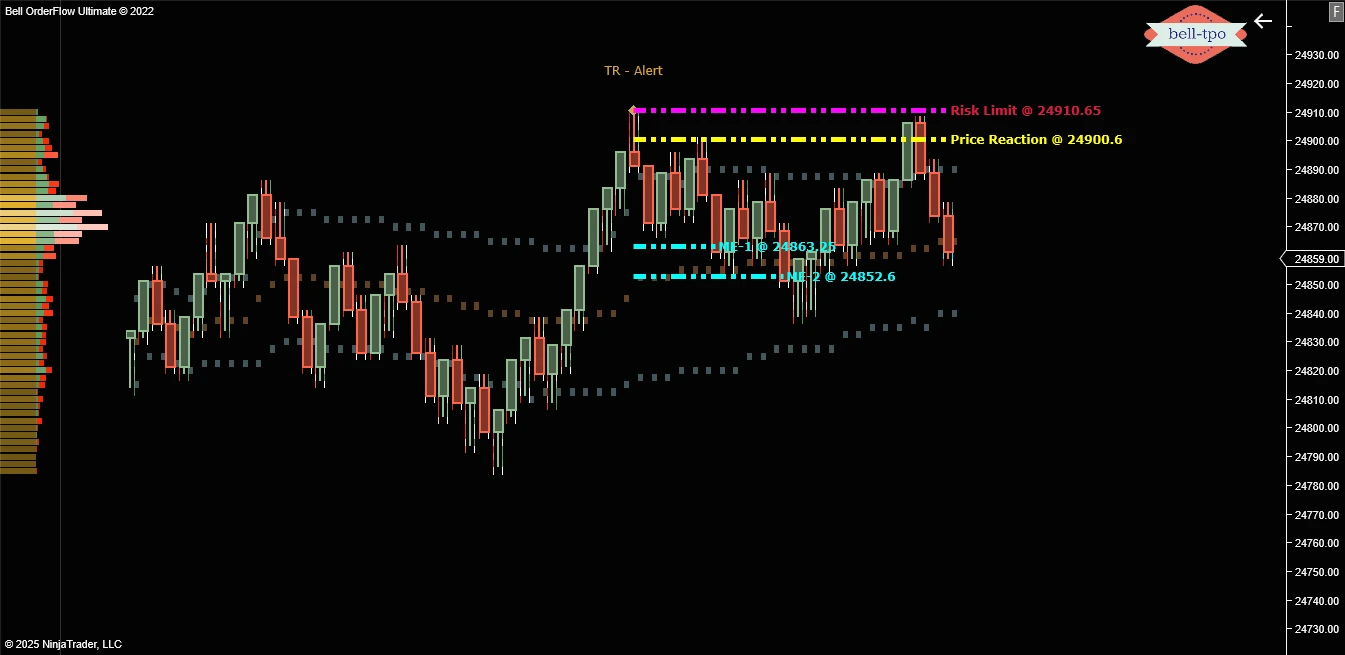

Today’s session in NIFTY_I was defined by a narrow range and noticeably low volatility. In such conditions, traders often find it difficult to identify directional clarity or high-probability opportunities. However, Bell OrderFlow Ultimate continued to prove its edge even in a compressed market. Key Observations with TR Alert: TR Alert Triggered @ 24900.6

TR (Trend Reversal) alert, indicating a possible shift in short-term sentiment. This level marked the first price reaction, where a potential reversal setup was identified.

Risk Limit Defined @ 24910.65This served as the protective barrier for managing trade exposure. Even in low momentum conditions, maintaining a defined risk level is crucial for consistent strategy execution.

Measured Extensions Provided Clarity:- ME-1 @ 24863.25 – This level was reached shortly after the TR alert, offering the first sign of confirmation for the short bias.

- ME-2 @ 24852.6 – The price further extended down to this level, resulting in a structured move of approximately 50 points from the initial reaction.

Educational Insight:

Despite the lack of volatility, Bell OrderFlow Ultimate was able to identify and track a clean 50-point move using its TR Alert mechanism. These alerts, coupled with predefined Risk Limits and ME levels, help traders navigate tricky sessions with discipline and data-backed setups.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.

🌐 Learn more: www.belltpo.com